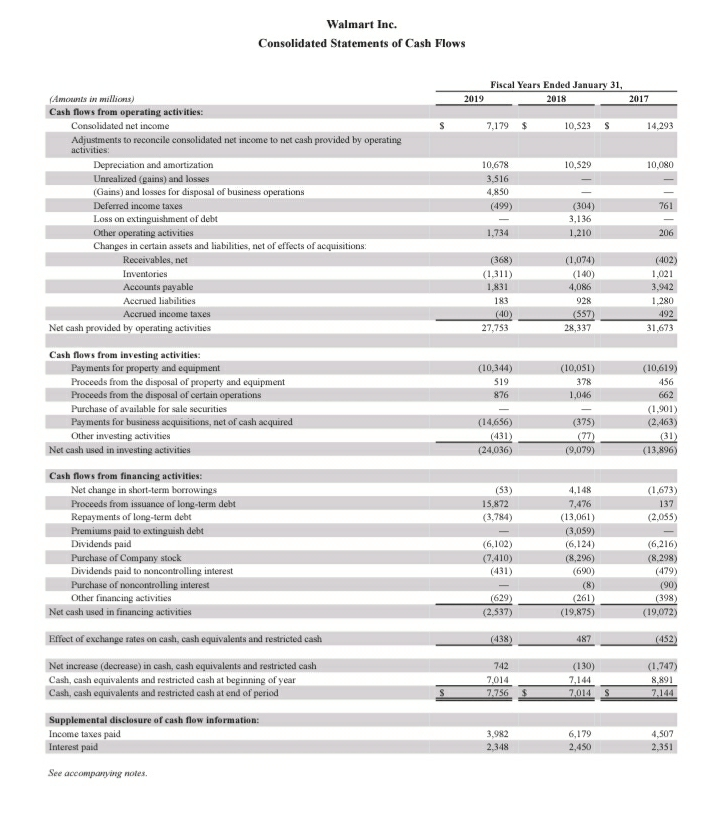

Cash flow from investing activities typically refers to the cash generated in a company by making or selling investments and/or earning from investments. Cash flow from investing activities is a major component of the cash flow statement. The cash flow statement is one of the four annual financial statements prepared by companies at the end of the year. Cash flow from investing activities involves the amount invested in fixed assets and in long-term securities (cash outflow), and the amount realized from the sale of these items (cash inflow). The four financial statements are: These financial statements systematically present the financial performance of the company throughout the year. The income statement reports the revenue and expenditure of a company during a specific period, while the balance sheet reports the assets, liabilities, and capital. Similarly, the statement of cash flow portrays the company's net cash flow for a certain financial period. It provides insight into all the cash that enters and leaves the business through its operating, investing, and financing activities. Cash flow from investing activities comprises all the transactions that involve buying and selling non-current assets, from which future economic benefits are expected. In other words, such assets are expected to deliver value and benefits in the long run. On CFS, investing activities are reported between operating activities and financing activities. The sum of all three results in the net cash flow of the company for the year. The format of a cash flow statement is as follows: Cash Flow From Operating Activities This section reconciles the net profit to net cash flow from operating activities by adjusting items on the income statement that are non-cash in nature. For example, depreciation is added back and income receivable is reduced. Cash Flow From Investing Activities Cash flow from investing (CFI) activities comprises all the cash purchases and disposals of non-current assets that produce benefits for the company in the long run. Usually, when companies expand they invest in property, plant, and equipment (PPE), and investors or shareholders of the company can easily find all these transactions in the CFI section of the cash flow statement. This section also mentions any cash spent on purchases of stocks in other companies from which dividends are earned. Examples of investing activities include: It's important to keep in mind that investing activities do not include any dividends paid, debts acquired, equity financing, and interest earned or paid. Cash Flow from Financing Activities Cash flow from financing activities includes cash transactions that increase or decrease a company's equity and/or liabilities. It typically includes issuing and buying back shares, acquiring loans, and paying dividends. In this example, we consider Walmart Inc.’s statement of cash flows for the year 2019. As you'll see below, the statement is separated into three parts, where investing activities come in between operating activities and financing activities. In CFI, Walmart has three negative cash flows, namely: At the same time, there were two positive cash flows in investing activities as follows: As the statement of cash flows indicates, Walmart made a significant capital expenditure in 2019 since it has a net cash outflow of $24,036 million in investing activities. The net cash used in investing activities was calculated by subtracting the positive cash flow of $1,395 million from the negative cash flow of $25,431 million. Even though the cash flow from investing activities offers a clear picture of a company’s investments, it's necessary to consider both the income statement and balance sheet to get a better understanding of its financial position. Cash Flow From Investing Activities is one of the categories of cash flow. Learn more about Cash Flow from Operating Activities in this article: Cash Flow From Operating ActivitiesCash Flow From Investing Activities: Definition

Cash Flow From Investing Activities: Explanation

Formula and Format

Calculation of Cash Flow From Investing Activities

Example

Cash Flow From Investing Activities FAQs

There are four main components in this section of a Cash Flow statement: Cash paid for property, plant, and equipment (PPE), Cash paid for investments in marketable securities, Cash received from sale of PPE and Cash received from sale or maturity of marketable securities.

The CFI section of a company’s statement of Cash Flows includes cash paid for PPE. However, in the operating activities section of its Cash Flow statement, it includes the Depreciation expense that appears on its income statement under income from continuing operations.

This section is divided into two parts: Cash Flows that decrease or increase a company’s assets and liabilities, and Cash Flows related to the disposal of assets.

In accounting, investment activities refer to the purchase and sale of long-term assets and other business investments, within a specific reporting period. The results of a company’s reported investing activities give insights into its total investment gains and losses during a defined period.

Negative Cash Flow from investing activities means that a company is investing in capital assets. As the value of these assets increases, the amount of net Cash Flow available to the company over time increases.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.