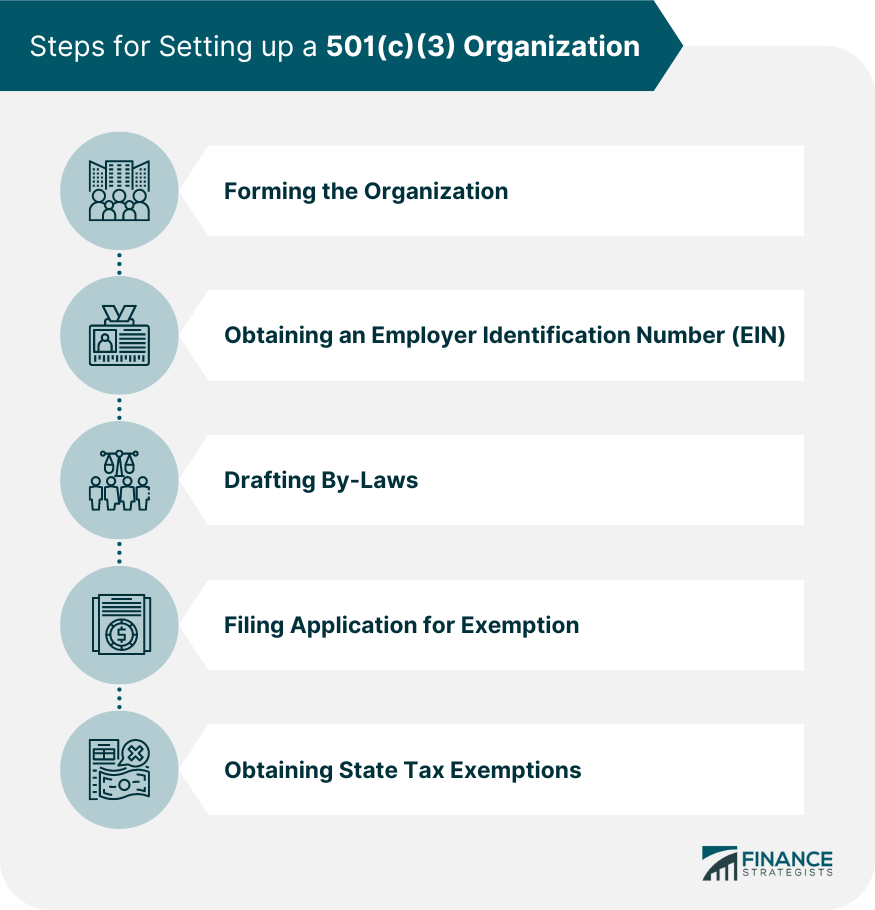

Setting up a 501(c)(3) organization is an important step in creating a non-profit group dedicated to fulfilling a purpose or mission. The first step is to understand the key elements of the process and determine if 501(c)(3) status is right for your organization. Once you've decided that forming a 501(c)(3) is the best option for your goals, there are several steps you'll need to take to make it happen. The first step for obtaining 501(c)(3) status is forming the business entity. This can be done through filing articles of incorporation with your state government. It's essential that these documents contain specific statements about the purpose of your organization and its non-profit status. After forming the business entity, you'll need to obtain an EIN from the Internal Revenue Service (IRS). This number will protect both you and your employees in certain financial matters, such as taxes and contracts. You can apply online at the IRS website, or by mail or fax using Form SS-4. Your corporate documents should include detailed by-laws that outline how your board of directors functions from electing officers and setting meeting agendas, to making decisions and spending allocations as well as address other legal matters. Once all of these items are completed, you must then prepare Form 1023 and submit it along with payment of any applicable fee to the IRS for consideration and approval to receive final confirmation that your organization has been granted nonprofit status. In addition to applying for federal tax exemption under section 501(c)(3), nonprofits may also qualify for state tax exemptions. These can provide additional benefits such as reduced fees for obtaining professional licensing or permission from governmental authorities required when operating within a given state or jurisdiction. The board is responsible for making sure that the organization’s activities are conducted in accordance with its mission and purpose, as defined by the IRS. As a result, it's important that 501(c)(3) boards understand their legal requirements, including those related to by-laws and IRS regulations. A 501(c)(3) organization must have a governing document known as the Articles of Incorporation that outlines its mission, structure, and procedures. These documents should include provisions for the board of directors such as term limits, voting rights, removal from office, and conflict of interest rules. The IRS typically requires at least three individuals to serve as board members for a given 501(c)(3) organization. They also require that all members be in attendance for at least one annual meeting. The IRS places no limitations on term length or additional members or meetings. In addition to federal requirements, each state has its own set of rules and regulations regarding nonprofit organizations. These may include providing background checks on board members or ensuring that certain policies are included in the organization’s by-laws. It's imperative to research your state's laws in order to make sure that you're meeting all necessary legal requirements. Overall, it's essential for 501(c)(3) organizations to ensure their boards understand their responsibilities under both federal and state law in order to remain compliant with applicable regulations. By familiarizing themselves with these requirements early on, they can help ensure they are taking appropriate steps while actively operating within the scope of their mission and purpose. When setting up a 501(c)(3) organization, it's crucial to consider all factors when selecting a board of directors. Not only does the board need to meet legal requirements related to IRS regulations, but careful consideration should be given to the qualities and characteristics that can help ensure success. The relationship between board members is vital for ensuring the highest level of collaboration within the organization. It's necessary to take dynamics into account—such as whether they share similar goals, values, and personalities—when forming your board in order to create an environment where all members can work together effectively. Board members are responsible for representing the interests of their constituents first and foremost. As such, it’s important for them to understand their fiduciary duties and commit to acting with integrity at all times in order for their organization to be successful. Choosing individuals who feel strongly about your mission will help ensure that everyone is working towards a common goal. This can also provide additional motivation when overcoming challenges or making difficult decisions. When choosing individuals for your board of directors, it's also crucial to look at skills and experience that can add value to your organization. You should look for members who possess knowledge in areas such as finance or fundraising, or those with leadership or management experience who can offer guidance and support on critical decisions affecting your organization’s future. Finally, you should take into account each individual’s background when making selections. It's essential that you choose people of diverse backgrounds so that your board adequately represents its constituency while expanding its reach into new markets and initiatives. The primary duty of a 501 (c)(3) board of directors is to ensure the organization remains true to its mission, purpose, and values as defined by the IRS. This includes maintaining legal compliance with both federal and state laws, monitoring financial performance, setting policies for staff and volunteers, overseeing fundraising activities, and making critical decisions related to strategic planning. In addition, 501 (c)(3) boards are responsible for protecting their assets from any potential liability or misuse by following established procedures and protocols. They should also be knowledgeable on IRS regulations regarding unrelated business income tax as well as be aware of any pending litigation or potential conflicts of interest within their organization. Board members must also remain vigilant in regard to any complaints or concerns that may arise from clients or donors. Ultimately, board members should work together as a team while upholding their fiduciary duties in order to make decisions that are beneficial for both the organization and those it serves. When it comes to running a 501(c)(3) organization, selecting the right board of directors is essential for ensuring long-term success. By understanding the duties and responsibilities associated with being a board member—as well as factors to consider when making selections—organizations can ensure they are putting their best foot forward in managing both their operations and mission. In addition, having an understanding of regulatory requirements such as those regarding unrelated business income tax, litigation or broader financial management can help protect the organization from potential liabilities. Ultimately, by taking these steps, organizations can create a board that works together effectively while helping to achieve their overall objectives.Setting up a 501(c)(3) Organization Overview

Forming the Organization

Obtaining an Employer Identification Number (EIN)

Drafting By-Laws

Filing Application for Exemption

Obtaining State Tax Exemptions

501(c)(3) Board of Directors Requirements

By-Laws Provisions

IRS Requirements

State Requirements

Other Factors to Consider When Choosing 501(c)(3) Board of Directors

Relationship Among Board Members

Fiduciary Duties

Passion for the Mission

Skills and Experience

Background

Duties of 501(c)(3) Board of Directors

Final Thoughts

501(c)(3) Board of Directors Requirements FAQs

The primary duty of a 501(c)(3) board of directors is to ensure the organization remains true to its mission, purpose, and values, as defined by the Internal Revenue Service (IRS). This includes maintaining legal compliance with both federal and state laws, monitoring financial performance, setting policies for staff and volunteers, overseeing fundraising activities, and making critical decisions related to strategic planning.

Board members must continually be watchful for any grievances or worries voiced by clients or donors, and adhere to existing rules and regulations to safeguard the organization's assets against any likely liability or misuse.

While each organization will have different requirements for its board of directors, individuals should possess skills relevant to their field such as demonstrated leadership ability, financial acumen, strong communication skills, and nonprofit management knowledge. In addition, prospective board members must display dedication to the organization’s mission and be committed to attending meetings regularly.

It is generally recommended that boards meet at least quarterly in order to review progress against goals set by the previous meeting as well as discuss any other pertinent topics related to running an effective 501(c)(3).

If you have questions about your duties as a board member, you can consult with other members of your board for advice or contact a legal professional who specializes in nonprofit law for more information.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.