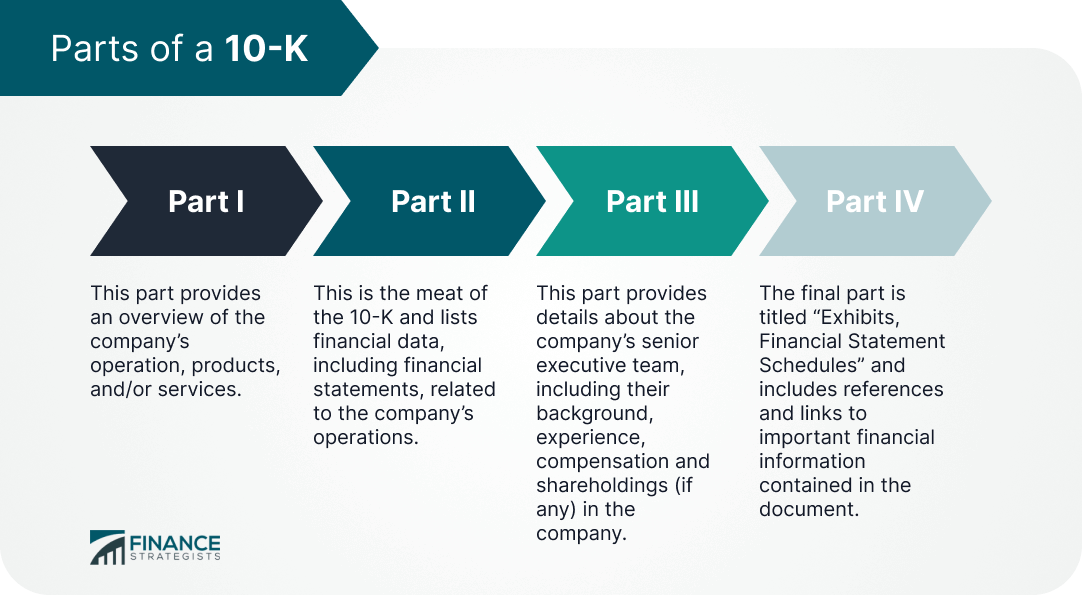

A 10-K is a form publicly traded companies file annually with the Securities and Exchange Commission (SEC). The form provides investors with various details about a company, including its history, senior management, financials, and risk factors. Only publicly-traded companies are legally required to disclose their financial information, and so only public companies are required to file a 10-K form, although private companies may elect to do so as well. The name "Form 10-K" comes from the Code of Federal Regulations (CFR) designation in accordance with sections 13 and 15(d) of the Securities Exchange Act of 1934. In addition to a 10-K, companies are also required to publish a 10-Q and 8-K report. A 10-Q is a quarterly report of a company's performance and financial position; an 8-K is required by the SEC whenever a company is undergoing a major event which shareholders must be aware of, such as an acquisition, changes in executives, bankruptcies, and so on. A 10-K consists of four parts. Each part is designed to provide specific information to investors. Together, they provide a comprehensive view of the operating environment of the company in the last year. Details of the four parts are as follows: This part provides an overview of the company's operation, products, and/or services. It also lists risk factors associated with the company's business in a current or future operating environment. Finally, it lists properties held by the company, and pending legal cases against it. This is the meat of the 10-K and lists financial data, including financial statements, related to the company's operations. Previously, companies were required to report such data for five years. As of December 2020, that requirement has been eliminated. Examples of financial data include income statements, balance sheets, and shareholder equity statement. The company also may or may not include quarterly earnings data for the last two years in this section, depending on whether there have been material changes to the earnings. It also lists risks accruing to its financials from its exposure to trading or investing markets. Financial data is complemented by a section of Management's Discussion & Analysis, also known as MD&A, in which the company's management discusses the company's performance during that period from their perspective. While accounting statements that adhere to Generally Acceptable Accounting Principles (GAAP) are common in the U.S., they are not necessary. This means that companies can choose to report line items that may not be recognized under GAAP. An example of a non-GAAP measure that is commonly reported by companies is EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). This part provides details about the company's senior executive team, including their background, experience, compensation and shareholdings (if any) in the company. If this information is extensive, then companies can choose to file it as a separate proxy statement. The proxy statement, which also includes information on corporate elections, is generally filed a month or two after the 10-K. The final part is titled "Exhibits, Financial Statement Schedules" and includes references and links to important financial information contained in the document. Existing regulations also require companies to publish their bylaws, list subsidiaries, and include copies of their material contracts in this section. Part IV also contains a signed statement from the company's senior executive team stating that the information contained in the 10-K is true. For someone reading it for the first time, the 10-K form can seem like an incredibly dense and long document because it contains so much information. If you are a first-time investor or an investor trying to understand an industry or a company for the first time, then it might be an idea to read through the entire document the first time. Most investors, however, are generally concerned with Part II, i.e., the financial data contained within the document, because it provides them with information for a sound basis to invest in a stock. It is important to analyze numbers in this section carefully and within context. As an example, consider the case of non-GAAP measures. As mentioned earlier, GAAP accounting is not followed by all companies. The intent of providing non-GAAP measures is to provide investors with additional information to evaluate a company. But it can also achieve the opposite goal by hiding information. For example, a company may choose not to report stock-based compensation for its senior executives. The number of companies using non-GAAP measures to report financial information has increased dramatically in recent years. According to research from consulting firm PricewaterhouseCooper (PwC), 97% of companies listed in the S&P 500 used, at least, one non-GAAP measure while reporting their finances. It is also important to understand metrics used by companies to report the sources of their revenues in the 10-K. Several are unfamiliar to everyday investors. Because they have a unique business model, technology companies often report value measures that may be difficult for investors who are new to the industry. As an example, social media company Twitter reports Monetizable Daily Active Users – users who log into its service daily and engage with content – as a revenue source because advertisers direct spending on the platform based on those numbers. It is difficult to find the same metric being used at conventional media companies. Similar care should be exercised while reading other sections. It is always a good idea to complement reading of the 10-K by following news developments related to the company to provide context to the numbers and company performance. For example, the loss of vital suppliers to a company may not be reported in financial information in the 10-K but can materially impact its future prospects. Companies must also file an annual report with their shareholders, per SEC regulations. The information contained in the annual report is similar to that in a 10-K and, in some cases, companies often reformat their 10-K as annual reports. But there may be instances where companies will choose to elucidate at length about their philosophy and goals in the coming years in their annual report. Annual reports are more colorful, more pictorial, and glossy than a 10-K, which are restricted to simple words and text. In terms of financial information, a 10-K is more detailed because companies are required to disclose certain information by law in the document.10-K Form Definition

Parts of a 10-K

Part I

Part II

Part III

Part IV

Reading the 10-K

What is the Difference Between 10-K and Annual Report?

10-K FAQs

A 10-K is a form publicly traded companies file annually with the Securities and Exchange Commission (SEC).

10-Ks cover all aspects of a publicly traded company's business in these 5 sections: business, risk factors, management's discussion and analysis, financial data and financial statement and supplementary data.

The information in a 10-K can aid an investor who is researching the company to see whether to buy that company's stock.

Most investors are generally concerned with Part II (the financial data) because it helps vet a stock for investing.

A 10-K is plain in appearance and uses simple words but is more detailed since the disclosure of certain information is required by law. 10-K reports can be dressed up to serve as an annual report.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.