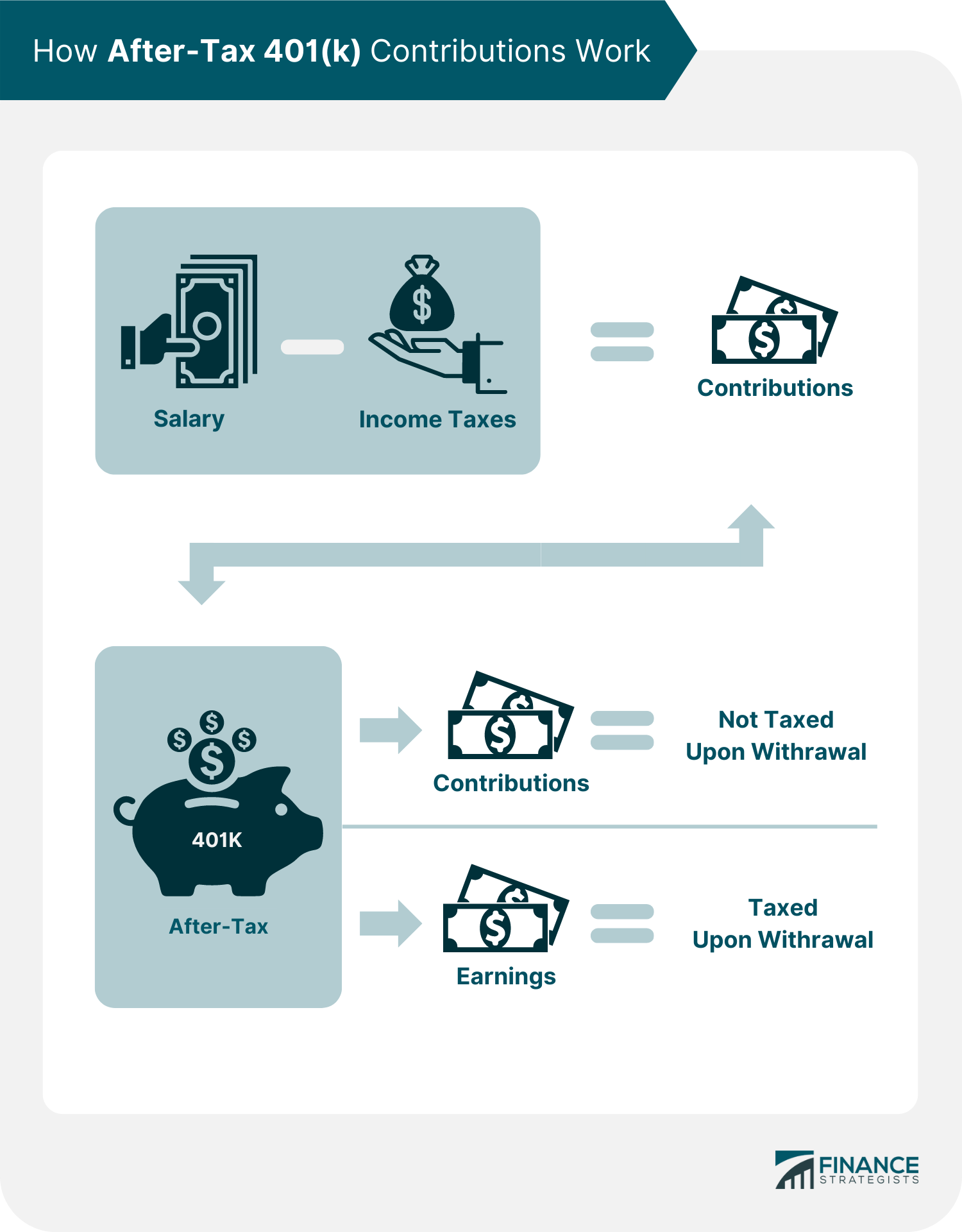

An After-Tax 401(k) Contribution is a retirement savings option that involves contributing money that has already been taxed into an employee’s 401(k). This strategy is possible whether the employee’s core 401(k) plan is under a traditional or Roth setup. After-Tax 401(k) Contributions are similar to Roth retirement plans because when employees withdraw these contributions upon retirement, they will no longer pay income taxes. However, they will still have to pay income taxes on any earnings they withdraw, which they need to reflect on their Internal Revenue Service (IRS) Form 1040. As a retirement planning tool, after-tax 401(k) contributions are often utilized by individuals who have maxed out their employee contribution limit for their core 401(k) plan. This is also a good option for high earners who would like to save more for retirement. Employees who wish to make after-tax contributions to their 401(k) can arrange for their employers to make direct paycheck deductions. After income taxes have been subtracted from the employee's salary, their after-tax 401(k) contributions will be transferred into their core 401(k) account. Unlike regular contributions to a core 401(k) plan, this alternative is not subject to the employee's contribution limit. Instead, it will be counted as part of the total contribution limit, which includes any employer contributions. Core 401(k) plans have an employee contribution limit of $23,000 in 2024, which has increased from the 2023 limit of $22,500. Employees who are 50 years old and older can make additional catch-up contributions of up to $7,500. Meanwhile, the total contribution limit for core 401(k) plans in 2024 is $69,000 or $76,500 for those 50 and older. This has increased from the 2023 limits of $66,000 or $73,500, respectively. The gap between the employee contribution limit and the total contribution limit may be filled in by employer contributions and after-tax 401(k) contributions. If an employee has reached the contribution limit to his core 401(k) plan and received the highest employer contribution possible, the after-tax 401(k) can be very useful. It must be noted that after-tax 401(k) contributions are not tax deductible since they have been made with post-tax dollars. Instead, these contributions can be withdrawn tax-free anytime. However, earnings will still be taxed as ordinary income upon withdrawal, even if this was done after retirement. Making after-tax 401(k) contributions to a core 401(k) brings several advantages. Making after-tax 401(k) contributions also comes with several drawbacks, including the following: Without being penalized, you can roll over after-tax 401(k) contributions to a Roth IRA upon retirement or job change. However, this is a complex process you can typically only accomplish once you have separated from the employer that sponsors your core 401(k) plan. As an IRS rule, you must roll over your 401(k) contributions in direct proportion to what you already have in the fund. For example, if you have $100,000 in your account and it was funded by $90,000 in pre-tax contributions and $10,000 after-tax contributions, the amount you transfer must be composed of 90% pre-tax money and 10% after-tax money. Once you have determined the amount you wish to transfer, your plan administrator will send you two checks: one for the after-tax contributions and one for the pre-tax ones. While you can choose to deposit both into a Roth IRA, depositing them into separate accounts is advisable. For instance, you can deposit the after-tax contribution check directly into a Roth IRA account while rolling over the pre-tax money into a traditional IRA. To do this, you must fill out the 401(k) distribution paperwork and indicate which account will receive which type of contribution. If you want your rollover to be valid, you have 60 days from receiving the checks to deposit them into the correct accounts; otherwise, they will become taxable. However, there is no rush to start the rollover since there is no time limit on a 401(k) plan’s portability. Thus, even after leaving your employer, you can wait until you are ready to decide what to do with your 401(k) account balance. There are other alternatives besides rolling over after-tax 401(k) contributions to a Roth IRA if you are retiring or separating from a company. You could choose between rolling the funds into a traditional IRA, moving them into a new company's 401(k) plan, or leaving them where they are. First, you may roll over both your pre-tax and after-tax 401(k) contributions into a traditional IRA. Traditional IRAs allow you to grow your pre-tax contributions without taxing them until you are asked to take required minimum distributions (RMDs) at age 73. However, since your traditional IRA account will also contain after-tax money, you must file IRS Form 8606 annually to ensure that withdrawals of your after-tax contributions will not be taxed. You must continue to file this form until you have consumed your entire after-tax balance. For your next option, you can transfer your pre-tax and after-tax 401(k) contributions into your new employer's 401(k) plan. This enables you to combine all your 401(k)s into one account, making it easier to track your retirement savings. Finally, you may also leave your funds exactly where they are. With this option, the funds in your previous 401(k) plan will continue to grow. However, you will not be able to make additional contributions in the future. When deciding between different rollover options, you can take your time, talk with a financial advisor, and discover the most appropriate course of action for your specific situation. An After-Tax 401(k) Contribution is a retirement savings option that involves contributing money that has already been taxed into an employee's 401(k). This strategy is possible whether the employee's core 401(k) plan is under a traditional or Roth setup. Like Roth retirement plans, employees will no longer pay taxes when they withdraw after-tax 401(k) contributions upon retirement. However, they will still have to pay income taxes on any earnings they withdraw. Unlike regular contributions to a core 401(k) plan, this alternative is not subject to the employee's contribution limit. Instead, it will be counted as part of the total contribution limit, which includes any employer contributions. After-tax 401(k) contributions come with their pros and cons. Some of the benefits include tax-deferred earnings and an increased maximum contribution limit. However, there are also some drawbacks, such as limited investment options and a complex rollover process. One of the best features of after-tax 401(k) contributions is that employees do not need to worry when they leave the employer sponsoring their core 401(k) plan. This is because they may transfer these funds into other retirement savings plans, such as a new 401(k) or a Roth IRA, Overall, if an employee has reached the maximum contribution limit to his core 401(k) plan and received the highest employer contribution possible, the after-tax 401(k) can be a promising strategy for those who wish to save more for retirement.What Is an After-Tax 401(k) Contribution?

How After-Tax 401(k) Contributions Work

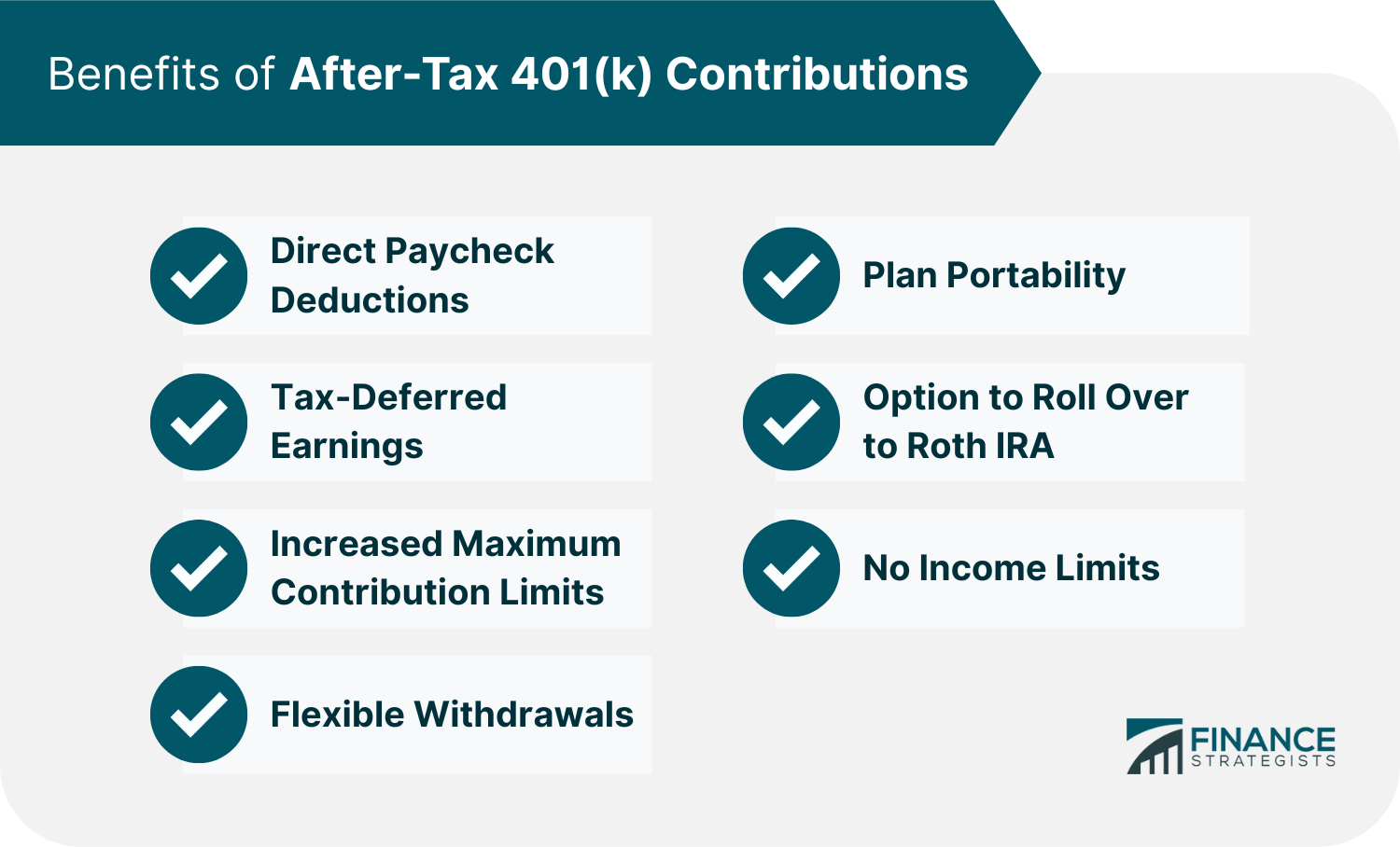

Benefits of After-Tax 401(k) Contributions

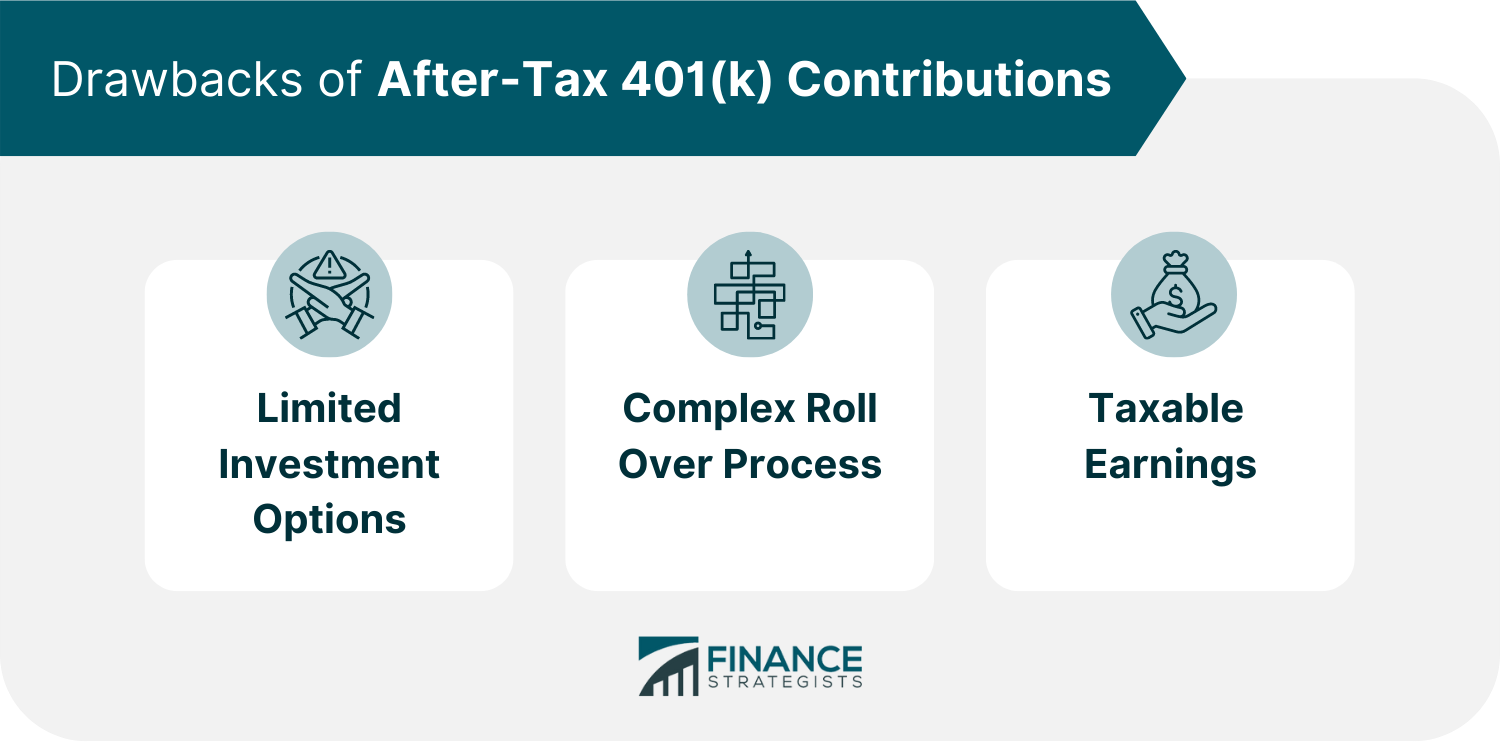

Drawbacks of After-Tax 401(k) Contributions

How to Roll Over After-Tax 401(k) Contributions to a Roth IRA

Other Rollover Alternatives

The Bottom Line

After-Tax 401(k) Contribution FAQs

If you have reached the maximum contribution limit to your core 401(k) plan, received the highest employer contribution possible, and still wish to save more for retirement, after-tax 401(k) contributions can be worth investing in.

Individuals will not pay taxes when they withdraw contributions from either a Roth 401(k) or an after-tax 401(k). However, they will still have to pay income taxes on any earnings they withdraw from after-tax 401(k) contributions. In contrast, earnings from a Roth 401(k) can be withdrawn tax-free after the individual reaches 59 ½ years old and completes the five-year holding period.

Transferring only after-tax amounts from your retirement plan to a Roth IRA is not allowed. You must rollover your 401(k) contributions in direct proportion to what you already have in the fund. If your account was funded by 90% in pre-tax dollars and 10% after-tax 401(k) contributions, any transfers must be composed of the same fund percentage.

The benefits of after-tax 401(k) contributions include direct paycheck deductions, tax-deferred earnings, an increased maximum contribution limit, flexible withdrawal, plan portability, rollover options, and no income limits.

The drawbacks of after-tax 401(k) contributions are limited investment options, a complex rollover process, and taxable earnings.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.