Cost is the sacrifice made that is usually measured by the resources given up to achieve a particular purpose. It is a sacrifice made in order to obtain some goods or services. Eventually, costs will become expenses. Cost measurement and allocation are significant aspects of financial and management accounting. Cost measurement and allocation techniques are used not only to assign incurred costs to products or services but also to plan future activities. In accounting, the term cost has a variety of meanings. Furthermore, various cost concepts and measurement techniques are needed for internal planning and control. The purpose of this article is to analyze the cost classifications and behavior patterns that are widely used in management accounting. Such an analysis will help management accountants when supplying information for planning and decision-making purposes. Cost can be defined as the amount (measured in terms of money) paid for goods and services received (or to be received). Accountants and managers use many different concepts of cost, each usually for a different purpose. It is the classification of cost that indicates to managers how the term is being used and whether they can do anything about the cost or not. Important types of costs are explained below. Product costs are assigned to goods either purchased or manufactured for resale; they are incurred to produce or purchase a product. Product costs are initially identified as part of the inventory on hand. Inventoriable cost is another name for product cost. It is stored as the cost of inventory until the goods are sold. Inventoriable costs become expenses (cost of goods sold) when the product is sold. Period costs are expensed during the time period in which they are incurred. They are costs that are treated as expenses of the period in which the costs are incurred. An expense refers to the consumption of assets for the purpose of generating revenue. A direct cost is a cost that can be traced to specific segments of operations. An indirect cost is a cost that cannot be identified with specific segments of operations. Common costs are shared by multiple segments. Example Segments = Plastic chairs (P) & Wood chairs (W) Product costs consist of: The formula for manufacturing cost is the following: Manufacturing costs = DM + DL + MOH Direct material (DM): Raw materials that are physically incorporated into the finished product. Direct labor cost: The cost of salaries, wages, and fringe benefits for personnel who work directly on the manufactured products. Manufacturing overhead: Manufacturing costs other than direct material and direct labor costs. Conversion costs are direct labor costs plus manufacturing overhead costs. These are the costs of direct material and direct labor. Period costs (expenses) incurred in and due to administrative activities. A variable cost changes in direct proportion to a change in the level of activity. Fixed costs do not change in total as activity changes. Marginal costs are additional costs incurred in producing extra units. These types of costs are the difference between costs for the corresponding items under each alternative being considered. For example, incremental cost increasing output from $1 000 to $1 100 units per week is the additional cost of producing an extra 100 units per week. Difference Between Marginal and Incremental Cost The main difference is that marginal cost represents the additional cost of one extra unit of output, whereas incremental cost represents the additional cost resulting from a group of additional units of output. These costs are created decisions made in the past that cannot be changed by any decision that will be made in the future. Written down values of any asset previously purchased are an example of sunk costs. This cost refers to the opportunity that is lost or sacrificed when the choice of one course of action requires that an alternative course of action be given up. Notably, opportunity cost only applies to resources that have some alternative uses. If no alternative use of resources exists, then the opportunity cost is zero. This is the expense measured by the cost of the finished goods sold during a specific period. Partially completed products that are not yet ready for sale. Completed goods available for sale. The elements of cost are categorized under: These are the principal substances used in production. Materials are transformed into finished goods through the addition of labor and factory overhead. The cost of materials may be divided into direct and indirect materials as follows: (a) Direct Materials Direct materials are those that can be identified in the product, which can be conveniently measured and directly charged to the product. Direct materials can be identified with the product, easily traced, and represent a major material cost associated with producing the product. Examples of direct materials include wood in furniture, iron in fans, clay in bricks, leather in shoes, and wheat in flour. (b) Indirect Materials All materials involved in the production of a product that are not direct materials are indirect materials. For example, nails and glue used in the manufacturing of a table are examples of indirect materials. In other words, indirect materials cannot be directly identified. Labor is the physical or mental effort expended in the production of a product. Labor costs may be divided into direct and indirect labor as follows: (a) Direct Labor Direct labor is all labor directly involved in producing a finished product; that represents a major labor cost of producing the product. The work of machine operators in a manufacturing concern would be considered direct labor. (b) Indirect Labor All labor involved in producing a product that is not considered direct labor is classed as indirect labor. For example, the work of a plant supervisor in a manufacturing concern would be considered indirect labor. Factory overhead refers to all costs other than direct materials and the direct labor required to produce a product. This follows from the fact that the cost of any product equals the cost of direct materials, direct labor, and factory overhead. Indirect materials and indirect labor are also included in factory overhead. This is because they can not be identified with a specific product. Other examples of factory overhead costs, aside from indirect materials and indirect labor, include rent, utility bills, and depreciation of factory equipment. Factory overhead costs can be further classified as fixed, variable, and semi-variable costs. By grouping the above elements of cost, the following equations showing the relationships between costs are obtained:Cost: Definition

Cost: Explanation

Types of Cost

Product Cost

Inventoriable Cost

Period Cost

Expense

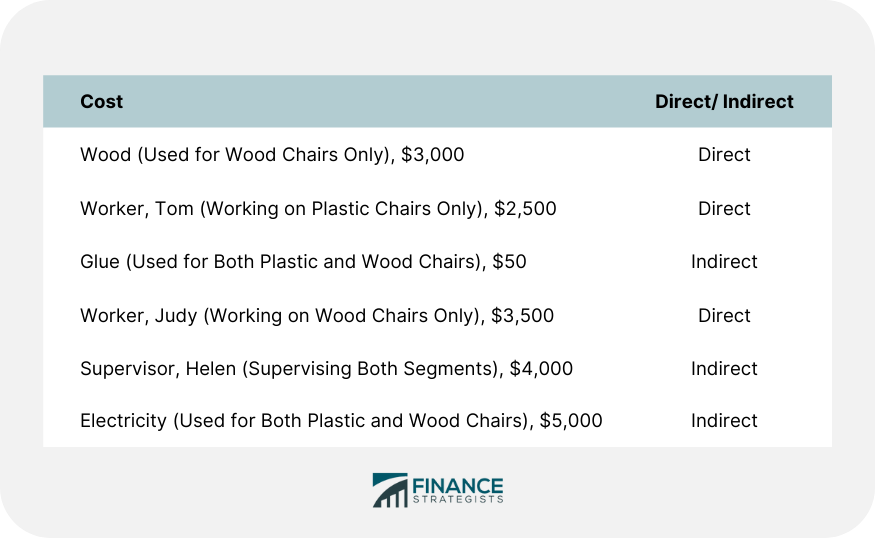

Direct Cost

Indirect Cost

Manufacturing Cost

Conversion Cost

Prime Cost

Non-manufacturing Cost

Variable Cost

Fixed Cost

Marginal Cost

Incremental Cost

Sunk Cost

Opportunity Cost

Cost of Goods Sold

Work in Process

Finished Goods

Elements of Cost

1. Materials

2. Labor

3. Factory Overhead

Cost FAQs

Cost is the sacrifice made that is usually measured by the resources given up to achieve a particular purpose. It is a sacrifice made in order to obtain some goods or services.

Cost can be defined as the amount paid for goods and services received. Important types of costs includes:- product cost- inventoriable cost - period cost - expense cost - direct cost - indirect cost - manufacturing cost - conversion cost - prime cost - non-manufacturing cost- variable cost - fixed cost - marginal cost - incremental cost - sunk cost - opportunity cost - work in process - finished goods

The main difference is that marginal cost represents the additional cost of one extra unit of output, whereas incremental cost represents the additional cost resulting from a group of additional units of output.

The elements of cost are categorized under:- material (the principal substances used in production)- labor (the physical or mental effort expended in the production of a product)- factory overhead (refers to all costs other than direct materials and the direct labor required to produce a product)

By grouping the above elements of cost, the following equations showing the relationships between costs are obtained: 1. Prime cost = direct material + direct labor 2. Conversion cost = direct labor + factory overhead 3. Factory cost = direct materials + direct labor + factory overhead

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.