Cost accounts are maintained independently of financial accounts because the two accounts have different aims, namely: The results of these accounts also differ, meaning that contrasting profits and results may arise. Such differences require reconciliation between the results, which also helps test the reliability of the accounts. Businesses maintain cost accounts and financial accounts based on a non-integral system or integral system of accounting. The non-integral system sees cost accounts and financial accounts maintained separately. A cost accountant maintains cost accounts as per the principles of cost accounting to ascertain the total and per-unit cost of products and jobs at different stages of production or execution. Meanwhile, a financial accountant maintains financial accounts as per the principles of financial accounting to record day-to-day transactions and find out their net effect on the profitability and financial position of the business. Thus, the aims, objects, principles, and methods of maintaining cost accounts and financial accounts differ, meaning the profits shown by the accounts may not align. The conflicting information provided by these two sets of accounts may not help organizations make correct policy decisions. Thus, the system of costing should be capable of reconciliation with financial accounts. Cost accounts depend upon estimates and comprise a detailed analysis of financial expenditure: failure to reconcile such analysis with financial accounts makes cost accounts unreliable. In this connection, H.J. Wheldon posits that “no system is complete unless it is linked up with financial accounts so that the results shown by both cost and financial accounts may be reconciled.” Reconciliation represents the process of tallying the working results or profits as shown by cost accounts with those of financial accounts. According to Eric L. Kohler, “Reconciliation is the determination of the items necessary to bring the balances of two or more related accounts or statements into an agreement. Efforts are also made to judge the arithmetical accuracy of the profits revealed by two different sets of books.” Thus, reconciliation identifies and accounts for the items which have led to the difference in working results as shown by cost accounts and financial accounts. The reconciliation occurs in an analytical form presented in the shape of a statement (known as the reconciliation statement) or a memorandum account (known as the memorandum reconciliation account). Since both cost and financial accounts are maintained independently and have different purposes and accounting procedures, the profit or loss shown may also differ. Thus, reconciling the two sets of accounts will help to determine the correct results and, at the same time, test the reliability of cost accounts. The reconciliation of cost and financial accounts can help a company’s management personnel in the following ways: Under the non-integral system of accounting, which maintains cost accounts and financial accounts separately, the documents used to ascertain the amount of charged expenditure are the same. For instance, material requisitions and wages sheets help determine the cost of materials used and labor paid. However, differences may arise in the profits or losses shown by the two sets of accounts. These differences are typically attributable to one or more of the following reasons: 1. Under/overabsorption of overhead: Financial accounts show a firm’s actual expenditure (e.g., factory or office expenses), whereas cost accounts show an approximate charge in respect of these items based on records or the predetermined absorption rate. 2. Items of receipts/income shown in financial accounts only: The following items of receipts and income are shown or included in financial accounts but excluded from cost accounts: 3. Items of expenses/losses shown in financial accounts only: The following items of expenses and losses are charged in financial accounts but not shown in cost accounts: 4. Items of abnormal profit/loss included in financial accounts only: These various items of abnormal profit/loss are included in financial accounts but excluded from cost accounts: 5. Items of expenses included in cost accounts only: These items of expenses are recorded in cost accounts only: 6. Difference in the basis for charging depreciation on assets: The methods for calculating depreciation on fixed assets in cost accounts and financial accounts may differ, leading to a difference in working results. Financial accounts offer depreciation based on the diminishing balance (written-down value) method or original cost method. However, cost accounts may follow the machine hour rate or production unit method of depreciation. 7. Difference in bases for valuation of stock: Financial accounts value the stock of raw material at cost price or market price, whichever is less, while cost accounts value the stock by adopting methods such as FIFO, LIFO, and average price methods. The stock of work-in-progress for cost accounts may be valued based on prime cost or factory cost. Financial accounts make valuations by taking office and administration expenses into account. When differences are identified between the results in cost accounts and financial accounts, the following steps should be undertaken to identify the cause: 1. Ascertain the extent of the difference between indirect expenses as recorded in financial accounts and the charges made in cost accounts. 2. Prepare a schedule of all expenses and losses included in the trading and profit and loss account but not in cost accounts. 3. Prepare a schedule of all income and profit credited to the profit and loss account but excluded from cost accounts. 4. Prepare a schedule of all items included in cost accounts but excluded from financial accounts. 5. Ascertain the basis on which stocks of raw materials, work-in-progress, and finished goods have been valued for balance sheet purposes, and then compare it with the valuations in the cost accounts. In turn, determine the difference. 6. Ascertain all items included in cost accounts and financial accounts, even if they differ in value 7. After locating the discrepancies, prepare a reconciliation statement by starting with profit as disclosed by cost accounts. Next, add the following items to the profit as per cost accounts: 8. Deduct the following items from profit as per cost accounts: After making the above adjustments, the profit as per cost accounts will agree with the profit as per financial accounts. Profit disclosed by a company’s cost accounts for the year was $50,000, whereas the net profit disclosed by the financial accounts amounted to $46,000. According to the following information: From the above, prepare a statement reconciling the figures shown by the cost and financial accounts.Reconciliation: Definition

Why Reconcile Cost Accounts and Financial Accounts?

Causes of Disagreement of Between Cost Accounts and Financial Accounts

Reconciliation of Costing and Financial Results

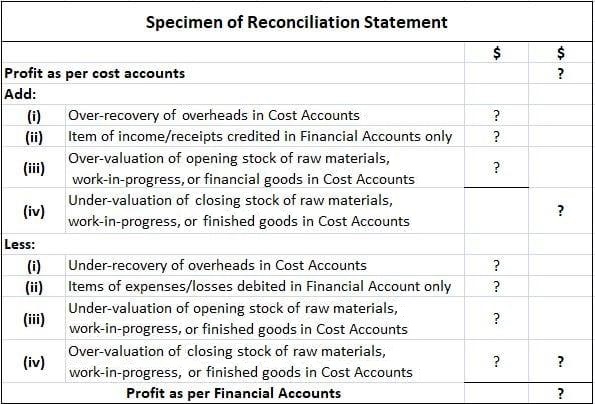

Specimen of Reconciliation Statement of Cost and Financial Accounts

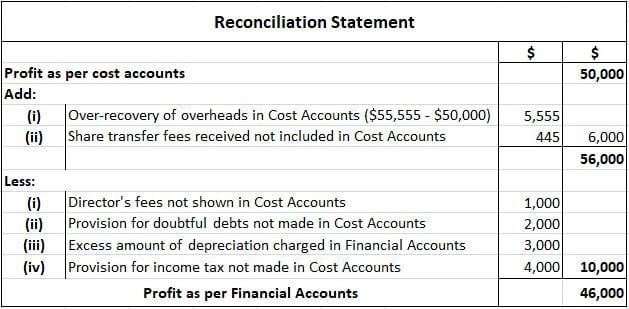

Example

Solution

Reconciliation of Cost Accounts and Financial Accounts FAQs

Yes, reconciling the two sets of accounts is important as it allows for an accurate understanding of a company’s financial performance. Differences between the results in cost and financial accounts can be caused by a number of factors such as over- or under-absorption of indirect expenses, incorrect valuations of stocks, or incorrect allocation of costs.

The main purpose of reconciling cost and financial accounts is to identify and correct any discrepancies between the two sets of accounts. This helps to ensure that the profit figure shown in financial accounts is accurate and consistent with the company’s actual performance, and that any non-recurring or unusual items are excluded from the profit figure.

When indirect expenses such as factory rent and electricity charges are under-absorbed in cost accounts, they result in an overstatement of profit as per the financial accounts. Conversely, when these expenses are over-absorbed in cost accounts, it leads to a understatement of profit as per the financial accounts.

Under-absorption of indirect expenses occurs when the amount charged for indirect expenses in financial accounts is lower than the amount actually incurred. This results in a higher profit as per the cost accounts.

A provision for doubtful debts refers to an expense made by a company in anticipation of a customer not being able to pay his outstanding dues. If such a provision is recorded in the cost account, it does not appear as an expense in the financial accounts, resulting in an understatement of the company's expenses.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.