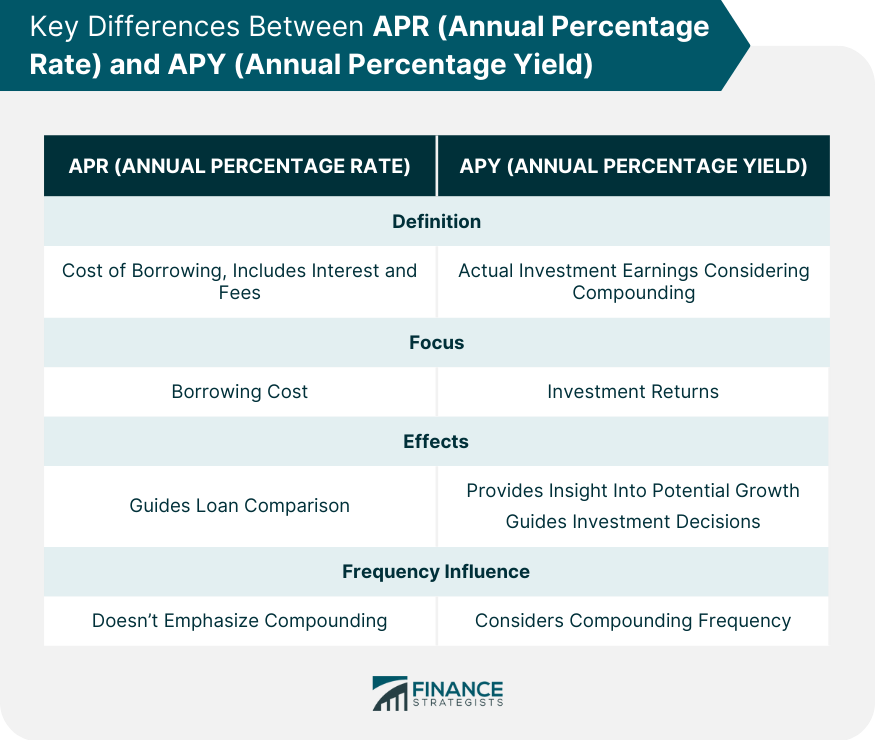

Both Annual Percentage Rate (APR) and Annual Percentage Yield (APY) are financial metrics that play pivotal roles in the realms of borrowing and investing, respectively. At their core, they serve to convey the real cost of borrowing or the genuine return on investments. While their purpose is to offer clarity, understanding their nuances and differences is essential for making informed financial decisions. APR and APY, though related, differ fundamentally in the way they are calculated and presented. With the progression of the financial sector, and the increasing complexity of financial instruments, it became essential to introduce metrics that could provide consumers with a clearer understanding of the costs and benefits. While APR is a more accurate estimation of the total cost of a loan than the nominal interest rate, it is limited because it only considers a simple interest rate. If the interest compounds on a smaller time frame than annually (such as monthly or semi-annually), the actual interest paid will be higher than the APR advertised. Factoring in compounding interest that happens within a year gives you a loan's APY, or Annual Percentage Yield (sometimes also called EAR, or Effective Annual Rate). The Annual Percentage Rate (APR) is a measure used primarily in the context of loans and credit cards. It represents the yearly cost of borrowing money and is expressed as a percentage. APR not only includes the interest rate on the principal amount but also integrates any fees or additional costs associated with the loan. For instance, if you take out a mortgage or a car loan, the APR would incorporate both the base interest rate and any origination fees or service charges. When comparing loan offers, APR serves as a comprehensive metric. Since it envelops both interest and fees, it provides potential borrowers with a more holistic view of the loan's cost. This all-encompassing nature of the APR ensures that lenders can't hide fees while promoting a lower interest rate. The Annual Percentage Yield (APY) is a metric that reflects the actual amount an investment earns or costs over a year, factoring in the effects of compounding. Compounding can be described as the process where an investment earns interest, and then that interest earns interest on itself. APY is most commonly associated with savings accounts, certificates of deposit, and other investment vehicles. What sets APY apart from a simple interest rate is its consideration of compounding. For instance, if you have a savings account that compounds interest monthly, the APY would be higher than the nominal interest rate because it accounts for the interest you earn on previously accrued interest. In essence, APY gives you a clearer picture of an investment's yield over time. While both APR and APY serve to inform consumers about the costs or returns of financial instruments, they cater to different aspects of finance. APR is primarily centered on borrowing and represents the true cost of taking out a loan or using a credit card. It provides an inclusive rate that incorporates both interest and associated fees. On the other hand, APY focuses on the earning potential of investments. It depicts how much one can expect to earn or owe, especially when the effects of compounding come into play. APR and APY can significantly influence decisions made by consumers and investors. For consumers looking to borrow, a lower APR indicates a cheaper loan, helping in comparisons across different lenders. For investors or those seeking to save, a higher APY means the investment or savings account will grow faster over time, assuming all other factors remain constant. One of the primary differentiators between APR and APY is the role of compounding. APR usually provides a straightforward annual rate without emphasizing compounding effects. Conversely, APY takes into account how often interest is added to the principal. Whether interest is compounded daily, monthly, or annually can lead to variations in APY. The more frequent the compounding, the higher the APY will be compared to the base interest rate. Both APR and APY can be swayed by prevailing market conditions. Central banks' monetary policies, inflation rates, and overall economic health can influence interest rates, which in turn impact both APR and APY. For instance, during economic downturns, central banks might lower interest rates to stimulate borrowing, potentially leading to lower APRs for consumers. As previously mentioned, the frequency of compounding is a crucial determinant of APY. An account with daily compounding will have a higher APY than one with annual compounding, even if their base interest rates are identical. This frequency plays a lesser role in APR, which typically doesn't factor in compounding in the same way. For APR, fees and charges associated with a loan or credit card can significantly affect the rate. These can include origination fees, service charges, and annual fees. Lenders are mandated to disclose the APR, ensuring transparency so borrowers can discern the true cost of borrowing. On the APY side, while it inherently considers compounding, fees like account maintenance charges can reduce the effective yield on an investment, though they're not part of the APY calculation itself. As a helpful rule of thumb, most credit card companies use an APR compounded monthly, whereas most mortgages use an APR that is calculated on an annual basis and is therefore the same as APY. If you are carrying credit card debt, your APR is already high, to begin with, but your APY is even greater than the stated APR, plus you may be charged additional fees for late payments! Here is how to remember interest rate, APR, and APY: Interest rate is the interest on the principal borrowed which does not factor in additional fees, and is usually stated annually. Annual Percentage Rate (APR) is the interest plus additional fees, stated as a percentage. This is stated annually and therefore does not factor in rates compounded on smaller time frames (such as monthly). Annual Percentage Yield (APY) or Effective Annual Rate (EAR) factors in additional fees and whether the rate is compounded on a smaller time frame. An APR is needed to compute the EAR. Compounding interest monthly rather than annually and other maneuvers like these to further enslave those in credit card debt is why credit card companies and other consumer lenders have a poor reputation. Now that you know the difference between the nominal interest rate, annual percentage rate, and effective annual rate, consider sharing this information with a friend to help them with their financial situation. APR encapsulates borrowing costs, encompassing interest and fees, while APY reflects investment returns, accounting for compounding effects. These metrics cater to distinct aspects of finance, with APR aiding borrowers in comparing loan options and APY guiding investors in assessing earnings potential. The impact of these metrics on consumers and investors is significant. For borrowers, a lower APR signifies cost-efficient loans, while investors seek higher APY for accelerated growth. Compounding frequency amplifies APY, highlighting its sensitivity to time frames. Market conditions, compounding frequency, and fees influence both metrics. APR responds to market shifts and includes fees, while APY factors in compounding and possible fees affecting investment outcomes. In an era of complex financial instruments, understanding APR and APY empowers informed decisions. This knowledge equips individuals to navigate borrowing and investing wisely, enhancing financial well-being.APR vs APY

What Is APR (Annual Percentage Rate)?

APY (Annual Percentage Yield)

Key Differences Between APR and APY

Focus

Effects

Compounding Frequency

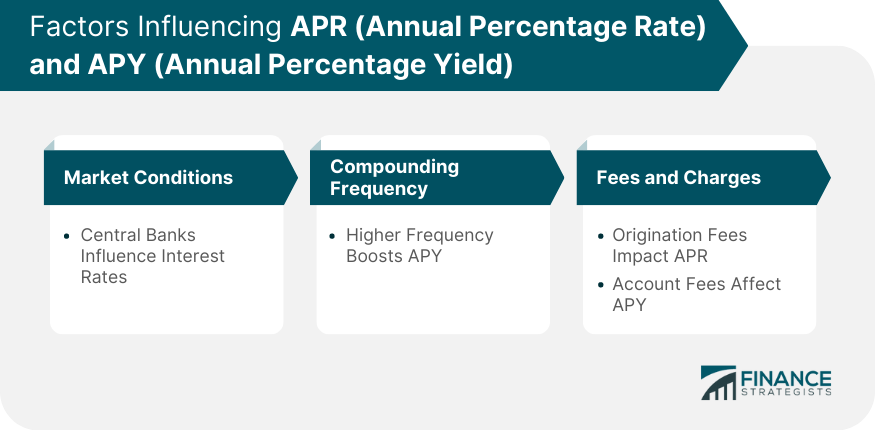

Factors Influencing APR and APY

Market Conditions

Compounding Frequency

Fees and Charges

When Is APR vs APY Used?

Conclusion

APR vs APY FAQs

APR is an estimation of the total cost of a loan that considers a simple interest rate. Factoring in compounding interest that happens within a year gives you a loan’s APY.

APR stands for Annual Percentage Rate.

APY stands for Annual Percentage Yield.

Although many credit cards advertise their low APR, they do, in fact, charge interest based on APY. Many banks are required to also inform you of the APY of any card you apply for.

Credit card companies compound interest monthly rather than annually. This and other maneuvers further enslave those in credit card debt and create a poor reputation for many consumer lenders.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.