401(k) plans are the most common type of retirement savings plan in the private sector. They allow employees to save for their retirement on a tax-deferred basis and also count as an asset on the employer's balance sheet. But while these plans have many advantages, they also do have some drawbacks that prospective employers and participants should know about.

Have questions about 401(k) Plans? Click here.

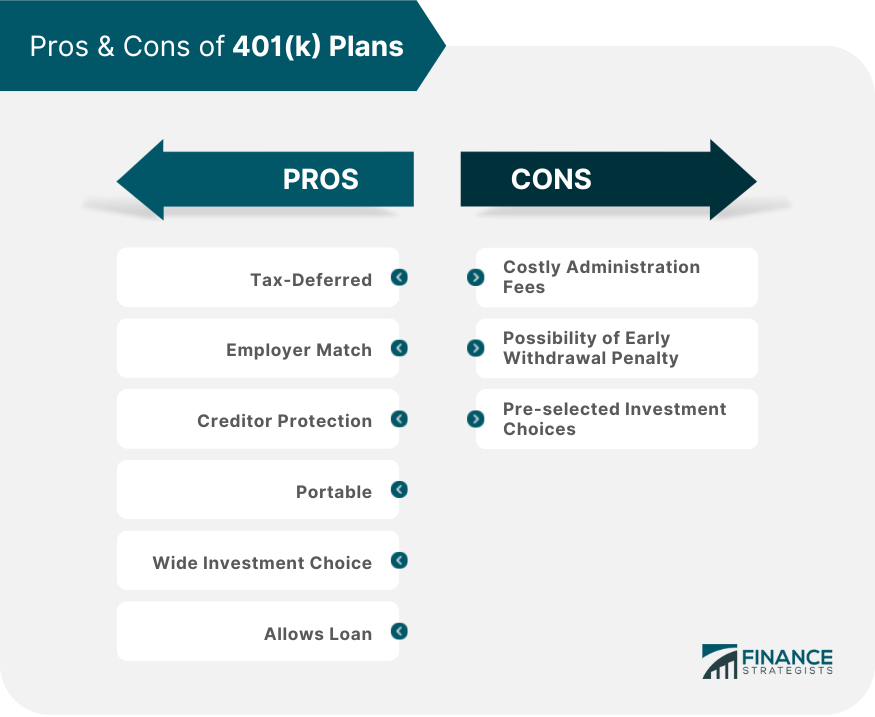

Here is a list of the pros and cons of 401(k) plans.

Advantages of 401(k) Plans

Disadvantages of 401(k) Plans

401(k) Plan Pros And Cons FAQs

A 401(k) plan is a retirement savings account offered to employees by employers, allowing them to contribute pre-taxed income from their salary towards the 401(k) plan. The invested money then grows tax-free until withdrawal at retirement age.

Benefits of investing in a 401(k) plan include access to employer matching contributions; potential tax advantages; professional asset management and advice; and higher contribution limits than other types of retirement accounts such as IRAs or regular taxable accounts.

Yes, there are always risks involved in making any kind of financial investment. The main risk of investing in a 401(k) plan is that the value of your investments can fluctuate due to market conditions and other factors. Additionally, you may incur penalties for early withdrawal before retirement age.

For 2019, individuals can contribute up to $19,000 per year or up to $25,000 if they are 50 years old or older by the end of the tax year. Contributions are limited to 100% of an employee’s income or $56,000, whichever is less.

Generally speaking, you can only withdraw funds from your 401(k) plan after age 59½ without incurring a 10% early-withdrawal penalty and income tax liability on the amount of the withdrawals. However, there are certain exceptions that may allow for an earlier distribution such as qualifying medical expenses or higher education costs. Be sure to speak with a qualified financial advisor or review IRS regulations to learn more about the specifics of these exceptions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.