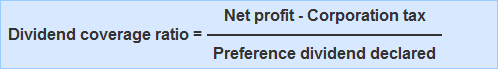

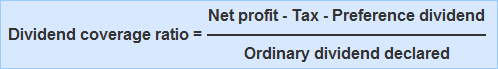

The dividend coverage ratio indicates the number of times that a dividend is covered by available profit. It is calculated separately for each class of shares. To calculate the dividend coverage ratio for preference shares, use the following formula: For ordinary (common) shares, apply this formula: Consider the following information relating to a company: Required: Calculate the dividend coverage ratio for preference shareholders and ordinary (common) shareholders. For preference shareholders: Dividend coverage ratio = (480,000 - 240,000)/$15,000 = 16 times For ordinary (common) shareholders: Dividend coverage ratio = ($480,000 - $240,000 - $15,000)/$25,000 = 9 times A high dividend coverage ratio shows that a company has the ability to pay similar or higher dividends in the future. A low dividend coverage ratio, on the other hand, shows that even a small decrease in the company's profit will result in a reduction in the dividend rate—in other words, the dividends may not be safe. Obviously, companies with high dividend coverage ratios typically command better prices if they are listed on a stock exchange.Formula

Example

Solution

Interpretation

Dividend Coverage Ratio FAQs

The primary goal of this ratio is to measure a company’s ability to pay dividends. It provides an indication of how sustainable the dividends are.

The calculation of this ratio involves dividing a company’s earnings before interest, tax, depreciation and amortisation (EBITDA) by its cash dividend payments.

Dividend coverage ratios can exceed one. This happens when a company decides to use cash generated from its business to pay dividends, even when it hasn’t generated enough EBITDA to cover the amount of dividends paid out. This practice puts the company in jeopardy if there are any lean periods because it might not be able to sufficiently generate EBITDA to make up for the previous shortfall.

A company that satisfies the dividend coverage ratio is still not guaranteed by any means, because it could change its policies in future and cut dividends. Even if this happens, however, it will be evident since you can compare past ratios with those of the company’s competitors.

A more conservative formula, but one that takes longer to calculate, involves dividing EBIT by dividends distributed. This also shows how sustainable the dividends are and helps investors determine which sector and industry they should invest in.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.