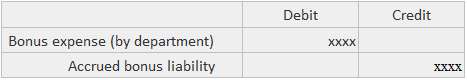

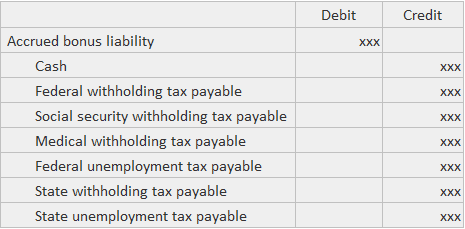

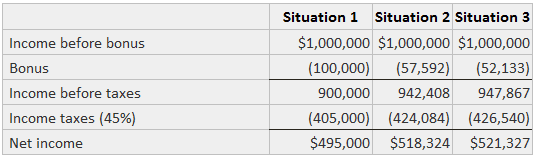

A special type of accrued liability arises when a firm agrees to pay a bonus to management contingent upon operating results. There are no substantive conceptual problems as to the classification or disclosures to be provided for liabilities created by these plans. The only difficulty lies in the calculation of the amount of the bonus under different definitions of the base income to which the bonus rate is applied. Three situations can be identified where the bonus is computed differently. Accrual bonus paid later: The general solution technique is to create a set of simultaneous equations that can be solved to determine the size of the bonus. The following symbols are used: Situation 1: The bonus is based strictly on pre-bonus income. The equations are: B = bY

T = t(Y - B) Situation 2: The bonus is based on pre-bonus income less taxes. The equations are: B = b(Y - T)

T = t(T - B)

Situation 3: The bonus is based on income after taxes and after the bonus. The equations are: B = b(Y - T - B)

T = t(Y - B) Solutions to these three situations are presented below, assuming that: Solution 1: B = (.10)(1,000,000) = 100,000

T = (.45)(1,000,000 - 100,000) = $405,000 Solution 2: B = (.10)(1,000,000 - T)

B = 100,000 - .1T)

T = .(45)(1,000,000 - B)

T= 450,000 - .45B

T = 450,000 - .45(100,000 - .1T)

T = 450,000 - 45,000 + .045T

.955T = 405,000

T = $424,084

B = 100,000 - (.10)(424,084)

B = 100,000 - 42,408

B = $57,592 Solution 3: B = (.10)(1,000,000 - B - T) 10B = 1,000,000 - B - T T = 1,000,000 - 11B T = .45(1,000,000 - B) 1,000,000 - 11B = 450,000 - .45B 10.55B = 550,000 B = $52,133 T = .45(1,000,000 - 52,133) T = $426,540 The following table summarizes the results.Sample Bonus Accrual

Bonus Accrual Equations

Calculation of Bonus Accrual

Bonus Accrual FAQs

A special type of accrued liability arises when a firm agrees to pay a bonus to management contingent upon operating results. There are no substantive conceptual problems as to the classification or disclosures to be provided for liabilities created by these plans.

The equations of bonus accrual when it is based strictly on pre-bonus income are: b = by t = t(y – b)

The equations of bonus accrual when it is based on pre-bonus income less taxes are: b = b(y – t) t = t(t – b)

The equations of bonus accrual when it is based on income after taxes and after the bonus are: b = b(y – t – b) t = t(y – b)

The following symbols are used in bonus accrual equations: b = bonus rate b = amount of the bonus t = income tax rate t = amount of income tax y = income before tax and bonus

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.