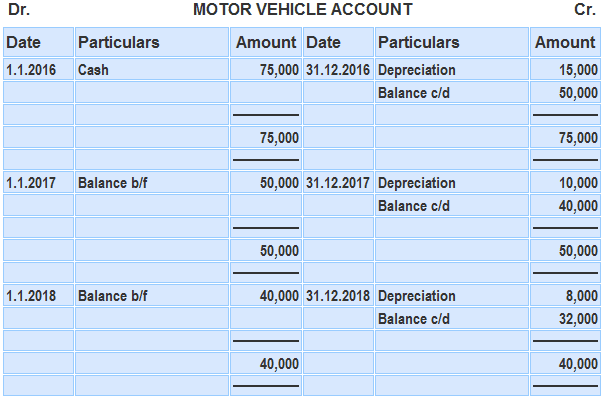

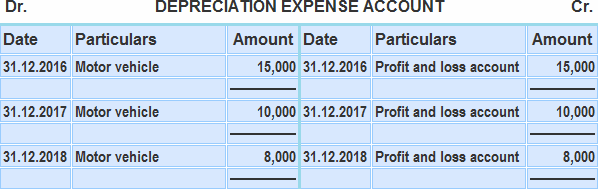

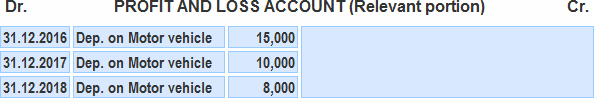

After calculating depreciation using a suitable approach, it must be brought to books. The accounting entries for depreciation are generally made at the end of each financial year. A new account called the depreciation account, or more appropriately the depreciation expense account, is opened in the books. This account is debited by the amount of depreciation to be provided for the year. Alongside this, the fixed asset account concerned is credited by the same amount. The effect of this entry is that the depreciation expense account shows the amount of expense for the year, while the fixed asset account shows a reduced balance. The depreciation expense account, being a nominal account, is closed at the end of each financial year by transferring its balance to the profit and loss account. ABC company purchased a motor vehicle for $75,000 on 1 January 2016. The company plans to provide depreciation at 20% per year using the reducing installment method. Required: Show the following accounts in the company's ledger for 2016, 2017, and 2018: Step 1: Calculation of depreciation for 2016, 2017, and 2018 For 2016: For 2017: For 2018: Step 2: Prepare the ledger accounts At the end of all three years, depreciation will appear on the debit side of the profit of loss account as an expense. It is shown below:Explanation

Example

Solution

Accounting Treatment of Depreciation FAQs

Depreciation refers to the loss in value of an asset over a period of time due to usage, passage of time and obsolescence. It can be expressed in monetary terms as decrease in value of an asset.

While most assets will incur some measure of Depreciation, it is not possible to quantify Depreciation for each and every asset in the business.

The machine will invariably be bought at a certain price, often denoted by the term capital cost or acquisition price. The value of the machine will decline over time and hence needs to be accounted for via Depreciation.

It is the simplest way to calculate Depreciation and it assumes that the value of an asset declines evenly over time, with no recognition of periods in which the asset has little or no value. This type of calculation will result in a consistent figure for each period.

As can be seen from the example above, an asset will continue to have some residual value even after the depreciable amount has been deducted. This is sometimes referred to as Salvage Value. Depreciation does not reflect this additional value.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.