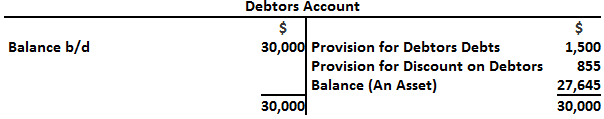

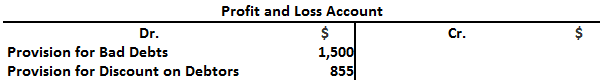

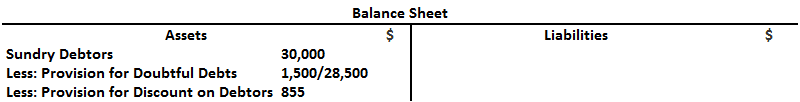

At the end of the trading period, there are typically outstanding debtors or accounts receivable. To motivate debtors to pay their debts, companies may sometimes offer a cash discount. For this purpose, it is necessary for the company to create a provision or allowance for the discount on debtors or accounts receivable. In other words, it is an anticipated loss that a trader willingly bears by allowing a cash discount to those customers who settle their accounts within the prescribed time. To make this provision, at the end of the financial year, a percentage is calculated on the total amount of sundry debtors (after deducting the provision for bad debts). The adjusting entry shown later in this article is passed to make the provision for discount on debtors. In December 2024, the total sundry debtors of a business are $30,000. The company decides to create a Provision for Bad Debts @ 5% and a Provision for Discount on Debtors @ 3% p.a. on sundry debtors. The amount of the provision for discount on debtors is an anticipated loss of the business, while on the other hand, it is a reduction in the value of the debtors account. Provision for discount on debtors has the following two effects on the final accounts: (i) (ii) (iii) (iv) (v) (vi)Example

Accounting Treatment

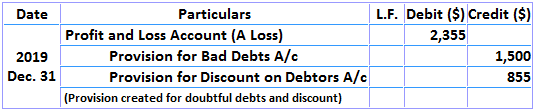

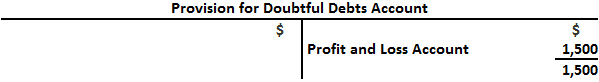

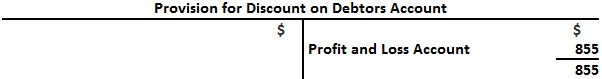

Adjusting Entry

Provision for Discount on Debtors FAQs

A provision for discount is an accounting entry that records the estimated amount of future discounts that will be granted to debtors. The provision is made against the accounts receivable account, which reduces the value of the receivables.

The benefits of using a provision for the discount include increased accuracy in recording the number of future discounts that will be granted to debtors, better decision making about extending credit to customers, and improved management of accounts receivable balances.

The provision for discount can also be estimated by calculating the average amount of discounts granted to debtors and multiplying it by the estimated amount of future discounts that will be granted. This will give you the estimated provision for a discount. Finally, the provision for discounts can be reduced by the number of discounts granted to debtors when they pay their accounts.

A provision for discount is necessary because it allows businesses to estimate and record the number of future discounts that will be granted to debtors. This information helps businesses make better decisions about extending credit to customers and managing their accounts receivable balances.

Debiting provision for discount on debtors and crediting provision for doubtful accounts to record the reduction of the provision for doubtful debts if it is less than the provision already existing.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.