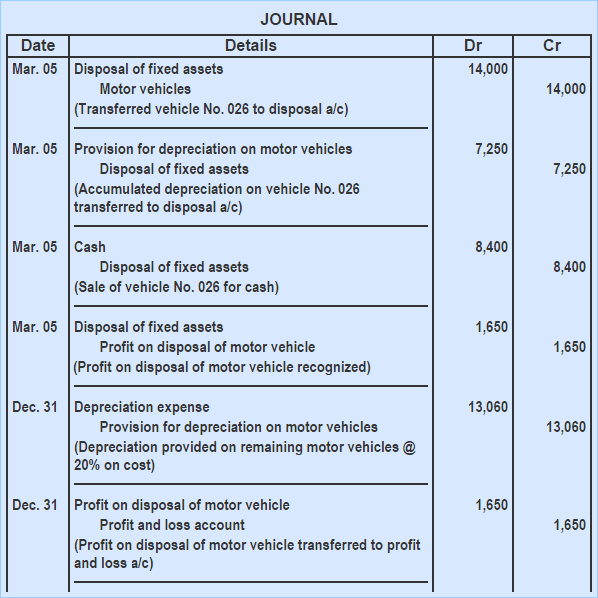

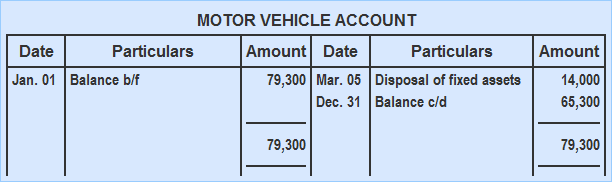

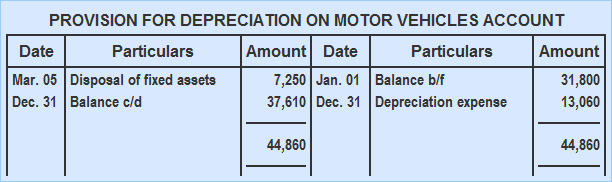

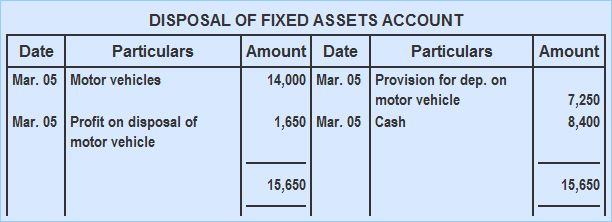

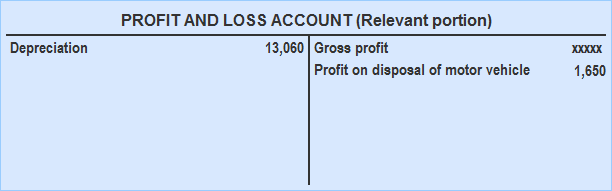

If a fixed asset is sold or disposed of, several accounting entries are made to record the relevant transactions. First, a new account called the disposal of fixed assets account is opened. In turn, the cost of the fixed asset being disposed of is transferred to this account. This occurs by debiting the disposal of fixed assets account and crediting the relevant fixed asset account with the cost of the asset being disposed of. Any accumulated depreciation is also transferred to the disposal of fixed assets account by debiting the provision for depreciation account and crediting the disposal of fixed assets account with the total accumulated depreciation on the disposed of item. It is generally not considered advisable to provide any depreciation for the year of disposal. Hence, the amount transferred to the disposal of fixed assets account is the accumulated depreciation at the end of the previous accounting period. The effect of the first two entries is that the cost and accumulated depreciation are removed from the normal accounts. Also, the disposal of fixed assets account now shows the book value of the item to be disposed of. If the asset is sold for cash, the cash or bank account is debited and the disposal of fixed assets account is credited with the amount actually received on the sale of the asset. If the asset is traded in, sold on credit, or destroyed (and an insurance claim is made), the account of the supplier of the new machine, the debtor, or the insurance company is debited. Also, the disposal of fixed assets account is credited with the agreed value of the item. After making the above-mentioned entries, the disposal of fixed assets account shows a debit or credit balance. If it shows a debit balance, this denotes a loss on the disposal of the fixed asset. Like all expense accounts, this debit balance should be transferred to the debit of profit and loss account at the end of the year. If, on the other hand, the disposal of fixed assets account shows a credit balance, this denotes a gain or profit on the sale of the fixed asset. This should be credited to the profit and loss account as an ancillary income (also known as other income or non-operating income) at the end of the year. The KLM company has several motor vehicles. On 1 January 2016, the motor vehicles account shows a balance of $79,300. On the same date, the provision for depreciation on the motor vehicles account stood at $31,800. On 5 March 2016, Motor Vehicle No. 026 was sold for $8,400. It had an original cost of $14,000 and an accumulated depreciation of $7,250. Required: Show journal entries and relevant ledger accounts, assuming a depreciation rate of 20% p.a. on cost.Explanation

Entry 1

Entry 2

Entry 3

Entry 4

Entry 5

Entry 6

Example

Solution

Depreciation and Disposal of Fixed Assets FAQs

Some businesses own or lease property, for example land, buildings, machinery and so on. This type of asset has a useful life of more than one accounting period (usually many years) and must be valued at the end of each accounting period. To do this, the asset’s value at the end of the period is depreciated.

With other types of assets, such as stock or work in progress, the only cost that needs to be transferred out is the amount used up during the accounting period. With Fixed Assets there are two costs that need to be transferred out at the end of each accounting period. Firstly, the amount used up during this period (Depreciation) and secondly, the original cost (also known as the fixed asset’s carrying value).

Yes. If there has been a significant change in market value shortly before the Fixed Assets account is closed and if there has not been a previous revaluation, then the fixed asset’s carrying value may be overstated. In this case, it might be better to revalue the Fixed Assets to show their new market values at the end of the period.

A company only records the actual amount of Depreciation taken each accounting period. It will not record any provision for future Depreciation, but it will transfer to profit and loss account any gain made on disposal of a fixed asset or an account receivable through use of accelerated Depreciation methods. This is because the amount of Depreciation taken in previous accounting periods was less than that allowed for in the accounts, thus creating a future expense when compared to the original cost.

Fixed Assets are not revalued unless there has been a significant change in value shortly before they are closed. It is unlikely that the company would sell all of its Fixed Assets before the next revaluation, if they were to be sold and there was no change in value at this point, it could result in a loss on sale of these assets.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.