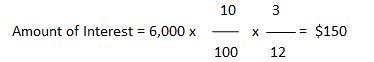

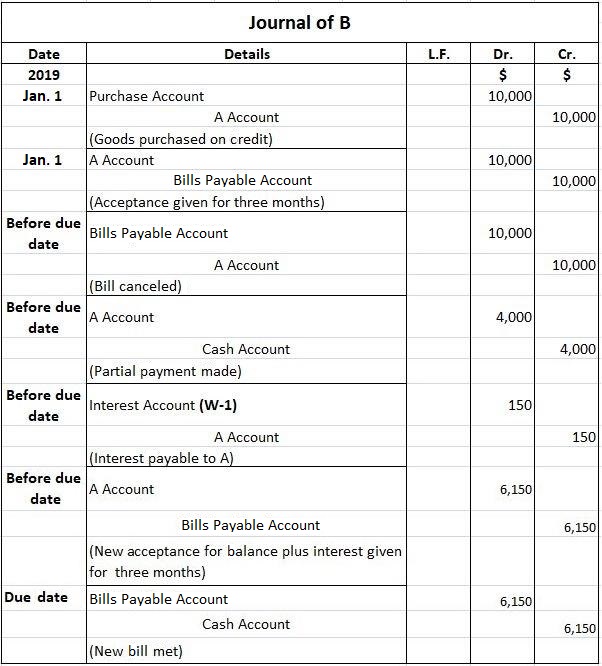

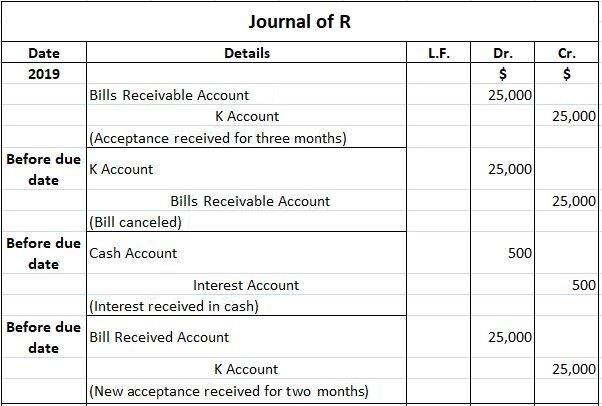

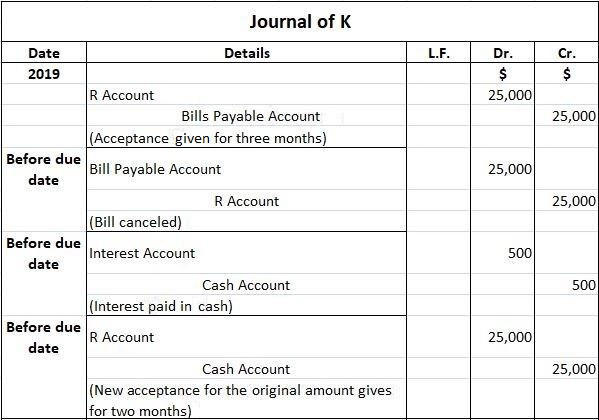

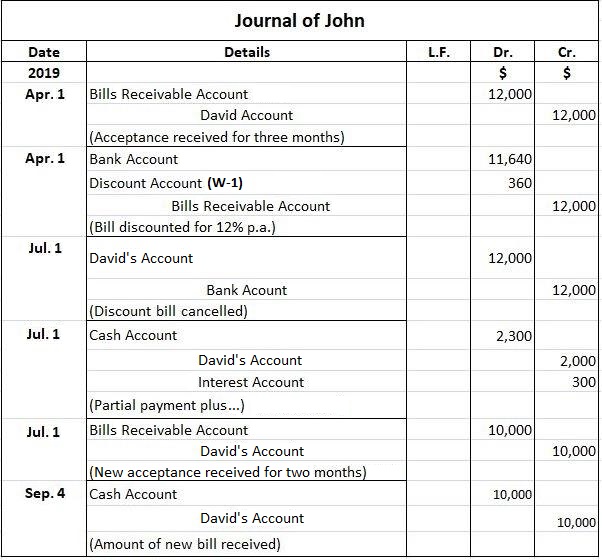

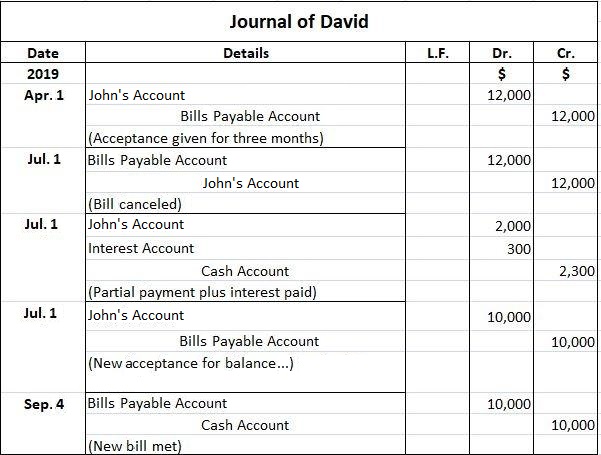

A renewal of bill of exchange is an act in which an old bill is canceled before maturity in return for a new bill, including interest, for an extended period. It is performed by a drawer at the request of a drawee. Sometimes, a drawee may not be in a position to pay the amount of a bill on the due date. In this case, they may ask the drawer to cancel the old bill and draw a fresh one for an extended period. The steps involved in the renewal of a bill of exchange are the following: 1. The old bill is canceled. The journal entry for cancellation of the bill is the same as the entry made if a bill is dishonored. Under each option used by the drawer (i.e., when the drawer keeps the bill with themselves, gets the bill discounted, or endorses or sends it for collection). 2. Entry made for partial payment of the bill, including interest if paid in cash. 3. Entry made for charging interest if not paid in cash. 4. Entry for drawing a fresh bill for the outstanding amount. A bill can be renewed in any of the following ways: 1. Drawee pays nothing and accepts a new bill for the original amount plus interest. 2. Drawee pays a partial amount and accepts a new bill for balance plus interest. 3. Drawee pays interest in cash and accepts a new bill for the original amount. 4. Drawee pays a partial amount and interest in cash and accepts a new bill for the balance amount. P draws a two-month bill on Q for $15,000 on 1 January 2019. Q returns the bill to P after accepting it. On 1 March, Q is unable to pay the bill. Therefore, they ask P to cancel the first bill and draw a fresh bill for the amount of the first bill plus interest @ 10% p.a. P agrees to the proposal and does so Q. The new bill is for two months. On the due date, the second bill is met. Required: Pass journal entries in the books of both parties. Solution: W-1: On 1 January 2019, A sold goods to B for $10,000 on credit. On the same date, A drew a three months bill of exchange on B, who accepted it and returned it to A. Before the due date, B paid A $4,000 and asked them to draw a new three-month bill for the balance plus interest @10% p.a. A agreed and B met the new bill. Required: Pass journal entries in the books of A and B. Solution: W-1: K accepted a three-month bill from R for $25,000. Before the due date, K asked R to renew the bill and R agreed. The terms were that K would pay $500 in cash in cash as interest and would accept a new two-month bill for the original amount of the first bill. Required: Pass journal entries in the books of both parties. Solution: On 1 April 2019, John drew a three-month bill on Yasir for $12,000, which was duly accepted and agreed to be returned by David. John immediately got the bill discounted @ 12% p.a. At maturity, David was able to pay $2,300 only, out of which $300 was for interest. David asked John to draw another bill for the balance amount. John did so, with a new two-month bill created that was eventually met on the due date. Required: Pass journal entries in the books of John and David. Solution:Renewal of Bill of Exchange: Definition

Renewal of Bill of Exchange: Explanation

Process of Renewal

Different Ways of Renewing a Bill of Exchange

Journal Entries for Renewal of Bill of Exchange

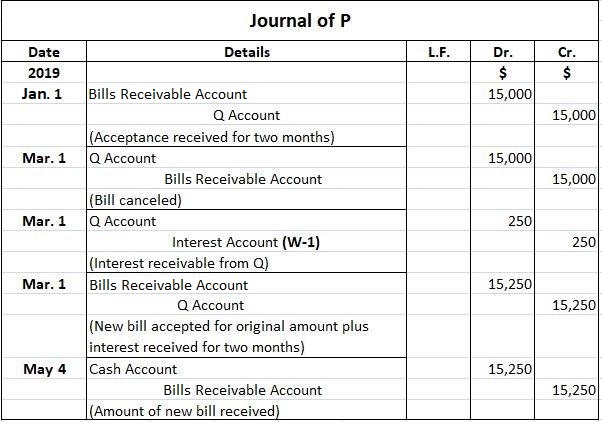

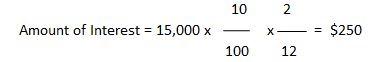

Example 1: Drawee pays nothing and accepts new bill for original amount plus interest

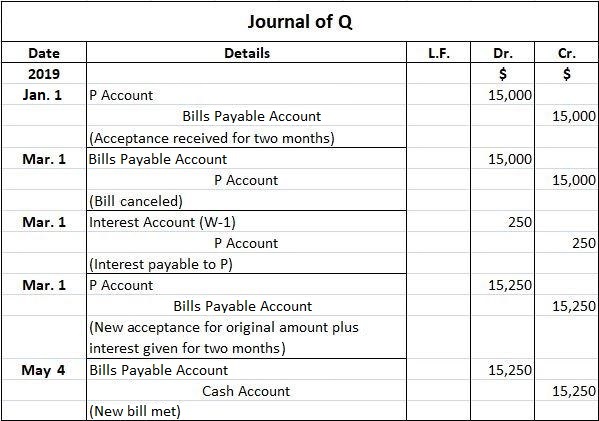

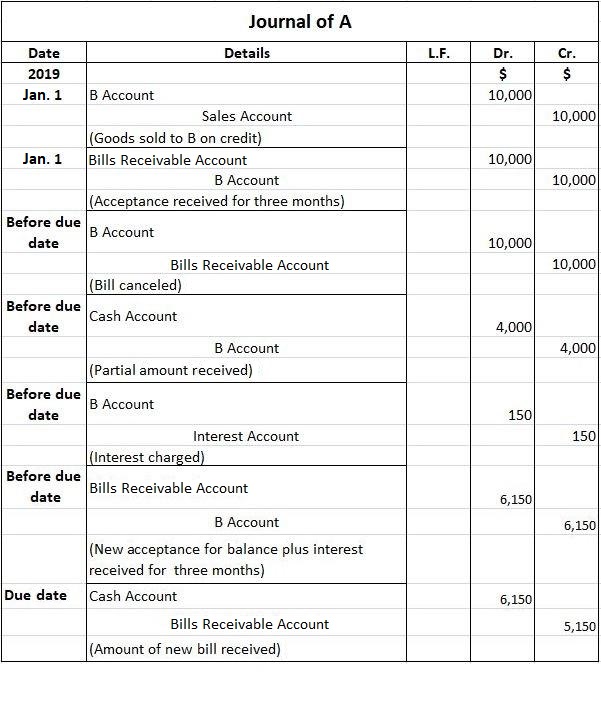

Example 2: Drawee pays partial amount and accepts new bill for balance plus interest

Example 3: Drawee pays interest in cash and accepts bill for original amount

Example 4: Drawee pays partial payment and interest in cash and accepts new bill for balance amount

Renewal of Bill of Exchange FAQs

The main difference between a renewal of Bill Of Exchange and accommodation bill are that in case of settlement done with an accommodation party, he does not get any interest or do not pay cash interest to the drawer. The second major difference is that in case of bills drawn on any party the second bill is the renewal of first bill. But in case of accommodation bills, it can be drawn on anybody.

The endorser of docas bill receives interest, therefore it cannot be classified as accommodation party.

Under indian law, a "bill" is defined as "a document entitling the holder to receive goods, money, or other valuable thing at a future time." A "note" is defined as "a document acknowledging a debt and promising payment." The key difference is that a bill entitles the holder to receive something, whereas a note acknowledges and promises payment.

A Bill Of Exchange is an unconditional order in writing, signed by the maker, directing a certain person to pay a certain sum of money to another person or to bearer. A promissory note, on the other hand, is a written promise by the maker to pay a certain sum of money to the payee at a certain time. The key difference is that a Bill Of Exchange is an order to pay, whereas a promissory note is a promise to pay.

An acceptor is the person who has signed the bill to be his. A drawee is the person on whom there is drawn, or whose order for payment there is made payable at a future time. The key difference between an 'acceptor' and a 'drawee' is that an acceptor is the person who has agreed to pay the bill, while a drawee is the person on whom the bill is drawn.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.