A trustee is an individual or organization responsible for managing the assets placed in a trust. The trustee performs this role on behalf of a grantor, the person who created and funded the trust. The trust is set up for the benefit of other individuals or organizations, known as beneficiaries. Trustees have a legal obligation to current and future beneficiaries to manage the trust appropriately. In

most cases, trustees are the only ones granted authority to access the

funds in the trust and conduct business on its behalf. Due

to the impact of their role on the trust and its beneficiaries, it is

essential to carefully consider who to assign as a trustee.

If

you are considering naming someone as the trustee of your trust, it is

important to know the scope of their duties and responsibilities. Trustees

must take their position seriously and understand each of their duties

before taking on the role. The primary duties of a trustee are: Trustees

must always act in the best interest of the beneficiaries. This means

making decisions that favor the beneficiaries and not their personal

interests. To achieve this, the trustee must manage the assets in the trust prudently. For instance, when investing the trust property, the trustee must proceed with caution to avoid potential losses. This could involve the same level of care that a reasonable person would use if they were in charge of their own assets. However, a trustee should not combine the trust's assets with their own personal assets. This ensures that the trust assets are protected if the trustee experiences personal financial problems, such as bankruptcy. Trustees are also responsible for defending the trust against any legal challenges and complying with all applicable laws. All of these fiduciary duties require commitment and diligence on the part of the trustee. Another

important duty of the trustee is to keep accurate and up-to-date

records of all trust property transactions and communications with

beneficiaries. This includes maintaining records of all income, expenses, and distributions from the trust. These records should be kept in a safe place. Beneficiaries should be readily able to access these documents upon request. The bulk of a trustee's responsibilities focus on asset and property management. These include: There

are three main types of trustees. The type of trustee you choose will

depend on the size and complexity of your trust, as well as your

personal preferences. Individual

trustees are typically family members or close friends. With this

set-up, selecting someone comfortable managing money and handling other

financial matters is paramount. Independent

trustees are professional fiduciaries, such as accountants or lawyers,

who are not related to the parties involved in a trust. This means that this type of trustee will not be benefited from the trust, whether directly or indirectly. Large

financial institutions are typically chosen to fulfill this role. These

organizations have the staff and resources to handle complex trusts. They also have experience managing trust funds and complying with all applicable laws. Trustees

play an important role in the administration of trusts. So it is

essential to choose someone qualified and capable of handling the task. It

is also important to note that you do not have to limit your choices.

In some cases, it may be advisable to name a possible successor in case

the initial trustee resigns or cannot fulfill the role as time goes on. Here are some factors to consider during your selection process: When

it comes to managing trust assets, individual trustees can easily

mismanage assets if they do not have the proper expertise. However,

working with an institutional trustee greatly minimizes this risk. These organizations typically come with a team of experts in fields such as accounting and law. Institutional

trustees also regularly undergo inspections by internal auditors and

regulatory government agencies to review their management practices. In

addition, institutional trustees typically carry liability insurance to

protect themselves from any legal ramifications that may arise from

their management of trust funds. When making your decision, it is important to compare the costs involved in working with different types of trustees. The fees charged by institutional trustees are often higher than those charged by individual trustees. However, the added cost is typically worth it, given the expertise and peace of mind that comes with working with professionals. Most

institutional trustees typically charge between 1% to 2% of the assets

they manage. So, if the trust property is $10,000,000, the trustee would

charge between $100,000 to $200,000. When choosing an institutional trustee, it is important to consider the organization’s reputation. Trustees

with a good reputation often have a team of experienced professionals

behind them. They also have a history of satisfied clients willing to

provide references. Individual trustees often have full-time jobs and may not be able to devote the time needed to manage a trust. If you choose an individual trustee, it is important to select someone with the time and willingness to manage the trust. Trustees

are legally responsible for managing trust assets and complying with

all applicable laws. So if you choose an individual trustee, it is

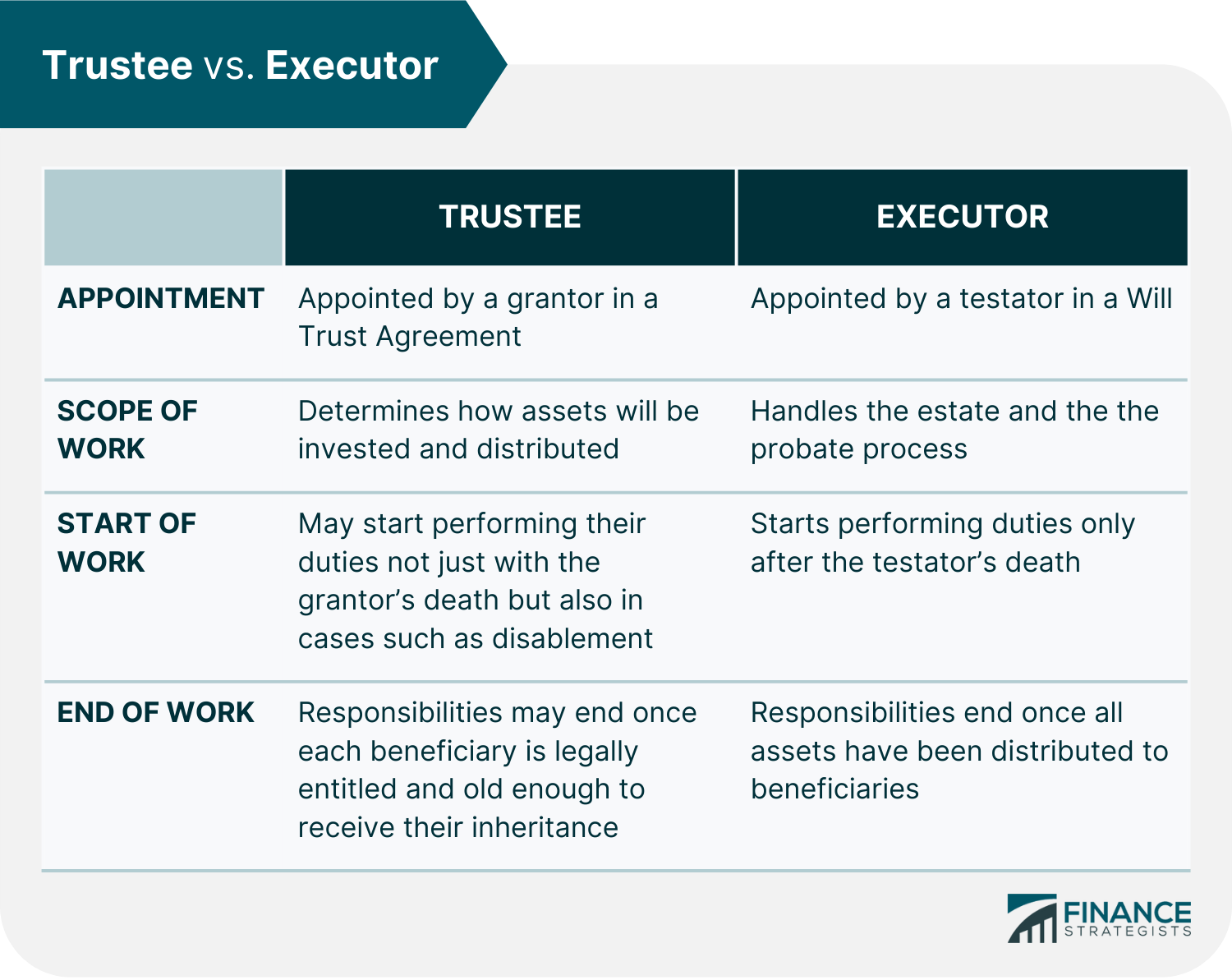

important to select someone reliable. They should not only be comfortable with handling financial matters but they should also be organized and detail-oriented. Trustees and executors both have a fiduciary duty to the beneficiaries of a trust or estate. However, there are differences in how they are appointed and the duties they are responsible for. A

trustee is responsible for managing the assets placed in a trust. With

this power, they can determine how assets like money or property will be

invested and distributed. Their purpose is to protect or grow the existing assets for the benefit of the beneficiaries. A

grantor assigns trustees through the trust agreement. In cases

involving minors, trustees usually manage the trust until the

beneficiaries are legally entitled and old enough to receive their

inheritance Unlike

executors, trustees do not just deal with the assets of a trust after

the person’s death. Instead, they can also start managing the trust when

a person is disabled or incapacitated. Then, they continue working with the beneficiaries for an extended period until the time stipulated in the trust agreement. An

executor only comes into play once someone has passed away. They are in

charge of handling the estate and the probate process. An

executor is assigned through a testator's will. They usually stop

working with the beneficiaries after all the assets have been

successfully distributed. A

trustee refers to the person who is in charge of managing a trust.

Trustees have a fiduciary duty to the beneficiaries of the trust. There

are three types of trustees: individual, independent, or institution.

The fees these different types of trustees charge typically depend on

their level of experience and expertise. When

choosing a trustee, it is important to consider their reputation, the

time commitment required, and the level of responsibility involved. A trustee is different from an executor. An executor is in charge of managing an estate only after someone has passed away. In contrast, trustees can start managing the trust when a person is disabled or otherwise incapacitated.What Is a Trustee?

Duties and Responsibilities of a Trustee

Fiduciary Duty

Recordkeeping

Asset and Property Management

For

example, this could mean limiting how much of the trust's funds

beneficiaries can access and how much must be allowed to grow through

investment.Types of Trustees

Individual Trustees

Independent Trustees

Institutional Trustees

How to Choose a Trustee

Expertise

Cost

Reputation

Time Commitment

Responsibility

Trustee vs Executor

Trustee

Executor

Final Thoughts

Trustee of a Trust FAQs

A trustee is a person who is in charge of managing a trust. They are responsible for managing trust assets and complying with all applicable laws.

The duties and responsibilities of a trustee include fiduciary duties, recordkeeping, and managing assets and properties.

A trustee is usually appointed by a grantor after establishing a trust. However, in certain cases, such as the death of the initial trustee, their successor may be assigned by a probate court.

Trustees are responsible for managing trust assets and complying with all applicable laws. In contrast, executors are in charge of managing an estate only after someone has passed away. They are responsible for distributing assets to beneficiaries and handling the probate process.

The typical fee of a trustee tends to be between 1% to 2% of the trust's value. Some states have set a maximum percentage that a trustee can charge. You can also negotiate the fee with the trustee when appointing them. In some instances, it may be possible to pay the trustee an hourly rate instead of a percentage-based rate.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.