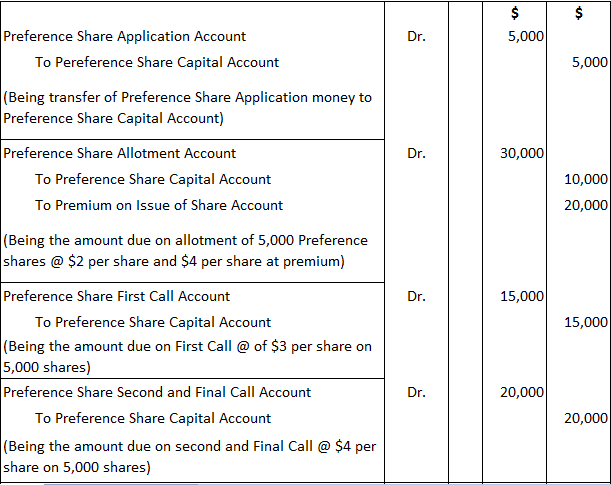

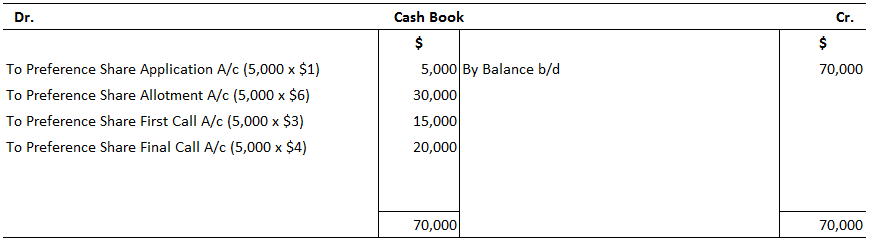

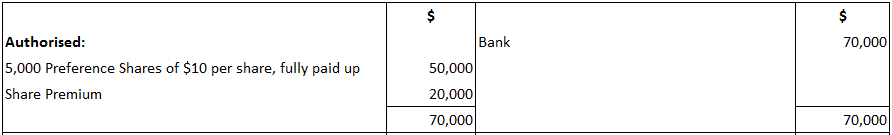

Asian Ltd. issued 5,000 preference shares of $10 each at a premium of $4 per share. $1 per share was payable on application and $6 per share on allotment, including the premium; as well as 3 per share on first call and $4 per share on final call. The shares were all subscribed and the money was duly received. Give the journal and cash book entries and balance sheet. An existing Company offered 20,000 equity shares of $10 each at a discount of 5%. The shares were payable as follows: The public applied for 16,000 shares and the shares were allotted. All the funds were received. Pass entries in the journal and cash book and show the balance sheet.Problem 1

Solution

Journal Entries

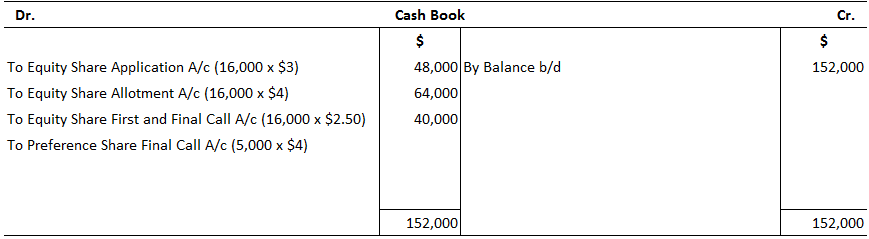

Cash Book

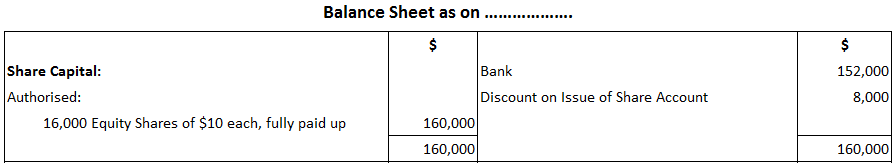

Balance Sheet

Problem 2

On Application

$3 per share

On Allotment

$4 per share

On First/Final Call

$2.50 per share

Solution

Journal Entries

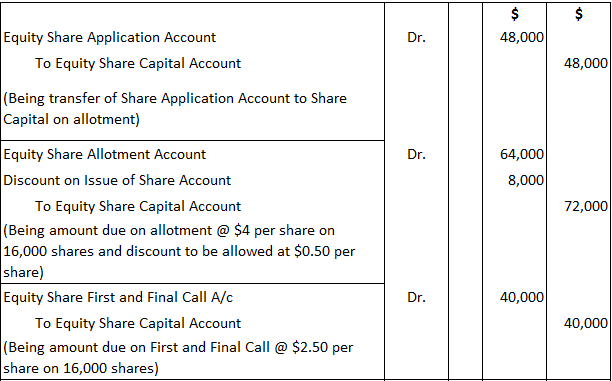

Cash Book

Balance Sheet

Issue of Shares at Premium and Discount | Examples FAQs

When a company issues its shares at a price more than the face value of the share, it is known as issue of shares at premium.

The term 'issue of shares for cash' indicates that all the money raised by issuing the shares is in cash form. In other words, the company doesn't issue shares against any other asset such as land, building or machinery.

When a company issues its shares at a price less than the face value of the share, it is known as the issue of shares at discount.

When a company issues its shares to the promoters, it is known as issue of shares for promoters.

A share with no fixed or stated value ('nominal value') is called a 'no par' or 'scrip' share. Shares without par value were first issued in the uk in 1853. The usual practice is for the company to state in its memorandum of association the maximum amount that it will accept for each share. This nominal value has no legal significance and shareholders are not entitled to any payment if the company is wound up.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.