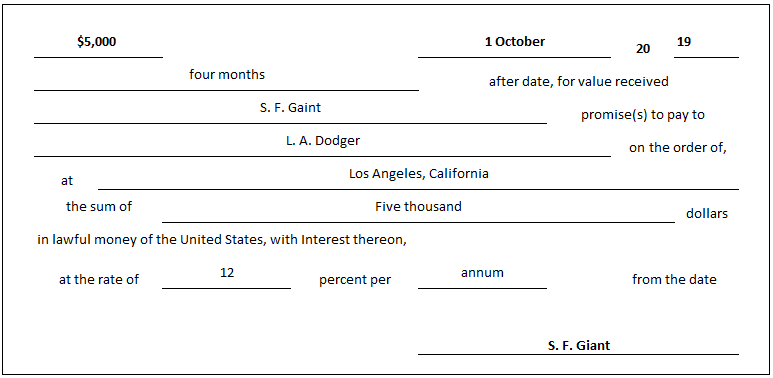

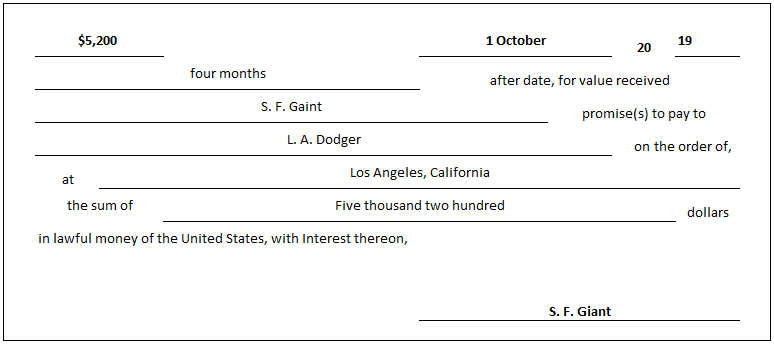

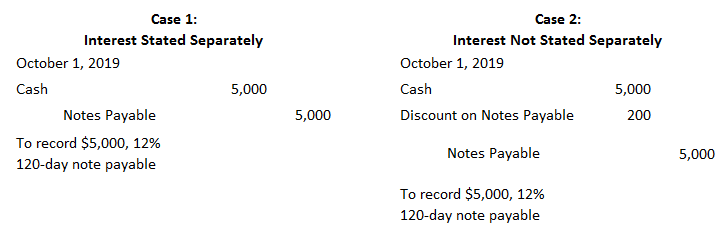

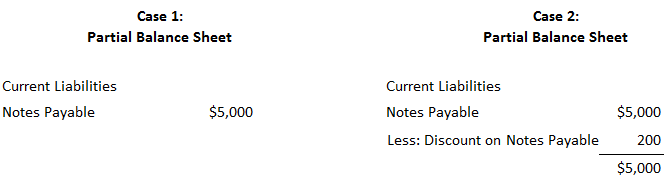

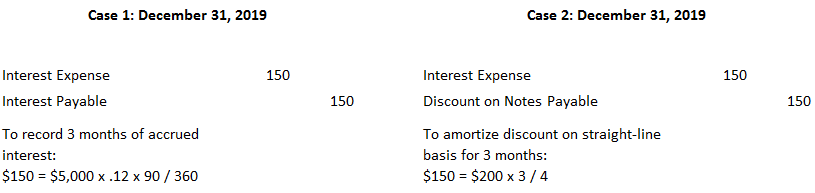

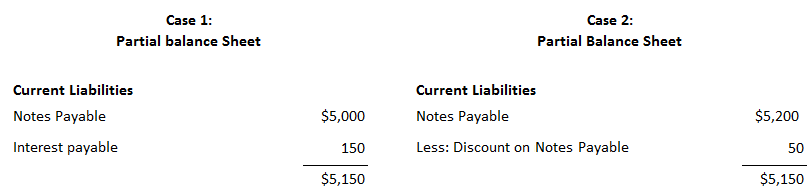

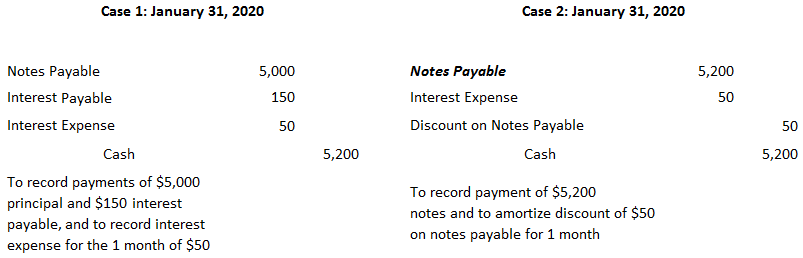

Notes payable is a liability that results from purchases of goods and services or loans. Usually, any written instrument that includes interest is a form of long-term debt. A firm may issue a long-term note payable for a variety of reasons. For example, notes may be issued to purchase equipment or other assets or to borrow money from the bank for working capital purposes. Generally, there are no special problems to solve when accounting for these notes. The asset received is debited, and the note is credited. As interest accrues, it is periodically recorded and eventually paid. A problem does arise, however, when an obligation has no stated interest or the interest rate is substantially below the current rate for similar notes. This situation may occur when a seller, in order to make a detail appear more favorable, increases the list or cash price of an item but offers the buyer interest-free repayment terms. According to the Accounting Principles Board (APB): If neither of these amounts can be determined, the note should be recorded at its present value, using an appropriate interest rate for that type of note. On 2 January 2019, Ng Corporation agreed to purchase a custom piece of equipment. The agreement calls for Ng to make 3 equal annual payments of $6,245 at the end of the next 3 years, for a total payment of $18,935. No interest is provided in the agreement. If the item is purchased outright for cash, its price would have been $15,000. Therefore, in reality, there is an implied interest rate in this transaction because Ng will be paying $18,735 over the next 3 years for what it could have purchased immediately for $15,000. The present value technique can be used to determine that this implied interest rate is 12%. It would be inappropriate to record this transaction by debiting the Equipment account and crediting Notes Payable for $18,735 (i.e., the total amount of the cash out-flows). This is because such an entry would overstate the acquisition cost of the equipment and subsequent depreciation charges and understate subsequent interest expense. Continuing the above example, the equipment and note should be recorded at their cash equivalent price of $15,000. The correct entry to pass in the journal is as follows: The discount is amortized over each of the next 3 years to Interest Expense. The following table shows how this is done. Each payment of $6,245 is divided between interest and principal. The interest portion is 12% of the note's carrying value at the beginning of each year. For example, in 2019 the interest is $1,800, or $15,000 x 0.12. In 2020, the interest is $1267, or $10,555 x 0.12. The principal is just the total payment less the amount allocated to interest. Each year, the unamortized discount is reduced by the interest expense for the year. This treatment ensures that the interest element is accounted for separately from the cost of the asset. The journal entry to record the payment for the first year is: The result of this entry is to record an interest expense of $1,800 and to reduce the carrying value of the notes payable to $10,555, as shown in the following T accounts: The entries in the following years would be made in the same manner. The important points to remember are: As with notes receivable, notes payable can result from different types of transactions, but the most likely sources are from purchases of goods and services through trade notes payable or from bank loans through notes payable. We will concentrate on notes payable to banks. The concepts related to these notes can easily be applied to other forms of notes payable. Bank loans are a major source of funding for all types and sizes of businesses. There are two different types of notes that can be issued to banks: The following example shows both types of notes. Case 1: Interest Element Stated Separately Case 2: Interest Element Included The note in Case 1 is drawn on the principal amount of $5,000. The interest element of 12% is stated separately. The note in Case 2 is drawn for $5,200, but the interest element is not stated separately. The interest of $200 (12% of $5,000 for 120 days) is included in the face of the note at the time it is issued but is deducted from the proceeds at the time the note is issued. Thus, S. F. Giant receives only $5,000 instead of $5,200, the face value of the note. The second case is an example of discounted notes payable. The journal entries to record this note under each of the two cases are: The entry in Case 1 is straightforward. Cash is debited and Notes Payable is credited for $5,000. In Case 2, Notes Payable is credited for $5,200, the maturity value of the note, but S. F. Giant receives only $5,000 cash. The $200 difference is debited to the account Discount on Notes Payable. This is a contra-liability account and is offset against the Notes Payable account on the balance sheet. Interest expense is not debited because interest is a function of time. The discount simply represents the total potential interest expense to be incurred if the note remains' unpaid for the full 120 days. Over the life of the note, the discount is written off as interest expense is recognized. The partial balance sheets for both cases as of the date of the note are presented below: Because the interest on the notes is not payable until maturity, an interest accrual must be made at year-end. This accrual is for three months, as adjusting entries are assumed to be made only at year-end (i.e., 31 December). The entry in each case is: The adjusting journal entry in Case 1 is similar to the entries to accrue interest. Interest Expense is debited and Interest Payable is credited for three months of accrued interest. The entry in Case 2 needs additional explanation. At the origin of the note, the Discount on Notes Payable account represents interest charges related to future accounting periods. At the end of the note's term, all of these interest charges have been recognized, and so the balance in this discount account becomes zero. To accomplish this process, the Discount on Notes Payable account is written off over the life of the note. This write-off is referred to as amortization of the discount. In the journal entry in Case 2, the discount is amortized on a straight-line basis. That is to say, an equal amount of the discount ($200 / 4 = $50) is charged each month to interest expense. The entry is for $150 because the amortization entry is for a 3-month period. After the entry on 31 December, the discount account has a balance of only $50. This increases the net liability to $5,150, which represents the $5,000 proceeds from the note plus $150 of interest incurred since the inception of the loan. Partial balance sheets at 31 December 2019 for Cases 1 and 2 appear as follows: As these partial balance sheets show, the total liability related to notes and interest is $5,150 in both cases. When the note matures on 31 January 2020, S. F. Giant must pay the entire principal and, in the first case, the accrued interest. In both cases, the final month's interest expense, $50, is recognized. The journal entries for both cases are presented below. In summary, both cases represent different ways in which notes can be written. In the first case, the firm receives a total face value of $5,000 and ultimately repays principal and interest of $5,200. In the second case, the firm receives the same $5,000, but the note is written for $5,200. The interest is deducted from the note at the time of its origin. Eventually, however, the firm must repay the full $5,200.Notes Payable: Definition

Notes Payable: Explanation

The use of an interest rate that varies from the prevailing interest rate warrants evaluation of whether the face amount and the stated interest rate of a note or obligation provide reliable evidence of properly recording the exchange and subsequent related interest

In such situations, the APB requires that the note, sales price, and cost of property, goods, or services exchanged for the note be recorded at the cash-equivalent price of the property, goods, or services, or the market value of the note (if it is easier to determine).Example

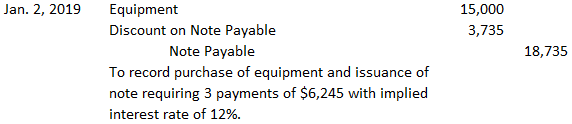

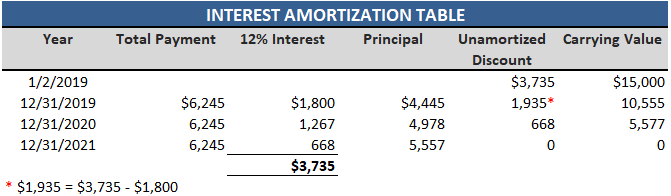

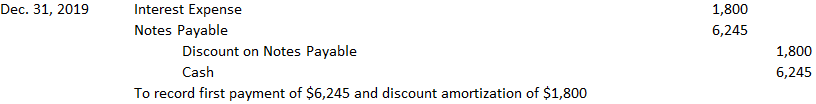

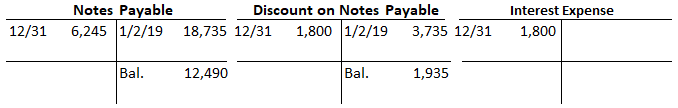

Journal Entry to Record Equipment Purchased and Issuance of Notes Payable

Notes Payable Issued to Bank

Issuance of the Note

Interest Accrual

Payment at Maturity of the Note

Notes Payable FAQs

A note payable is a borrowing that is written as a legal contract. The organization borrows money from the owner of the firm, and the borrower agrees to repay the amount borrowed plus interest at a specified date in the future.

One problem with issuing notes payable is that it gives the company more debt than they can handle, and this typically leads to bankruptcy. Issuing too many notes payable will also harm the organization's credit rating. Another problem with issuing a note payable is it increases the organization's fixed expenses, and this leads to increased difficulty of planning for future expenditures.

Taking out a loan directly from the bank can be done relatively easily, but there are fees for this (and interest rates). Issuing notes payable is not as easy, but it does give the organization some flexibility. For example, if the borrower needs more money than originally intended, they can issue multiple notes payable.

The following is a list of common items contained within a note payable: Accounts Payable, Note Payable, Interest Rate, Maturity Date, and Principal.

A discount on a note payable is the difference between the face value and the discounted value at issuance. This interest expense is allocated over time, which allows for an increased gain from notes that are issued to creditors.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.