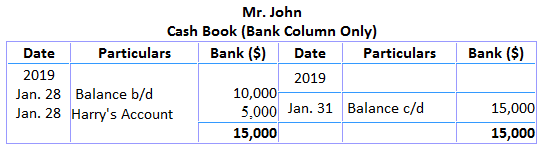

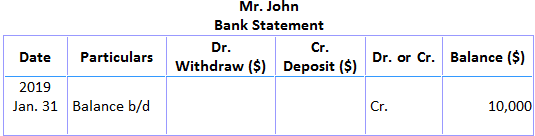

A check that a customer has deposited but that the bank has not yet credited or collected in the customer's account by the date on which the bank statement is issued is known as an uncleared check. Whenever a check is received from a debtor or third party and deposited into the bank for collection, it is immediately recorded in the bank column on the debit side of the cash book. In the cash book, the bank balance increases on the day that the check is deposited. The bank, however, needs time to process the check. The bank will credit the customer's account only when the amount has been collected from the debtor's bank. Until the check has been collected, the bank balance appearing in the bank statement will be less than the balance appearing in the bank column of the cash book. On 20 January 2019, Mr. John's balance in his cash book and bank statement was $10,000. On the same day, a check amounting to $5,000 was received from a debtor, Harry, which was deposited at the bank for collection. The bank does not collect the amount of the check until 31 January 2019. Also, a bank statement is sent by the bank on that date, as shown below. The bank column of the cash book shows a balance of $15,000 at the end of the month. According to the bank statement, however, the balance is $10,000. This discrepancy of $5,000 is due to an uncollected check. As this indicates, whenever checks are uncollected, uncleared, or uncredited, the cash book will show a greater bank balance compared to the bank statement. As discussed above, the cash book will show a greater bank balance compared to the bank statement when checks are uncredited. However, the discrepancy is temporary because the amount of the uncollected check will eventually be collected and credited. Nevertheless, on the other hand, on the date of the bank statement, the amount of the deposited check was not shown in the bank account. This is why the bank statement shows less bank balance compared to the cash book. For this reason, it is necessary to credit the total amount of any uncredited checks when preparing a bank reconciliation statement to bring down the balance to the level of the bank statement.What Are Uncleared, Uncollected, Uncredited Checks?

Effect of Uncleared Check on Bank Balance

Example

Treatment of Uncleared Checks in Bank Reconciliation Statement

Treatment of Uncleared Checks in Bank Reconciliation Statement FAQs

Uncleared check refers to the check that a customer has deposited but that the bank has not yet credited or collected in the customer’s account by the date on which the bank statement is issued.

Whenever a check is received from a debtor or third party and deposited into the bank for collection, it is immediately recorded in the bank column on the debit side of the cash book.Until the check has been collected, the bank balance appearing in the bank statement will be less than the balance appearing in the bank column of the cash book.

The cash book will show a greater bank balance compared to the bank statement when checks are uncredited.For this reason, it is necessary to credit the total amount of any uncredited checks when preparing a Bank Reconciliation Statement to bring down the balance to the level of the bank statement.

An uncleared check will not appear in the bank account when preparing a balance sheet. In other words, it will not be part of the assets.

When a customer or any third party makes a deposit into the bank, the amount of this deposit does not appear in the bank account.When these deposits are collected, by cash or check, they will be recorded as part of the cash balance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.