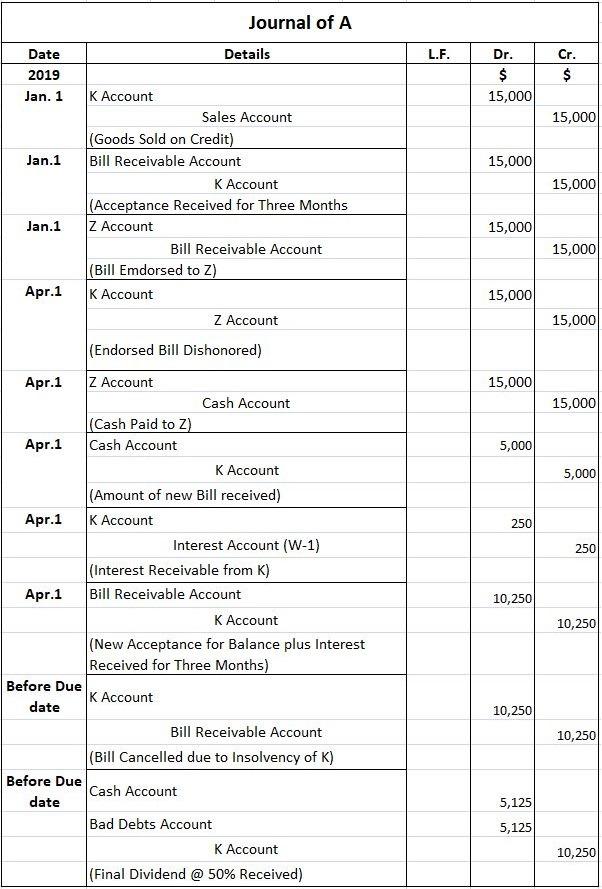

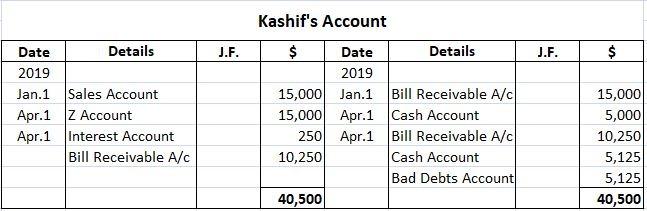

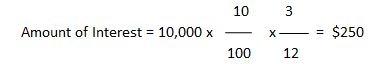

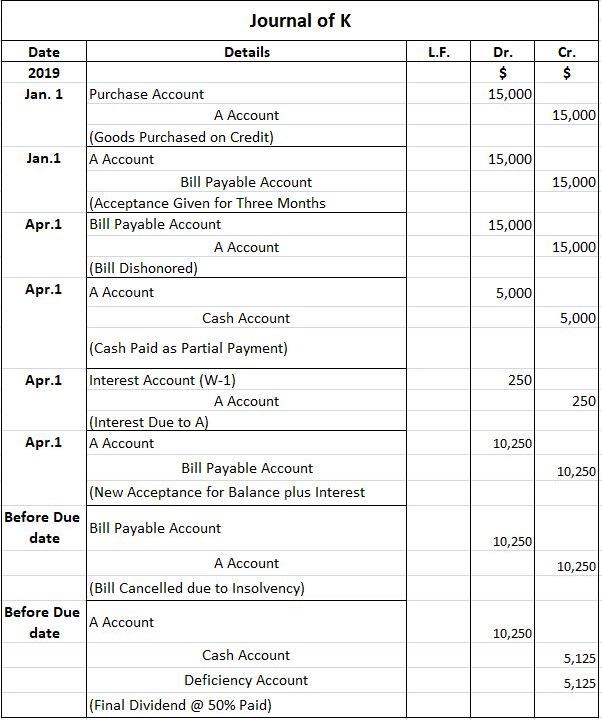

Insolvency arises when an entity is unable to pay its debts when they fall due. An insolvent person may have some valuable assets. When they are declared as insolvent or bankrupt, their property is sold by a court-appointed liquidator. The amount realized through asset sales is normally less than the debts. Creditors are paid out of realized money. The amount which is paid to creditors is termed as the dividend. When a drawee of a bill of exchange is declared as insolvent, any bill of exchange that they accept will be dishonored immediately. In the books of the drawer, a ledger account will be prepared for the drawee. The drawee's ledger account will show the total amount receivable from the drawee. The amount realized by selling their property will be received as a final dividend. In addition, the balance that could not be recovered will be debited to the bad debts account in the drawee's books. Treatment of the drawee's insolvency in accounting will be passed in the books of both the drawer and drawee. 1. When the drawee is declared insolvent 2. To receive final dividend and close the drawee's account 3. When nothing is recovered from the drawee This example focuses on the renewal and insolvency of the drawee. On 1 January 2019, A sold goods to K worth $15,000. On the same date, A drew a three-month bill on K. A endorsed the bill to his creditor Z to settle his debts. At maturity, the bill was dishonored and A had to pay Z. K paid $5,000 in cash and accepted a new bill for three months for the balance amount plus interest @ 10% p.a. Before the due date of the second bill, K became insolvent and only $0.50 was received from his estate as a first and final dividend. Required: Pass journal entries in the books of A and K. Also, prepare K's account in the books of A. Working:Insolvency: Definition

Insolvency: Explanation

Effect of Insolvency of Drawee

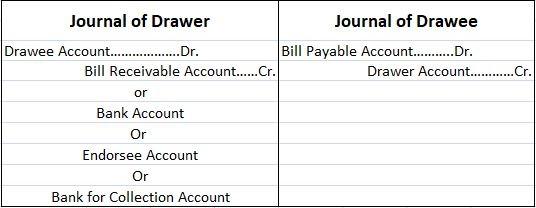

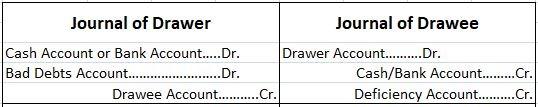

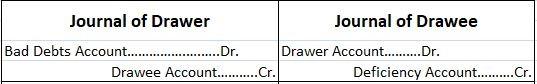

Accounting Treatment of Drawee's Insolvency

Example

Solution

Insolvency FAQs

Outstanding debts are converted into an asset called bad debts.

The debtor will be declared as insolvent when he fails to make payments or meet his obligations with regards to his creditors or debtors after receiving demand for the same.

A debtor will be declared as insolvent when he fails to make payments or meet his obligations with regards to his creditors or debtors after receiving demand for the same.

The process of becoming insolvent starts with the filing of a petition by the debtor under chapter 7, 11 or 13 of the bankruptcy code. Once the petition is filed, an automatic stay goes into effect which forbids all creditors from taking any legal or collection action against the debtor.

The process of becoming insolvent starts with the filing of a petition by the debtor under chapter 7, 11 or 13 of the bankruptcy code. Once the petition is filed, an automatic stay goes into effect which forbids all creditors from taking any legal or collection action against the debtor.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.