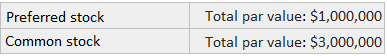

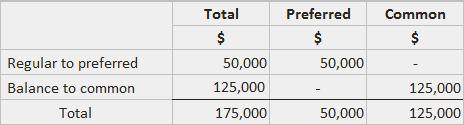

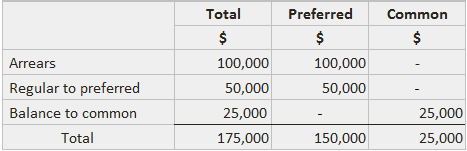

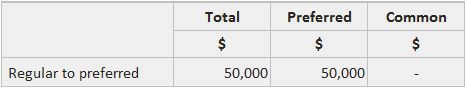

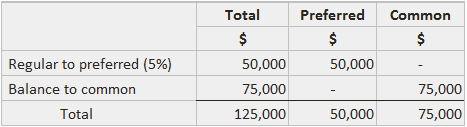

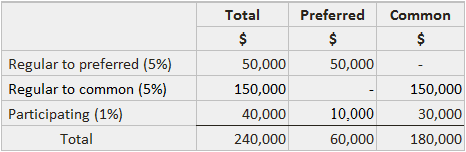

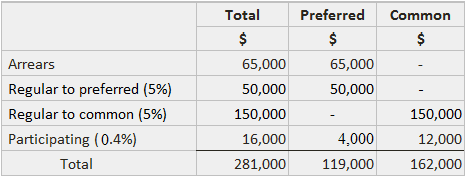

In the absence of specifications otherwise, holders of preferred stock are entitled to receive dividends in any given year only up to a stated maximum. If they fail to receive the maximum, common stockholders receive no dividends at all. In order to make the preferrred shares more marketable and, in this way, to lower the dividend rate, many firms issue cumulative preferred stock. Under the terms of this arrangement, any amounts of preferred dividends not declared in a given year are carried forward into the future. They must be paid in total before any dividends are paid to common stockholders. Since these dividends in arrears have not been declared payable by the directors, they do not constitute a liability. However, they do constitute a significant limitation on the potential cash flows to investors. Furthermore, the fact that the company is unable to pay a dividend may signal serious cash flow problems, which could have implications for creditors. For these reasons, the existence of dividends in arrears should be clearly disclosed. As an additional feature, some preferred stocks may be participative. That is to say, preferred stockholders can receive more than the stated dividend if the dividend on the common stock exceeds a specified amount. This arrangement increases the possibility of a higher payoff and generally allows the stated preferred dividend rate to be set lower than otherwise. Although the use of participating preferred stock was fairly common early in the twentieth century, its use is currently confined usually to closely held companies. When preferred stock is fully participating, there are in effect three thresholds that are passed through as the total dividend increases: To demonstrate these features, assume that Sample Company has the following capital structure: Several situations can be considered regarding the issuance of dividends on preferred stock. 1. Preferred stock is not cumulative or participating; the total dividend is $175,000: 2. Preferred stock is cumulative but not participating; $100,000 of dividends are in arrears; the total dividend is $175,000: 3. Preferred stock is participating but not cumulative; the total dividend is $50,000: 4. Same as 3 above; the total dividend is $125,000: The second threshold of $200,00 (or 5% of total par value) was not reached. 5. Same as 3 above; the total dividend is $240,000: In this case, the second threshold was exceeded and the excess was shared on the basis of total par values (one-fourth to preferred stockholders, three-fourths to common stockholders). 6. The preferred stock is cumulative and participating; $65,000 of dividends are in arrears; the total dividend is $281,000: The participation rate of 0.4% was found by dividing the excess over the second threshold ($16,000) by the total par value ($4,000,000).

Dividends on Preferred Stock FAQs

A dividend on preferred stock is a distribution of cash or other assets to shareholders that is paid out from the company's earnings and declared by the board of directors.

Cumulative preferred stock provides a clear legal priority in the event of default.

Preferred stock gives the investor a higher claim in liquidation, while preference shares provide the same claims as common stockholders.

Arrearages in payment of cumulative dividends may be related to the firm's financial condition, or they may result from dividend-payment decisions made by management. For both reasons, these arrearages should be disclosed in the footnotes to the Financial Statements.

Dividends on preferred stock are typically paid quarterly but can be paid more or less frequently at the discretion of the board of directors.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.