An angel investor is an individual or group that provides capital to startups and small businesses. The investor typically extends this help in exchange for equity stakes in the company, meaning they are part-owners and have a vested interest in its success. Angel investors usually have vast networks and are experienced in their respective fields, using such expertise to help entrepreneurs launch thriving ventures. These investors may also advise or mentor the founders on their business decisions. They often bridge early-stage financing gaps when other funding sources, such as bank loans or venture capitalists, are unavailable. Angel investors are also known as informal investors, business angels, private investors, angel funders, or seed investors. Angel investing differs from traditional lending, wherein the borrower repays their debt with interest. An angel investor takes on more risk than a lending institution, assuming the startup may be unable to repay them if it fails. Angels provide seed or early-stage funding when companies are too small to access venture capital financing or large loans. Seasoned angels will usually ask for a maximum of 25% equity, leaving the highest stakes to founders to incentivize them to make their startups succeed. Angel investors are often the founder's friends, family, or connections through industry seminars, forums, business referrals, and word of mouth. If there is a mutual interest, angels conduct due diligence and evaluate the startup's investment documents, industry, and founders. After a verbal agreement between parties, a contract is prepared, which includes details on equity shares, payouts, investment terms, rights and responsibilities, governance, and exit strategy. Seed funds are released once the legal agreement is signed. Angel investment amounts vary but are usually relatively small compared to traditional loans or venture capital. Aside from the obvious financial benefit, consider the following advantages of working with an angel investor: Angel investing involves fewer hoops to jump through. It can be faster and less rigorous than other funding sources since the process is more informal. Negotiating and signing the legal agreement in such a transaction is quicker than with a bank loan. Angel investors invest their own money and do not usually require repayment, unlike lenders, meaning the company is unburdened by debt. It allows the founder to keep majority ownership of the company and control its operations and decision-making process. Angel investors often have the experience and resources which are invaluable for a startup to be successful. They can advise on building a team, attracting customers, increasing revenue, and selecting marketing strategies. Founders should be conscious of diving into an agreement and consider possibilities or potential conflicts like the following: In some cases, angel investors involve themselves in decisions and operations of the business in exchange for the funds granted. This can be challenging to manage if their advice diverges from your own. It can also be difficult to negotiate a fair equity stake. Another disadvantage of angel investors is that they typically take a smaller equity stake in your company than venture capitalists. If a company cannot attract additional investors, it could lead to problems like insufficient funds to pay bills, hire employees, or expand the business. Startups that receive angel funding might feel pressure to succeed quickly, as the investors are vested in the company's success. Angels may force founders to take steps they are uncomfortable with. There is a risk for the funders to prematurely exit the venture. Angel investors are typically high-net-worth individuals with the financial resources to invest in early-stage businesses. These may include successful entrepreneurs, family members, friends, corporate executives, financiers, or private investment firms that specialize in angel investing. Angel investors are often motivated by more than money—they may simply believe in the founders or the startup idea. In some cases, angels form ‘angel networks’ that pool their financial resources together to increase the amount of capital available for investments. Crowdsourcing has recently become a popular method for finding angel investors, allowing startups to get funds from thousands of individuals. Websites like GoFundMe and StartEngine allow individuals and startups to create campaigns and raise money from the public. Finding an angel investor can be daunting for a startup entrepreneur. However, many resources and platforms are available to help entrepreneurs locate potential investors. Many angel investors tend to belong to networks of other angel investors. These networks allow experienced angels to share their advice and knowledge with other less experienced members. Consider the following: ACA is North America's largest network of angel investors. They have more than 15,000 individual members representing over 250 angel groups and funds that invest in early-stage companies. ACA does not directly provide funds for startups but connects investors with entrepreneurs. The ACA directory is a database with complete information and links to members' and affiliates' websites. ACA also provides resources and training for new and experienced angels and entrepreneurs. AIN is a global online platform connecting startups and entrepreneurs with investors worldwide. It has a directory of more than 300,000 accredited investors looking to invest in promising startups. There is also an online course for entrepreneurs that explains the basics of raising funds from investors. AIN also has a free subscription plan for startups and entrepreneurs, allowing them to create their profiles and get in touch with potential investors. Angels can review startup profiles, conduct due diligence, and make offers directly on AIN's platform. TAF is a private, invite-only angel investment group focusing on digital media and technology investments. It has over 80 active members from the U.S., Canada, and Europe, as well as from other countries. The Forum offers resources to its members, including educational forums, networking events, mentorship opportunities, and deal flow access. Since TAF is exclusive, the best avenue for contact is through mutual connection with current investors. However, TAF can also be reached by emailing SC Moatti at [email protected]. Angel investors and venture capitalists provide funds to startups and businesses. However, funding sources, amounts, investment timing, and interests differ. Angel investors are usually private individuals or groups using their money to invest in startups. Venture capitalists are institutional investors who use money from external sources, such as pension funds and banks. As such, angels usually invest smaller amounts than venture capitalists. Seed funders also tend to enter earlier in the startup process and are more likely to fund an entrepreneur’s idea before it has been profitable. Meanwhile, venture capitalists invest at a later stage when there is already some success, with a proven track record and revenue model. Angel investors generally believe in the founders or the potential of a startup's product or service instead of its immediate financial value. It is why angels provide mentorship and typically require equity shares more than investment returns. Venture capitalists tend to be more focused on the financial aspects of a deal, looking for high returns on their investments, and may require more control over decision-making. An angel investor provides capital for a business startup, usually in exchange for ownership equity. These investors cover the costs of launching a new product or service, marketing strategies, hiring staff, and other initial business expenses. Angel investors provide more than just funding – they also bring their industry expertise and experience. Business owners seeking angel investors should look for those with experience in their field and who share similar visions for the future of their startup. Potential angel investors can be family, friends, successful entrepreneurs, or corporate executives. Remember that while angel investors and venture capitalists provide business funding, they differ in typical sources and amounts, interests, and investment timing. Startups and founders may consult a financial advisor for more information on angel investors and guidance on other funding sources.What Is an Angel Investor?

How Angel Investing Works

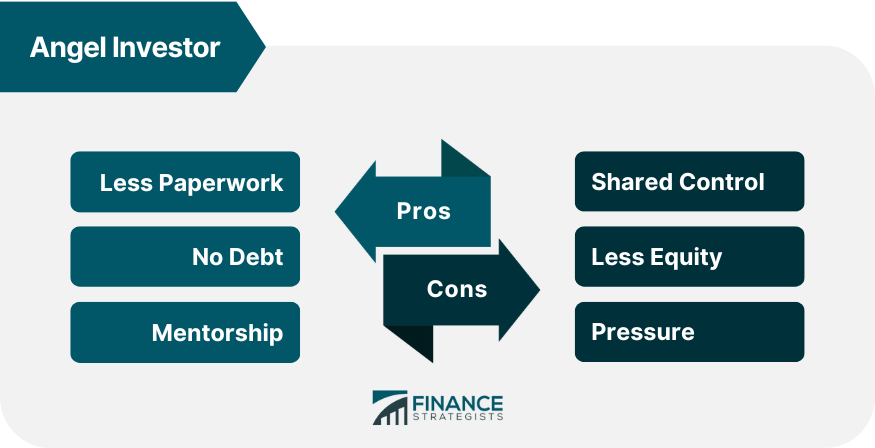

Pros of Using Angel Investors

Less Paperwork

No Debt

Mentorship

Cons of Using Angel Investors

Shared Control and Ownership

Less Equity

Pressure

Who Are Potential Angel Investors?

Where to Find an Angel Investor

Angel Capital Association (ACA)

Angel Investment Network (AIN)

The Angels' Forum (TAF)

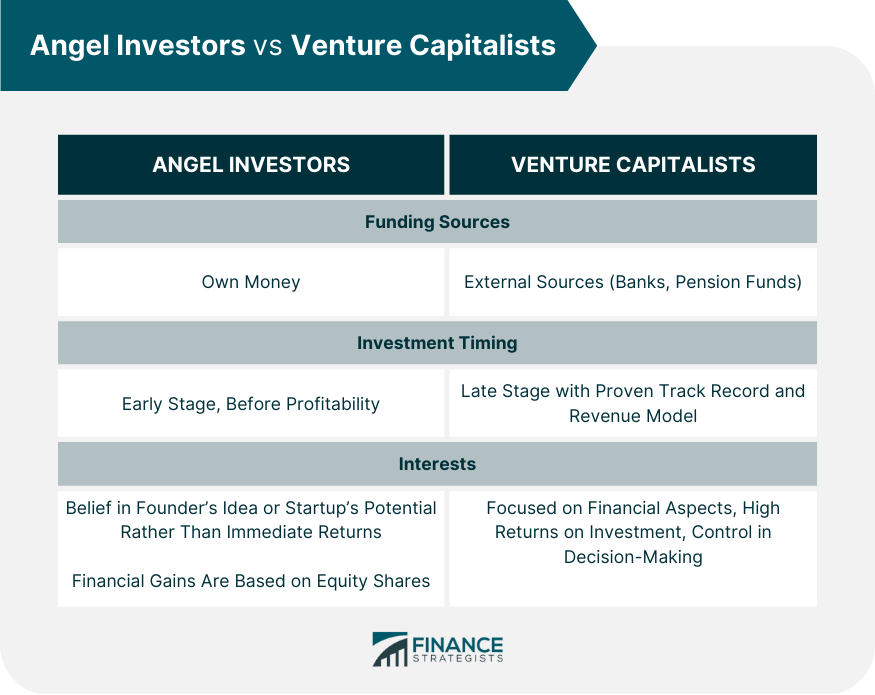

Angel Investors vs Venture Capitalists

Final Thoughts

Angel Investor FAQs

These business and startup funders differ in typical sources and amounts of investment, interests, and control. Additionally, angels are usually part of the initial stages of a startup, while venture capitalists generally enter the later stages of a business's development.

The percentage of a business or project an angel investor takes typically depends on the amount and type of investment. Generally, angels take a maximum of 25% equity for their involvement. However, this can vary depending on the nature of the deal.

Angel investors usually require less paperwork than traditional lenders. Aside from funding, angels typically provide mentorship and guide startup founders on how to succeed. Lastly, investments are generally not considered debts.

Angels typically make money when the company they invest in goes public or is sold. At this point, angel investors may receive a return on their investments through equity or cash payments. Additionally, angels may benefit from capital gains tax deferral if they hold onto their shares after a certain period.

Angels can be family, friends, or connections through conferences and industry seminars. Angel investors can also be found through online directories, angel investing networks such as Angel Capital Association (ACA), The Angels’ Forum (TAF) and Angel Investment Network (AIN).

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.