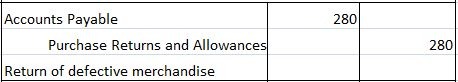

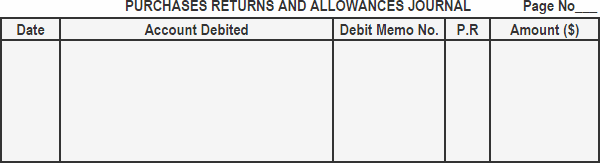

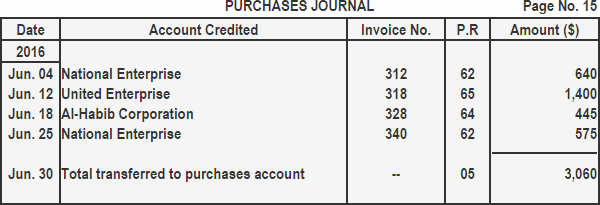

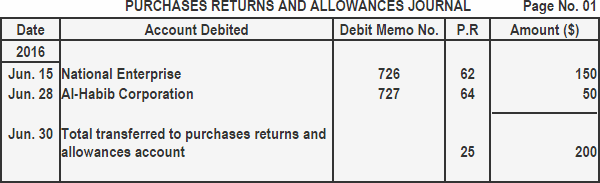

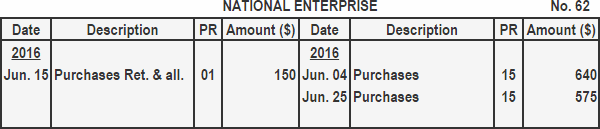

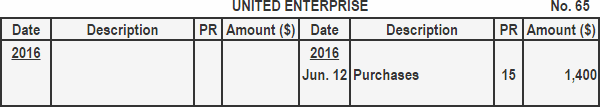

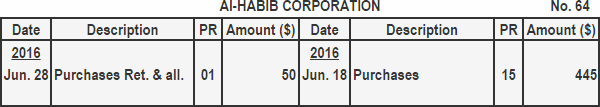

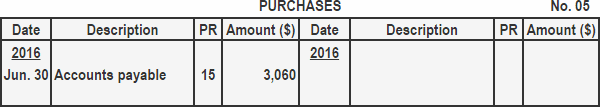

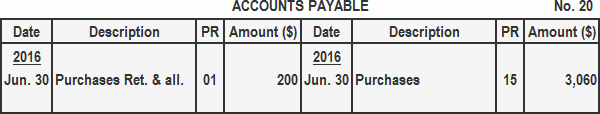

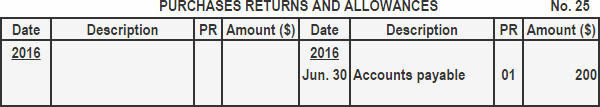

The refunds and other allowances given by suppliers on merchandise originally purchased for resale are known as purchase returns and allowances. When merchandise purchased on account is returned, or when an allowance is requested, an entry is made in the purchase returns and allowances journal. Any entry relating to the return of merchandise purchased for cash is recorded in a cash receipts journal. In merchandising, a return occurs when a customer returns to the seller part or all of the items purchased. When merchandise is returned to suppliers or a price adjustment (allowance) is requested, the buyer usually contacts the supplier in writing. This written information is called a debit memorandum or debit memo. A debit memo is a document sent by a purchaser to the seller showing the amount by which the purchaser proposes to debit the seller’s account. It serves as a voucher for entries in the purchase returns and allowances journal. All debit memos are serially numbered. The accounting treatment for purchase returns and allowances is similar to the treatment of sales returns and allowances, except that different accounts are involved. These include purchase returns and allowances, as well as accounts payable. To illustrate, suppose that the Russell Company purchased 10 television sets for future resale at a total cost of $2,800. The periodic inventory system is used, and the payable amount is recorded at the gross or invoice price. If 1 television costing $280 is found to be defective and is returned, the Russell Company will make the following entry: The purchase returns and allowances account is offset against total purchases when calculating the cost of goods sold. The ultimate effect is to reduce the cost of goods sold. Although the purchases account can be credited directly for any returns and allowances, the use of the purchase returns and allowances account gives management more control over these items. The format of the purchase returns and allowances journal is shown below: A description of the columns in the above format is: Entries from the purchase returns and allowances journal are posted to the accounts payable subsidiary ledger and general ledger. The process followed is described below. The ABC company engaged in the following transactions during the month of June 2016: Required: Purchases journal and purchases returns and allowances journal: Accounts payable subsidiary ledger: General ledger:Purchase Returns and Allowances: Definition

Journal Entry

Explanation

Accounting Treatment

Format of Purchase Returns and Allowances Journal

Posting Entries to Purchase Returns and Allowances Journal

Example

Solution

Purchases Returns and Allowances Journal FAQs

When you purchase inventory from vendors, there are times when those goods become damaged or cannot be sold as a result of a recall. In these instances, you can return the goods to your suppliers for a refund or credit toward future orders. The purchase returns and allowances journal is a Special Journal used to track these returns and allowances.

The purchase returns and allowances journal is used by the accounting department to record all returns and allowances made on purchases. These records are then posted into the General Ledger, where they become part of an overall return and allowance account that can be used to offset inventory purchases.

The purchase returns and allowances journal has six columns, with multiple rows. The first column, or date column, contains dates that correspond to the entries within the journal. The second column, or account debited column, holds the name of supplier from whom goods are returned. The third column, or debit memo number column, is used to record the identifying numbers of relevant debit memos. The fourth column, or posting reference column, contains the account numbers associated with supplier accounts. Finally, the fifth and sixth columns are used for itemized listings of purchase transactions.

A purchase returns and allowances account is simply a virtual account that exists solely to show the net effect of all transactions relating to returns and allowances. This is an important step for proper inventory costing.

Items returned can be damaged or unsellable per company policy, or they returns and allowances account is a ledger account that tracks all returns, discounts, allowances, price adjustments, etc. Made on purchases for later use as deferrals against cost of goods sold or deductions from income tax expense.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.