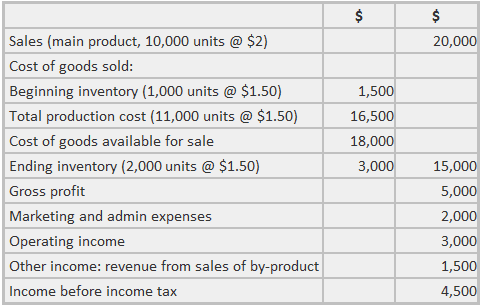

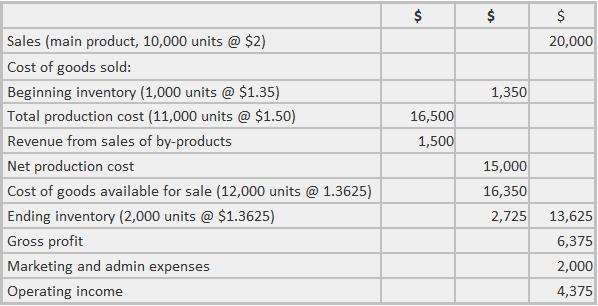

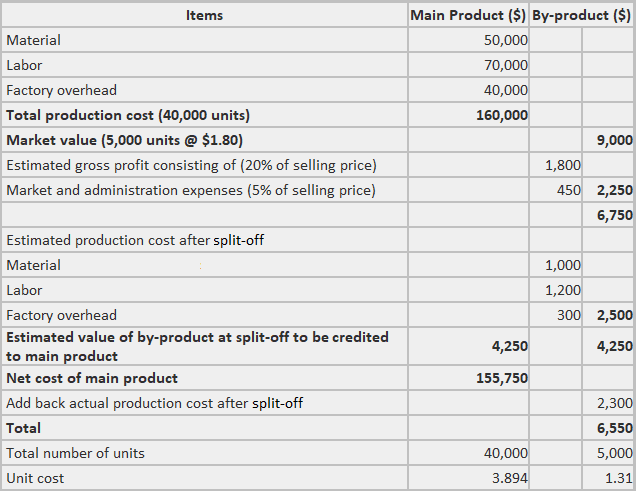

A by-product is a product with a relatively small total value that is produced simultaneously with a product of greater total value. The product with the greater value, commonly called the main product, is usually produced in greater quantities than the by-product. In most cases, manufacturers can exercise only a limited level of control over the quantity of the by-product that comes into existence. However, with the rise of advanced engineering methods, there are opportunities for greater control over the quantities of residual products. Furthermore, by-products may turn out to be valuable. For example, a company that regularly disposes of waste materials from its production process may find that the waste has utility has a fertilizer. As such, the by-product can serve as an additional source of income. The accepted methods of costing for by-products fall into two categories: In this method, a joint production cost is not allocated to the by-product. Any revenue resulting from the sale of the by-product is credited either to income or to the cost of the main product. In some cases, costs subsequent to the split-off from the main product may be offset against the revenue earned from the by-product. For inventory costing, an independent value may be assigned to the by-product. The methods commonly used in industry are: Method 1 is a typical non-cost procedure in which the final inventory cost of the main product is overstated to the extent that some of the cost belongs to the by-product. However, this shortcoming is removed to a certain degree in Method 1 (d), although a sales value rather than a cost is deducted from the production cost of the main product. (a) By-product revenue as other income To illustrate this procedure, the following income statement is presented: (b) By-product revenue as additional sales revenue In this case, the income statement above would show that $1,500 revenue from sales of the by-product is an addition to sales of the main product. As a result, total sales revenue would be $21,500 and gross profit and operating income would increase accordingly. All other figures would remain the same. (c) By-product revenue as a deduction from the cost of goods sold In this case, the $1,500 revenue from the by-product would be deducted from the $15,000 cost of goods sold figure, thereby lowering the cost and increasing the gross profit and operating income. Income before tax remains at $4,500. (d) By-product revenue deducted from production cost In this case, the $1,500 revenue from by-product sales is deducted from the $16,500 total production cost, yielding a revised production cost of $15,000. This revised cost results in a new average unit cost of $1.3625 for the main product. The final inventory will consequently be $2,725 instead of $3,000. The income statement appears as follows: These methods do not require complex journal entries. The revenue received from by-product sales is debited to cash (or accounts receivable). In the first three cases, income from by-product sales is credited, while in the fourth case, the main product's production cost is credited. Revenue from by-product sales, less the cost of placing the by-product on the market (i.e., marketing and administrative expenses), and also less any processing costs, are shown on the income statement in a manner similar to that indicated in Method 1. Method 2 recognizes the need to assign some cost to the by-product. However, it does not attempt to allocate any of the main product's cost to the by-product. Any expenses involved in further processing or marketing the by-product are recorded in separate accounts. All figures are shown on the income statement. This is achieved by following one of the procedures described in Method 1. Entries in the journal for Method 2 involve charges to by-product revenue for the additional work required, and potentially also for factory overhead. Marketing and administrative expense might also be allocated to the by-product on some predetermined basis. Certain firms carry an account called the by-product account, to which all additional expenses are debited and all income statements are credited. The balance of this account is shown in the income statement using one of the procedures outlined in Method 1. However, it is necessary to report accumulated manufacturing costs applicable to by-product inventory on the balance sheet. Some portion of the joint production cost is allocated to the by-product. Inventory costs are based on the allocated cost, plus any subsequent processing cost. In this category, the following methods are used: The replacement cost method is usually applied by firms whose by-products are used within the plant. This avoids the need to purchase certain materials from outside suppliers. The production cost of the main product is credited for such materials, and the offsetting debit is assigned to the department that uses the by-product. The cost assigned to the by-product is the purchase or replacement cost existing in the market. The replacement cost method is commonly used in the steel industry. Although many by-products are sold in the open market, other products (e.g., blast furnace gas and coke oven gas) are mixed and used to heat open-hearth furnaces. The waste heat from the open hearths is reused to generate the steam required by the various production departments. The resourceful use of these by-products, as well as their accounting treatment, are reflected in the following procedure used by steel companies: The reversal cost method is based on the theory that the cost of a by-product is related to its sales value. It is a step toward recognizing a by-product's cost prior to the split-off from the main product. It is also the closest approach to the methods used in joint product costing. The reversal cost method is similar to the last technique illustrated in Method 1. However, it reduces the manufacturing cost of the main product not by the actual revenue received, but by an estimate of the by-product's value at the time of recovery. This estimate must be made prior to the split-off from the main product. Dollar recognition depends on the stability of the market (in terms of price) and the stability of the by-product; however, control over quantities is important. The by-product account is charged with this estimated amount. In addition, the production (manufacturing) cost of the main product is credited. Any additional costs in terms of materials, labor, or factory overheads that are incurred after the split-off from the main product are charged to the by-product. Marketing and administrative expenses may also be allocated to the by-product on some equitable basis. The proceeds from sales of the by-product are credited to the by-product account. This account's balance can be shown on the income statement as indicated in Method 1, except that the manufacturing cost applicable to by-product inventory should be reported in the balance sheet. The reversal cost method of ascertaining the costs of the main product and by-product is illustrated as follows: This illustration indicates that an estimated value of the by-product at the split-off point results when estimated gross profit and production cost after split-off are subtracted from the by-product's ultimate market value. Alternatively, if the by-product has a market value at that split-off point, the by-product account is charged with this market value. In addition, the main product's production cost would be credited. It is also possible to use the total market values of the main product and the by-product at the split-off point as a basis for assigning a share of the cost prior to split-off to the by-product. This involves applying the events offsetting credit to the production cost of the main product.By-products: Definition and Explanation

Methods of Costing By-Products

1. Non-cost or Sales Value Method

2. Cost Methods

Replacement Cost Method

Reversal Cost Method

By-Products FAQs

The by-product should be recorded as inventory until its intended marketability has been established. The cost of a by-product is attributed to individual products manufactured using it if those products are finished and ready for sale, or if there is a market for the by-products. If a market is not established, the cost of the by-product remains in ending inventory until it is sold as part of the main products. When this happens, it is recorded as a separate line item on the income statement.

All costs not reasonably attributable to any one product are considered period costs, and should be recorded on the income statement as sg&a (selling, general and administrative expenses).

The scrap value is credited to the appropriate production overhead account; however some companies will also record the scrap value as a separate line item.

Unamortized costs are not carried forward unless they can be specifically attributed to the new by-product. Otherwise, these costs remain in ending inventory until they are completely used up.

A by-product is typically the leftovers from an activity that continues to be useful to your company, but doesn't contribute directly to its intended purpose or production process. For example, if your company makes tires it might also produce sawdust as a by-product. Sawdust is useless to the tire company, so it would have no value. But if your company runs a wood shop, the sawdust may be useful for flooring or other products. Likewise, leftover scrap metal from making cars might have some resale value as it could be sold for recycling.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.