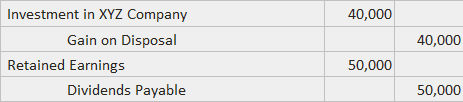

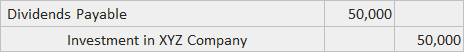

In rare circumstances, the board of directors of a firm may choose to distribute an asset other than cash to its stockholders. The asset must be sufficiently divisible to ensure its division in proportion to the number of shares held. For this reason, property dividends are typically limited to such things as inventories and investments in securities. The only significant accounting issue that might exist for property dividends concerns the recognition of a gain or loss on the distribution of the difference between the property’s book value and its fair value. APBO 29 established GAAP on this matter and called for the use of the asset’s fair value (par. 23). However, in practice, some complexity may arise as to whether the fair value should refer to the date of declaration or the date of payment. The date of declaration represents the date on which the firm is committed to using the asset for the specified purpose, while the date of payment signifies when the stockholders receive the property. If there is a material difference in a particular case, examining the declaration might resolve the issue. On the one hand, if the board declares the distribution of a certain quantity of assets (such as shares of stock held as investments), the gain or loss would be better measured on the declaration date. On the other hand, if the declaration specifies a dollar amount of value, the date of distribution is preferable. The issue may also cause difficulties assigning the gain or loss to a period if the end of a fiscal year intervenes between the date of declaration and the date of payment. Suppose that the Sample Company board of directors declares a property dividend to be paid as 20,000 shares of XYZ Company stock. The investment has a cost of $10,000 but is worth $50,000 at the date of declaration. These journal entries would be made at that date to (1) write up the investment and (2) record the dividend: When the shares are distributed, this journal entry is made: The absence of an arms-length transaction imposes the need for care in establishing a reasonable value for the property.Property Dividends: Definition

Property Dividends: Explanation

Example

Property Dividends FAQs

A property dividend is not income.

The fair value should be used for valuing the stock.

If there is a big difference between book value and market price, it is best to find out the date of declaration.

The difference does not matter because you are using fair value for both dates.

No, sample company accounts for dividends differently in neither gaap nor ifrs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.