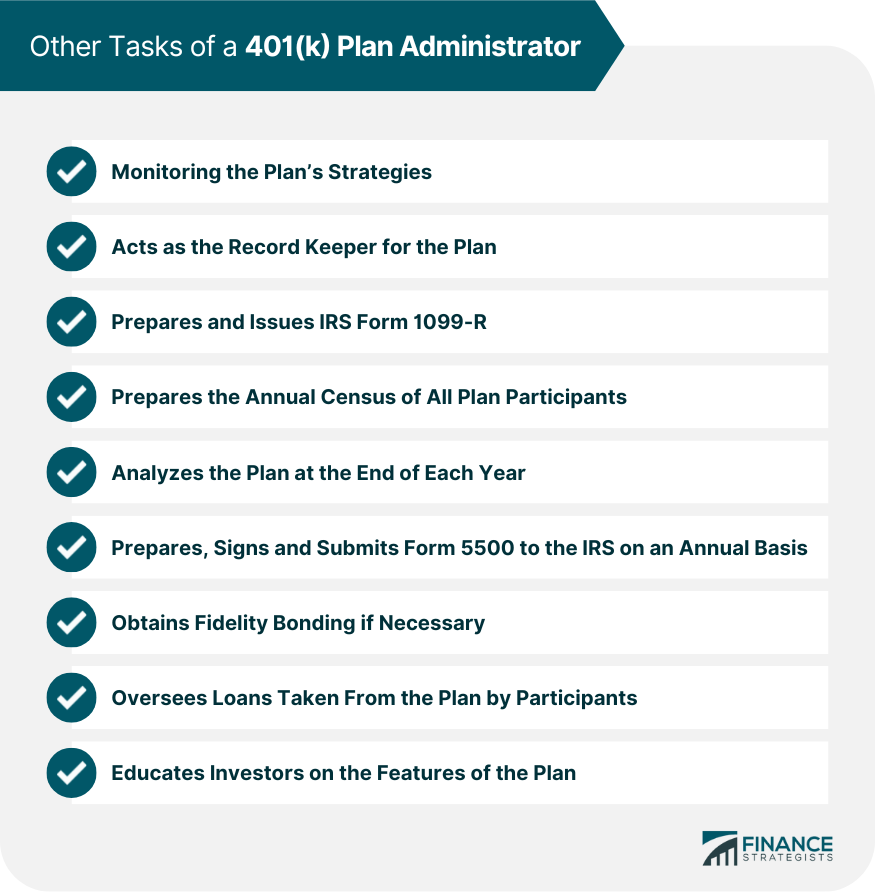

There are several parties involved in running a 401(k) plan, and each member of the team has a clearly defined set of responsibilities that they must fulfill in order for the plan to be compliant and functional. One of the key players in any 401(k) plan is the plan administrator. Which has a fiduciary duty to oversee the plan's operations and perform or oversee the day-to-day functions of the plan, such as reallocating funds for a participant at their request, buying and selling shares of the investments inside the plan for participants. And also, sending out periodic statements to all plan participants. The administrator could be the employer itself, a team of employees, a third party, or a company executive. The majority of plan sponsors enlist the help of a third-party plan administrator that specializes in this area because of the complexities that are involved in maintaining a 401(k) plan. Ultimately, the plan administrator has a fiduciary duty to ensure that all of the plan's functions and operations fall within the guidelines laid out in the plan documents. There are also several other tasks that the plan administrator performs, such as: Fiduciary duty refers to acting in a capacity that is solely in the best interest of the client (in this case, the sponsor and participants of the 401(k) plan) irrelevant of all other factors. A fiduciary is in a position of great trust, and a fiduciary is expected to adhere to strict rules regarding how it can act and what it can do so that the client's interests are always put ahead of anything else. One of the key aspects of the administrator's fiduciary duty is to monitor the service providers to ensure that they are acting properly and implementing adequate rules and procedures that guarantee financial safety and privacy to all plan participants. The administrator has the authority to replace a service provider if they do not use adequate safeguards to prevent such things as identity theft and other forms of fraud.

Have questions about 401(k) Plans? Click here.

This includes the Actual Deferral Percentage test (ADP) and the Actual Contribution Percentage test (ACP).

These tests ensure that the highly compensated employees of the company are not benefitting excessively in relation to the rest of the employees.

If the plan fails either of these nondiscrimination tests, then the administrator is charged with the task of bringing the plan back within compliance guidelines.

This could be done by either reducing the contributions of the highly compensated employees or making a corporate nonelective contribution for the rest of the employees.

The IRS can then look at this information and determine the status of the plan's operations and financial condition.

This includes ensuring that the plan participant qualifies for a loan and that the participant's account balance is adequate enough to provide a loan and those loan repayments are made in a timely fashion.

The administrator must also deal with any loan on which the participant has defaulted. It must also adequately document all hardship withdrawalsFiduciary Duty Defined

The Plan Administrator's Fiduciary Duty

401(k) Plan Administrator FAQs

A 401(k) plan is a retirement plan that encourages employee participation through substantial tax benefits.

The administrator could be the employer itself, a team of employees, a third party, or a company executive.

With a Roth 401(k), taxes are paid as money is put into the retirement account. With a traditional 401(k), taxes are paid as money is taken out.

Alternatives to 401(k) plans include traditional IRAs, Roth IRAs, pension plans (if your employer offers one), and 403(b) retirement plans for employees of non-profit organizations.

Fiduciary duty refers to acting in a capacity that is solely in the best interest of the client (in this case, the sponsor and participants of the 401(k) plan) irrelevant of all other factors.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.