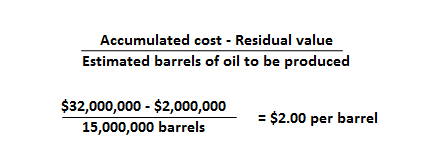

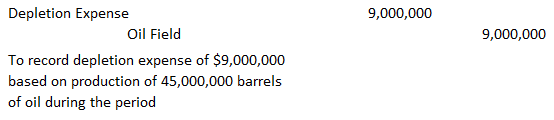

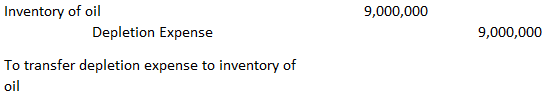

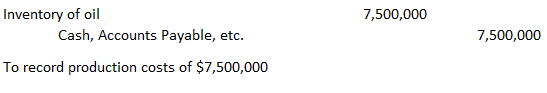

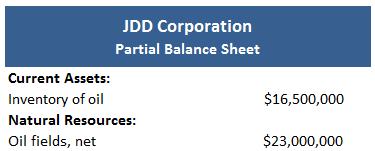

Natural resources are physical substances that are converted into inventory when extracted from the ground and, when sold, produce revenues for the firm. Natural resources include oil, natural gas, coal, iron, uranium, and timber. These assets are often referred to as wasting assets. This is because once they are removed from the ground or physically consumed, they cannot be replaced. Natural resources give up their benefits as the resources are removed. This process is called depletion and it essentially follows the same process as units of production depreciation. That is to say, to determine the cost per unit of output, the capitalized cost of the natural resources is divided by the estimated output. This per-unit cost is then charged to depletion expense as the resources are removed. To show how depletion is calculated, assume that JDD Company pays $18 million for land on which to drill oil. Other capitalized costs relating to exploration and development are $14 million and so the total cost is $32 million. The company estimates that there will be a $2 million residual value at the end of the project, and so the total depletable cost is $30 million. Geologists also estimate that the oil field will produce 15 million barrels of oil over the project's life. The depletion charge is $2 per barrel, calculated as follows: If 4.5 million barrels are produced this year, the depletion charge amounts to $9 million ($4,500,000 x $2.00). The required journal entry is: By convention, the credit is made directly to the asset account rather than a contra-asset account. The depletion expense ultimately becomes part of the cost of the oil inventory that eventually will be sold. This allocation can be accomplished by making the following journal entry: In this example, other production costs, including transportation and direct labor, must be included as part of the inventoriable cost of the oil. Continuing our example, assume that during the year these costs amount to $7.5 million. They would be recorded as follows: After these entries, and assuming that no sales have occurred yet, the relevant section of JDD's balance sheet would be as follows: The inventory of oil is recorded in the current assets section, while the book value of the oil fields is shown in the noncurrent section under natural resources. Finally, when the barrels of oil are sold, the sale and cost of sale are recorded in the usual manner.What Are Natural Resources?

Accounting for Natural Resources

Example

Accounting for Natural Resources FAQs

Natural resources are physical substances that are converted into inventory when extracted from the ground and, when sold, produce revenues for the firm.

Natural resources are usually classified as noncurrent assets.

Depletion is a process of allocating the cost of natural resource reserves to expense, using units-of-production Depreciation. The cost per unit will be determined by dividing the total capitalized cost of the natural resource by its estimated output.

The accounting treatment of the costs associated with the extraction and production of natural resources depends on whether these assets are acquired in a business combination or developed, through leasing arrangements or by individuals. If they were acquired in a business combination, they would be recorded at their fair market value on the date of purchase. Costs incurred in acquiring the assets would be allocated to the various assets based on their fair values.

Natural resources developed by an individual would be expensed as incurred. If the owner of these resources enters into an agreement to sell them, the owner would recognize a gain or loss on the sale.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.