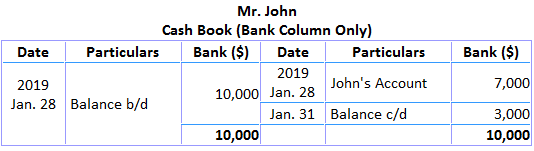

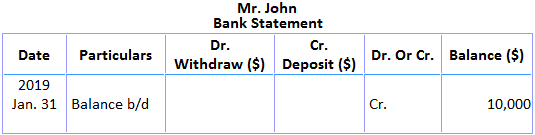

An unpresented check (or outstanding check) is a check that has been issued or drawn by the depositor but not presented to the bank for payment until the date that the bank statement is issued. When a check is issued to a creditor or third party, it is immediately recorded in the bank column on the credit side of the cash book. This reduces the bank balance in the cash book. However, the receiving party may not present the check to the bank for payment on the same date. The bank will only debit the depositor's account when the check is presented to it, and this will be paid by the bank. So, as long the check remains unpresented, a disparity will exist between the balances of both the books. Do you know how to read a check? On 28 January 2019, the balance as per the cash book and bank statement amounts to $10,000. On the same day, a check of $7,000 is issued to a creditor, Mr. John, who presents the check to his bank on 2 February 2019. Since Mr. John didn't present the check to the bank for payment, the cash book shows a bank balance of $3,000, whereas the bank statement shows a bank balance of $10,000. There is a discrepancy of $7,000 between the balances of the books. Therefore, when checks are unpresented, the cash book's balance appears lower than the bank statement's balance. The difference between the balances of the cash book and bank statement caused by unpresented checks is only temporary. This is because the check will be eventually be presented; that's why we will not alter our cash book. However, on the date of the bank statement, the amount of the check (i.e., $7,000) was shown in the bank account. As the bank statement shows a greater balance compared to the cash book, it is important to debit the amount of the unpresented cheque when preparing the bank reconciliation statement, which will bring up the balance to the level of the bank statement.What Are Unpresented or Outstanding Checks?

Effect of Unpresented Checks on Bank Balance

Example

Treatment of Unpresented Checks in Bank Reconciliation Statement

Treatment of Unpresented Checks in Bank Reconciliation Statement FAQs

An unpresented check (or outstanding check) is a check that has been issued or drawn by the depositor but not presented to the bank for payment until the date that the bank statement is issued.

When a check is issued to a creditor or third party, it is immediately recorded in the bank column on the credit side of the cash book.However, the receiving party may not present the check to the bank for payment on the same date. The bank will only debit the depositor’s account when the check is presented to it, and this will be paid by the bank.So, as long the check remains unpresented, a disparity will exist between the balances of both the books.

We we will not alter our cash book because the check will be eventually be presented. As the bank statement shows a greater balance compared to the cash book, it is important to debit the amount of the unpresented cheque when preparing the Bank Reconciliation Statement, which will bring up the balance to the level of the bank statement.

The credit side of the cash book is debited when an unpresented check is issued. This reduces the bank balance in the cash book.However, on the date of printing or preparing a Bank Reconciliation Statement, we will debit (in order to make the balance of the cash book equal to that of a bank statement) the amount of the check.

To begin, you need to open a blank cash book. While doing this, it is important to determine which check dates correspond with the date of bank statement.You should also prepare a list of all the outstanding checks at the time of preparing the next Bank Reconciliation Statement, or by adding up all those checks that have not cleared the bank since the last reconciliation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.