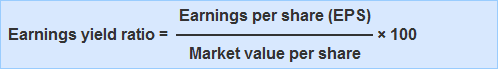

The earnings yield ratio is an effective restatement of the price-earnings ratio. It shows earnings per share as a percentage of the market value of the ordinary share. Earnings yield is calculated by dividing the earnings per share (EPS) for the last 12 months by the current market value of the share and multiplying the result by 100. If a company has an earnings per share (EPS) ratio of 2.8 and its shares trade at $56 per share, the earnings yield ratio is (2.8/56) × 100 = 5%. The earnings yield ratio is 5%. This means that the company's EPS during the last 12 months was 5% of the current market value of its ordinary shares.Formula

Example

Earnings Yield Ratio FAQs

The Earnings Yield Ratio shows how much of a return an investor could potentially receive from holding the company’s shares, in relation to its current share price.

The earnings per share is divided by the market value of the ordinary shares and multiplied by 100.

It is useful to compare the Earnings Yield Ratio with those of similar companies and the market in general. High Earnings Yield Ratios may suggest that a company is undervalued, while low ratios might mean than an individual share or the whole market is overvalued.

The principles of calculating an Earnings Yield Ratio are consistent worldwide, although it will be expressed differently depending on the accounting framework used.

The Earnings Yield Ratio is most useful when comparing like with like, i.E. Firms in similar sectors and of a similar size. We also need to be aware that certain industries are more cyclical than others. The riskier an industry, the higher the Earnings Yield Ratio could be.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.