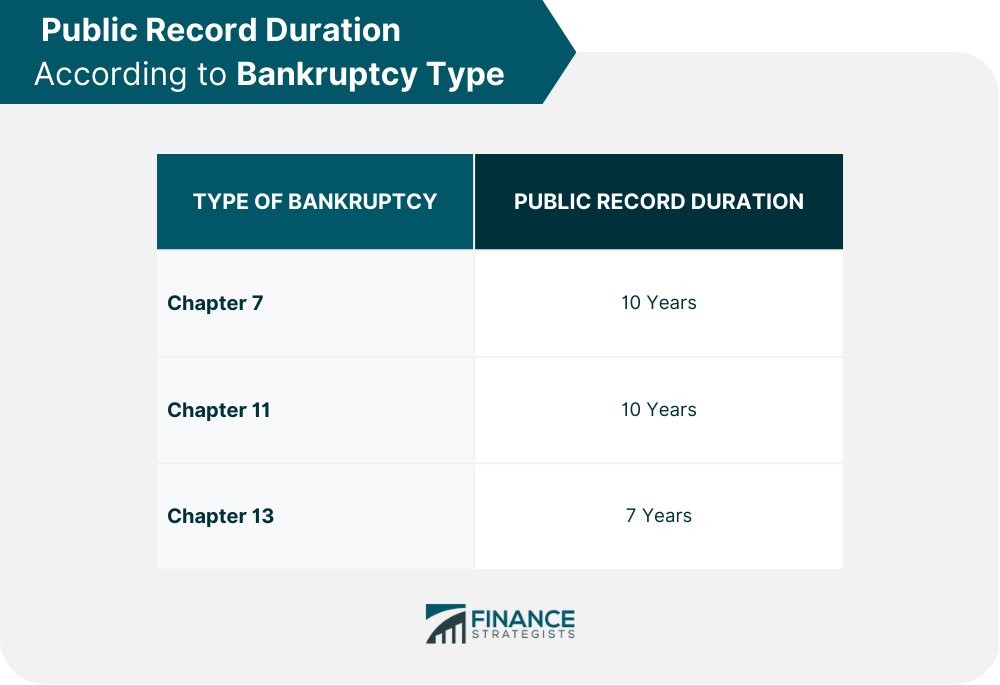

The duration of time that bankruptcy stays on public record depends on the type of bankruptcy filed, among other factors. Typically, bankruptcy filings remain on the public record for ten years. However, it is essential to note that there are some factors that can impact the length of time that bankruptcy stays on public record. The type of bankruptcy filed, the state in which the bankruptcy was filed, and whether or not the individual has had previous bankruptcy filings can all impact the duration of time that bankruptcy stays on public record. The duration of time that bankruptcy stays on public record varies depending on the type of bankruptcy filed. Chapter 7 bankruptcy is one of the most common types of bankruptcy that individuals file. This type of bankruptcy is also known as "liquidation bankruptcy," It is designed to help individuals discharge their unsecured debts, such as credit card debt, medical bills, and personal loans. The duration of time that Chapter 7 bankruptcy stays on public record is ten years. This means that the bankruptcy will remain on the public record for a decade after the individual files for bankruptcy. Businesses and organizations typically file for Chapter 11 bankruptcy. This type of bankruptcy, also known as "reorganization bankruptcy, " is designed to help businesses and organizations restructure their debts and operations to become more financially stable. The duration of time that Chapter 11 bankruptcy stays on public record is ten years, just like Chapter 7 bankruptcy. Chapter 13 bankruptcy is designed for individuals with a regular income but struggling to pay off their debts. This type of bankruptcy is also known as "wage earner's bankruptcy." It allows individuals to restructure their debts and create a repayment plan that lasts three to five years. The duration of time that Chapter 13 bankruptcy stays on public record is seven years. This means that the bankruptcy will remain on the public record for seven years after the individual completes their repayment plan. The consequences of bankruptcy on public record can be far-reaching and long-lasting. For example, bankruptcy can impact an individual's credit score, ability to obtain loans, and future employment opportunities. Lenders use credit scores, which range from 300 to 850, to evaluate an individual's creditworthiness. A bankruptcy filing can cause an individual's credit score to drop by 200 or more points, which can make it difficult for them to obtain loans or credit in the future. This can make it challenging for them to rent an apartment or get a job, as many employers run credit checks before hiring employees. After filing for bankruptcy, many lenders will view the individual as a high-risk borrower, and they may be less likely to approve their loan applications. If they do approve the loan application, the interest rates will likely be higher, and the repayment terms may be less favorable. Many employers conduct background checks on job candidates, which may include a review of their credit history. If an individual has a bankruptcy filing on their public record, it may be viewed as a negative factor by potential employers, which could impact their ability to secure employment. There are some ways that individuals can remove bankruptcy from their public record, although these options may not be available to everyone. Two options are discussed below. Expungement of bankruptcy records refers to the process of having bankruptcy records removed from public records. This option is typically only available to individuals who have had their bankruptcy case dismissed or who have successfully completed a Chapter 13 repayment plan. To expunge bankruptcy records, individuals must file a motion with the bankruptcy court, and the court must approve the request. If the court approves the request, the individual's bankruptcy records will be removed from public records. This option is typically only available to individuals who can show that their bankruptcy records are causing them significant harm, such as impacting their ability to obtain employment or housing. To obtain a court order to seal bankruptcy records, individuals must file a motion with the bankruptcy court, and the court must approve the request. If the court approves the request, the individual's bankruptcy records will be sealed, meaning that they will not be available for public viewing. Bankruptcy is a legal process that can have long-lasting consequences for individuals, businesses, and organizations. When a person files for bankruptcy, the process results in the creation of a public record that details their financial situation. The duration of time that bankruptcy stays on public record depends on the type of bankruptcy filed, among other factors. Typically, bankruptcy filings remain on the public record for ten years. However, there are some ways that individuals can remove bankruptcy from their public record, although these options may not be available to everyone. It is essential to be aware of the potential consequences of bankruptcy on public records and to consider all options carefully before filing for bankruptcy. A financial advisor can guide you on matters related to bankruptcy.Duration of Bankruptcy on Public Record

Factors That Affect the Length of Time Bankruptcy Stays on Public Record

Types of Bankruptcy and Their Public Record Durations

Chapter 7 Bankruptcy

Chapter 11 Bankruptcy

Chapter 13 Bankruptcy

Consequences of Bankruptcy on Public Record

Impact on Credit Score

Effect on Loan Applications

Potential Impact on Employment Opportunities

Ways to Remove Bankruptcy from Public Record

Expungement of Bankruptcy Records

Obtaining a Court Order to Seal Bankruptcy Records

The Bottom Line

How Long Does Bankruptcy Stay on Public Record? FAQs

Typically, bankruptcy filings remain on the public record for ten years, although the duration of time can vary depending on the type of bankruptcy filed and other factors.

Yes, bankruptcy can be removed from the public record through expungement or by obtaining a court order to seal the records.

Bankruptcy on public record can impact an individual's credit score, ability to obtain loans, and future employment opportunities.

Yes, bankruptcy can impact an individual's future employment opportunities as many employers conduct background checks that include a review of their credit history.

Yes, it is possible to file for bankruptcy more than once, although the length of time that the bankruptcy stays on public record may be impacted if an individual has had previous bankruptcy filings.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.