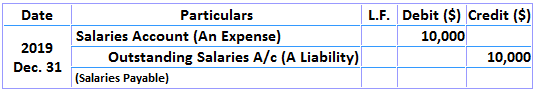

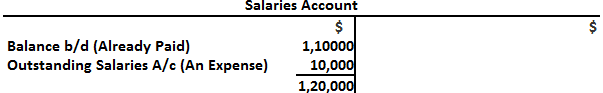

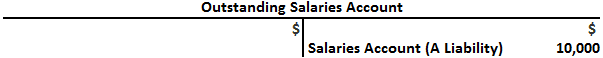

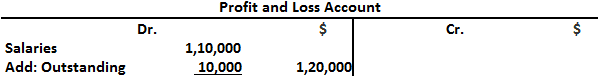

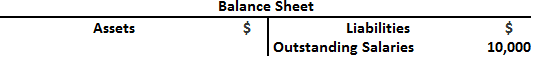

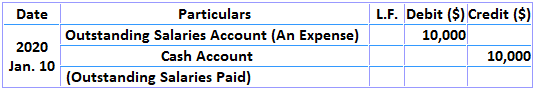

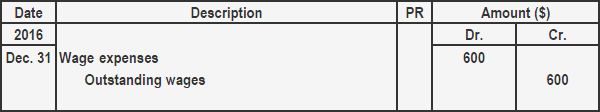

Outstanding expenses are expenses relating to the current period that have been incurred but not paid at the end of the period. In other words, services or benefits from these expenses have been received but payments are not made until the end of the period. In fact, the benefits of these expenses have been received during the current accounting period, but they have not been actually paid in the current year. Suppose that a company's accounting period ends on 31 December. The business pays monthly salaries of $10,000 a month after receiving services from employees. In this way, for the 11 months of 2019, the business has paid salaries amounting to $110,000. However, the salaries for December 2019 will be paid on 10 January 2020. Now, the salaries of December 2019 $10,000 will be treated as outstanding salaries of 2019. Outstanding expenses have the following two effects on final accounts: The adjusting entry for accrued or outstanding expense is made as follows: The amount of accrued expenses will be added to the income statement and the same amount will be shown as a liability in the balance sheet. In the next year, when the salaries are paid, the following entry will be made and the outstanding salaries account will be closed. A company closes its books on 31 December each year. Wages amounting to $600 are incurred in 2016 but not paid until the end of the year. Make an adjusting entry for this outstanding expense on 31 December 2016.Example

Accounting Treatment

Adjusting Entry

Example

Solution

Adjusting Entry for Accrued/Outstanding Expenses FAQs

Outstanding expenses are expenses relating to the current period that have been incurred but not paid at the end of the period. In other words, services or benefits from these expenses have been received but payments are not made until the end of the period.

The concept of an accounting period is used to segment the life of a business into equal pieces. Accounting periods must conform to the principle of consistency.

The accounts prepared at the final stage of the Accounting Cycle to illustrate the profit or loss and financial position of a business concern are known as the Final Accounts.

A liability is a debt or other obligation owed by one party to another party. In more direct terms, it is a payment or obligation for which a company is held liable by another party.

An accounting balance sheet is a financial document that shows the relationship between a company’s assets, liabilities, and shareholder equity at a particular point in time.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.