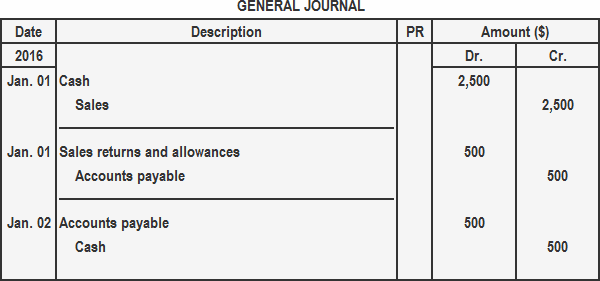

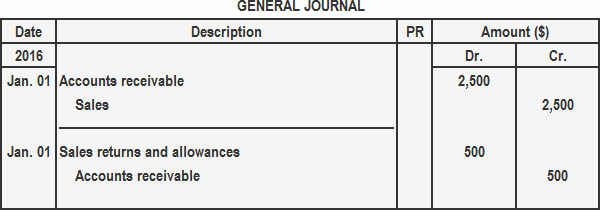

Occasionally, customers return the merchandise they purchase. In accounting, such returned merchandise are termed as sales returns or returns inwards. The major reasons for sales returns are: When merchandise is returned, customers usually ask for a cash refund. However, a customer may find that low-quality (or slightly damaged) goods can be resold at a lower price or they can be used elsewhere. In such circumstances, they usually prefer to retain the goods in question and ask for an allowance (e.g., price reduction) from the seller rather than returning the goods and asking for a refund. The refunds and allowances discussed above are accounted for by maintaining an account known as the sales returns and allowances account. When customers return merchandise sold for cash, the sales returns and allowances account is debited and the accounts payable account is credited. This entry is made when a customer notifies the business that they will return the merchandise. Afterward, another journal entry may be required in which the accounts payable account is debited and the cash account is credited. This journal entry is made when a cash refund is given to the customer for the goods they returned. These two journal entries complete the accounting process required in the books of the seller for the return of merchandise. On 1 January 2016, the Modern Trading Company sold merchandise for $2,500 to Small Retailers. Small Retailers received the delivery on the same day and found the merchandise costing $500 did not meet the order specification. These merchandise were returned to the Modern Trading Company on the same day. In turn, the Modern Trading Company granted a cash refund of $500 to Small Retailers on 2 January 2016. Required: In the books of seller (i.e., Modern Trading Company), make a journal entry: When merchandise are returned by a credit customer, only one journal entry is required. In this entry, the sales returns and allowances account is debited and the accounts receivable account is credited. On 1 February 2016, John Enterprise sold merchandise for $1,500 to Sam Enterprise on account. On the same date, merchandise amounting to $200 were returned to John Enterprise because they failed to meet the required quality standards. Required: Pass journal entries in the books of John Enterprise at the time of the sale and at the time of the return of merchandise.Returns Inwards: Definition

Journal Entries

Return of Merchandise Sold for Cash

Example

Solution

Return of Merchandise Sold on Account

Example

Solution

Journal Entry for Sales Returns (Returns Inwards) FAQs

You can set-up a sales returns and allowances account by opening an appropriate account in your chart of accounts. You can then create journal entries from the beginning that will automatically debit this new account on all future transactions.

When return goods are given by the customer, a journal entry is required in two steps. First, the sales returns and allowances account is debited. Second, accounts payable is credited. Then, an adjusting journal entry can be made to show that payment has been received.

The seller makes an adjusting entry in which the accounts payable account is debited and the sales returns and allowances account is credited. This journal entry ensures that payment has been received for the returned goods.

Yes, if return goods are given back to the manufacturer by a customer, they have sales returns and allowances journal entries. These should be set-up in the books before any transactions are made.

This means that you have allowed return of goods or given back money to your customers.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.