A petty cash book is maintained to record small expenses such as postage, stationery, and telegrams. A separate column is used for each type of expenditure. The difference between the sum of the debit items and the sum of the credit items represents the balance of the petty cash in hand. A petty cash book also refers to the book in which small payments are recorded, which are not convenient to record in the main cash book. In all businesses, some payments are made by check for better control over cash. However, for the payment of small expenditures (e.g., stationery, travel, postage, and newspapers), paying by check is unreasonable. In addition, the chief cashier in a large business is required to handle numerous large transactions on a daily basis. If they record petty expenses in the main cash book, then both the chief cashier and the main cash book will be overburdened. To solve these problems, the chief cashier delegates responsibilities to another senior staff member to account for day-to-day small transactions. For this purpose, he is given a small amount and a separate book to record these small payments. The book in which these small payments are recorded is known as the petty cash book. The funds used for small payments are known as petty cash, and the person responsible for making and recording these payments is the petty cashier. Three different systems are used to maintain petty cash. These systems are: Under this system, the petty cashier is given a lump sum to meet petty expenses. When the whole amount of petty cash is spent, the petty cashier submits the account to the chief cashier who again pays a lump sum to the petty cashier. Under the fixed system of petty cash, a fixed amount is given to the petty cashier for a fixed period of time. At the end of fixed period, the petty cashier submits the details of petty expenses, and the chief cashier again advances a fixed amount for the next fixed period. This is the most scientific approach to maintain Petty Cash. Under the imprest system, total petty expenses for a specific period are estimated and the amount is advanced to the petty cashier. This amount is known as imprest cash. The petty cashier spends the imprest cash during the period. At the end of the period, the petty cashier submits the statements covering petty expenditures to the chief cashier. The amount spent by the petty cashier is reimbursed, thus making up the balance to the original amount. In this way, the petty cashier will begin every period with an amount equal to imprest cash, and the amount held by the petty cashier will never exceed this. The imprest system has the following advantages: There are two main types of petty cash book: A simple petty cash book is just like the main cash book. Cash received by the petty cashier is recorded on the debit side, and all payments for petty expenses are recorded on the credit side in one column. Record the following transactions in a simple petty cash book for the month of January 2019. An analytical petty cash book is the most effective way to record petty cash payments. A separate column is assigned for each petty expense on the credit side. Whenever a petty expense is recorded in the total payment column, the same amount is recorded in the relevant petty expense column. Record the following transactions in an analytical petty cash book for the month of January 2019. When a petty cashier needs money, the main cashier gives them a cheque. This cheque is recorded on the payments side of the main Cash Book. The petty cashier receives cash against the cheque from the bank and records the cheque in the receipts column of the petty cash book. When a payment needs to be made from the petty cash fund, the petty cashier prepares a petty cash voucher (PCV). This voucher must be authorized by a responsible officer before the petty cashier makes the payment. Before issuing the payment, the petty cashier records the payment date, payment details (in the particulars column), the PCV number, and the amount of the voucher (in the total payment column and also in the relevant analysis column). The first PCV of the month is labeled with the numeral 1, followed by the number of the month. For example, the first voucher of May would be numbered as 1/5, the next as 2/5, and then as 3/5, and so on. At the end of each month, when the petty cashier approaches the main cashier for reimbursement, the latter will prepare a cheque voucher. The cheque voucher lists the total of the various payment analysis columns of the petty cash book. For example, consider the following: When a cheque (for $402.00) is issued to the petty cashier, the entries made in the main cash book are: Therefore, the total debits in the ledger agree with the credit in the main cash book. In other words, the petty cash book does not form a part of double-entry bookkeeping. The position of the petty cash book is similar to a subsidiary book. The petty cashier is always assumed to hold cash equal to the imprest account in the form of actual cash or paid-up PCVs. Petty Cash Book: Definition

Explanation

Systems for Maintaining Petty Cash

Open or Ordinary System of Petty Cash

Fixed System of Petty Cash

Imprest System of Petty Cash

Advantages of the Imprest System

Types of Petty Cash Book

Simple Petty Cash Book

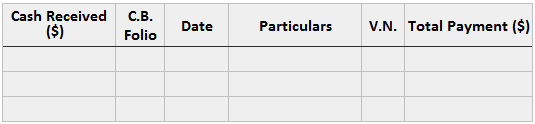

Format of a Simple Petty Cash Book

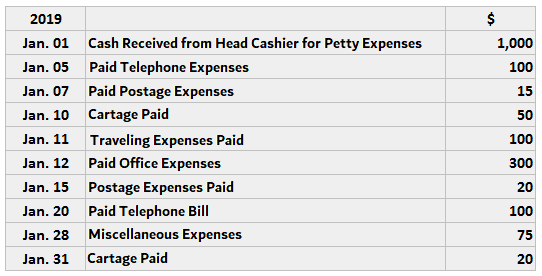

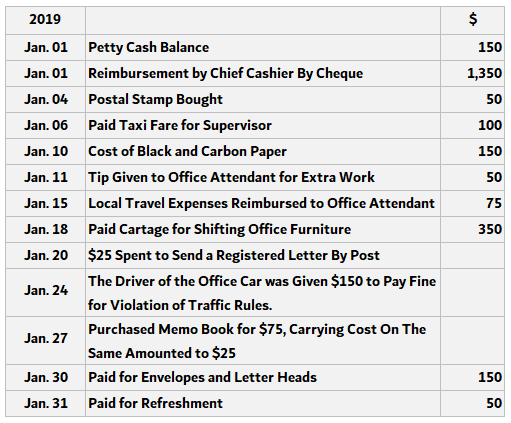

Example of a Simple Petty Cash Book

Solution

Analytical Petty Cash Book

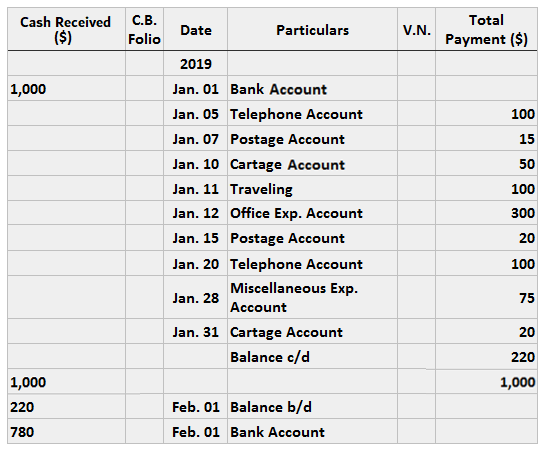

Format of an Analytical Petty Cash Book

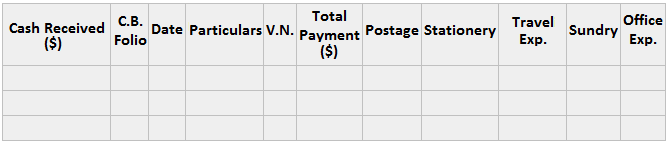

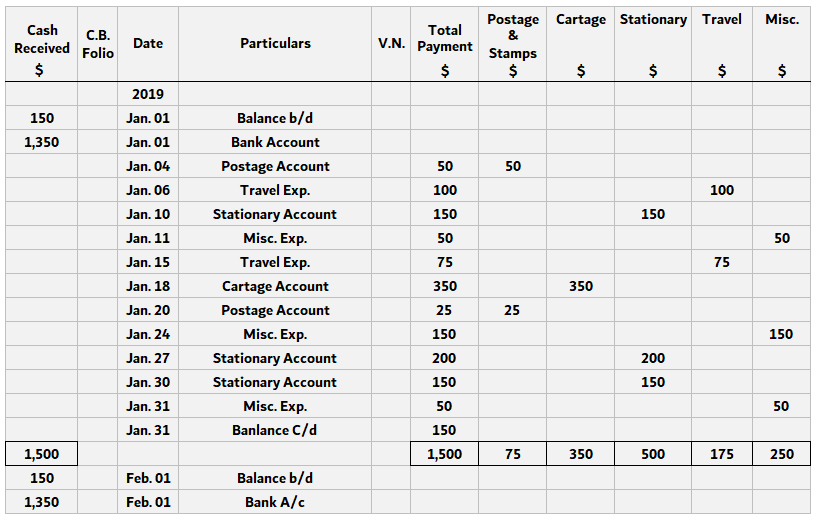

Example of an Analytical Petty Cash Book

Solution

Operation of Petty Cash

Posting Petty Cash Book to Ledger

Wages

$113.20

Transport

$41.80

Stationary

$80.60

Staff Tea

$26.40

Telephone

$140.00

Total

$402.00

Petty Cash Book FAQs

A petty cash book is maintained to record small expenses such as postage, stationery, and telegrams. A separate column is used for each type of expenditure.

There are three systems used to maintain petty cash - Open systems (or ordinary systems) for petty cash, fixed system for petty cash, imprest system of petty cash

The two types of petty cash books are simple petty cash book and analytical petty cash book

A simple petty cash book is just like the main cash book. Cash received by the petty cashier is recorded on the debit side, and all payments for petty expenses are recorded on the credit side in one column.

An analytical petty cash book is the most effective way to record petty cash payments. A separate column is assigned for each petty expense on the credit side. Whenever a petty expense is recorded in the total payment column, the same amount is recorded in the relevant petty expense column.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.