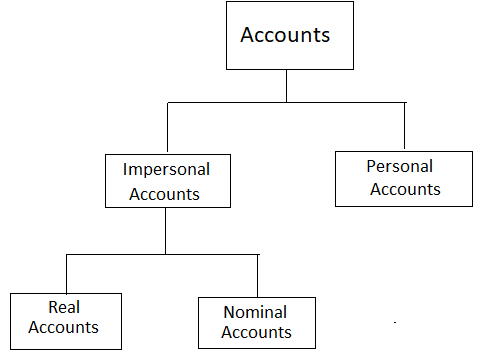

Accounts are classified using two approaches: This article briefly discusses how accounts are classified under both approaches. According to the traditional approach, accounts are classified into three types: real accounts, nominal accounts, and personal accounts. Given that it is an old system for classifying accounts, it is used rarely in practice. Personal accounts are the accounts that are used to record transactions relating to individual persons, firms, companies, or other organizations. Examples of such accounts include an individual's accounts (e.g., Mr. X's account), the accounts held by modern enterprises, and city bank accounts. Impersonal accounts are those that do not relate to persons. There are two types: Real accounts exist even after the end of accounting period. For the next accounting period, these accounts start with a non-zero balance, which is carried forward from the previous accounting period. Examples of such accounts include machinery accounts, land accounts, furniture accounts, cash accounts, and accounts payable accounts. Usually, real accounts are listed in the balance sheet of the business. For this reason, they are sometimes referred to as balance sheet accounts. Nominal accounts are closed at the end of the accounting period. For the next account period, these accounts start with a zero balance. Nominal accounts typically cover issues such as income, gains, expenses, and losses. Normally, nominal accounts are used to accumulate income and expense data. In turn, these data can be used to prepare income statements or trading and profit and loss accounts. For this reason, nominal accounts are sometimes referred to as income statement accounts. Examples of nominal accounts include sales, purchases, gains on asset sales, wages paid, and rent paid. The modern approach has become a standard for classifying accounts in many developed countries. The main types of accounts used under this approach are mostly self-explanatory. Specifically, under the modern approach, accounts are classified into the following five groups: Consider the list of accounts shown below. Our task is to classify these accounts using both the traditional and modern approaches. Traditional classification: Modern classification:

Classification of Accounts Under the Traditional (or British) Approach

Personal Accounts

Impersonal Accounts

Real Accounts

Nominal Accounts

Classification of Accounts Under the Modern (or American) Approach

Example

Classification of Accounts FAQs

Traditional approach (also known as the british approach) , modern approach (also known as the american approach)

Real accounts, nominal accounts, and personal accounts

Asset accounts, liability accounts, revenue accounts, expense accounts, capital/owner’s equity accounts

Classification of accounts in the ledgers is needed to create the Financial Statements. If the sale and purchase of assets have been properly recorded, that makes it easier to see asset classifications you need to report on the balance sheet.

A personal account is created and used for the personal needs of a single person, and an impersonal account can be shared with other people.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.