Filing for bankruptcy can be difficult, but it is sometimes necessary when individuals are in financial distress. Bankruptcy can offer relief from overwhelming debt and provide a fresh start. A discharged bankruptcy may stay on a credit report for as long as ten years, which can substantially impact an individual's creditworthiness, potentially limiting their ability to obtain credit in the future. Removing a discharged bankruptcy from a credit report can be lengthy and complicated. The following steps can help individuals navigate the process effectively. The first step in removing a discharged bankruptcy from a credit report is to obtain a copy of the credit report. Each of the three major credit bureaus, namely Equifax, Experian, and TransUnion, is required by law to provide individuals with one free credit report per year. Obtaining a copy of the credit report is essential to identify any inaccuracies that need to be addressed. After obtaining a copy of the credit report, the next step is to review it for inaccuracies. This may include incorrect reporting of the bankruptcy discharge date, debts not included in the bankruptcy filing, or accounts not closed after the bankruptcy was discharged. It is important to review the credit report carefully and identify any errors that must be addressed. The next step is to dispute any inaccuracies with the credit bureaus. This involves submitting a dispute letter to the credit bureau detailing the errors that must be corrected. The dispute letter should include the individual's personal information, a description of the errors, and any supporting documentation. Credit bureaus are required to investigate disputes within 30 days and notify the individual of the outcome. If the dispute is resolved in the individual's favor, the credit bureau must update the credit report accordingly. If the credit bureau dispute does not result in the discharged bankruptcy being removed from the credit report, the next step is to file a dispute with the bankruptcy court. This involves submitting a motion to reopen the bankruptcy case and requesting the removal of the discharged bankruptcy from the credit report. The motion must be filed in the bankruptcy court where the case was originally filed. The individual must provide a compelling reason for why the bankruptcy should be removed from the credit report. This may include errors in bankruptcy filing, fraudulent activity, or other extenuating circumstances. If the individual is having difficulty removing the discharged bankruptcy from the credit report, they may want to seek the assistance of a credit repair agency or attorney. Credit repair agencies specialize in removing inaccuracies from credit reports and can often negotiate with credit bureaus and bankruptcy courts on behalf of the individual. An attorney can provide legal advice and guidance on removing the discharged bankruptcy from the credit report. They can also represent the individual in court and negotiate with creditors and credit bureaus. There are specific circumstances under which it is legal to remove a discharged bankruptcy from a credit report. However, it is essential to understand the legal grounds for doing so and the options available. Inaccuracies on a credit report are grounds for removal. This may include errors in reporting, incomplete or outdated information, or fraudulent activity. If a discharged bankruptcy is inaccurately reported or contains errors, it can be removed from a credit report. The most common options for removing a discharged bankruptcy from a credit report include disputing inaccurate information with credit bureaus and filing a dispute with the bankruptcy court. Disputing inaccurate information involves submitting a dispute letter to the credit bureaus detailing the inaccuracies in the credit report. Filing a dispute with the bankruptcy court requires submitting a motion to reopen the bankruptcy case and requesting the removal of the discharged bankruptcy from the credit report. It is important to note that not all discharged bankruptcies can be removed from a credit report. If the bankruptcy was dismissed rather than discharged, it could not be removed from the credit report. Additionally, if the bankruptcy was legitimately filed and discharged, it can only be removed from the credit report once the ten-year reporting period has expired. Removing a discharged bankruptcy from a credit report can be a lengthy and complicated process. However, there are alternative options for managing the impact of a discharged bankruptcy on a credit report. One of the most effective ways to overcome the negative impact of a discharged bankruptcy is to rebuild credit. This involves establishing a new credit history by applying for credit cards, making on-time payments, and paying off debts in a timely manner. Bankruptcy counseling programs can provide valuable resources and guidance for individuals who have filed for bankruptcy. These programs offer financial education and support to help individuals manage their finances and rebuild credit. A discharged bankruptcy will remain on a credit report for up to ten years from the filing date. While waiting for the bankruptcy to fall off the credit report is not ideal, it may be the only option for some individuals. During this time, focusing on rebuilding credit and managing finances responsibly is essential. Filing for bankruptcy can be difficult, but it can provide relief from overwhelming debt and offer a fresh start. A discharged bankruptcy can remain on a credit report for up to ten years, significantly impacting an individual's ability to secure credit in the future. To remove a discharged bankruptcy from a credit report, individuals must understand the legal grounds and available options. Inaccuracies on a credit report are grounds for removal. The most common options include disputing inaccurate information with credit bureaus and filing a dispute with the bankruptcy court. It is important to note that not all discharged bankruptcies can be removed from a credit report, and seeking the assistance of a credit repair agency or attorney may be necessary. Alternative options for managing the impact of a discharged bankruptcy on a credit report include rebuilding credit, seeking bankruptcy counseling programs, and waiting for the bankruptcy to fall off the credit report. Taking action and being proactive in managing credit after a bankruptcy filing is crucial. Seeking the advice and guidance of a financial advisor can help individuals navigate the process effectively and make informed decisions about managing their finances. Bankruptcies are automatically removed from credit reports after 10 years. To remove a bankruptcy early, the best method is to look carefully at your bankruptcy papers for any (even minor) inaccuracies and dispute them with the three credit bureaus (TransUnion, Experian, and Equifax).Understanding Discharged Bankruptcy and Credit Reports

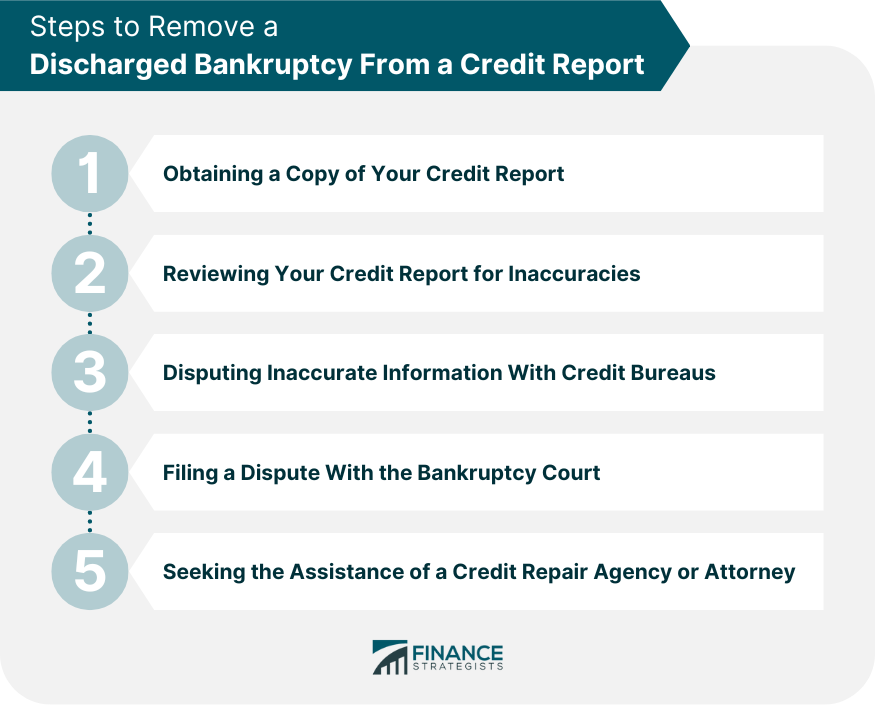

Steps to Remove a Discharged Bankruptcy from a Credit Report

Step 1: Obtaining a Copy of Your Credit Report

Step 2: Reviewing Your Credit Report for Inaccuracies

Step 3: Disputing Inaccurate Information With Credit Bureaus

Step 4: Filing a Dispute With the Bankruptcy Court

Step 5: Seeking the Assistance of a Credit Repair Agency or Attorney

Legality of Removing a Discharged Bankruptcy From a Credit Report

Legal Grounds for Removing a Discharged Bankruptcy

Options for Removing a Discharged Bankruptcy

Limitations and Restrictions on Removing a Discharged Bankruptcy

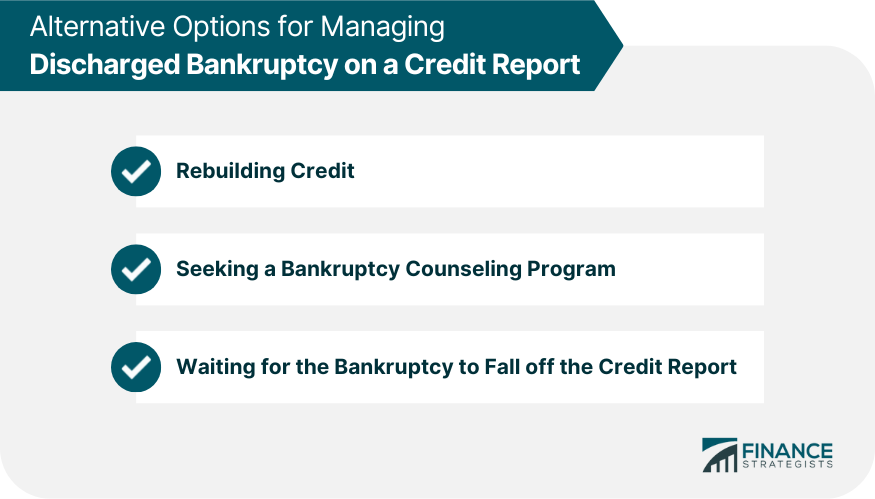

Alternative Options for Managing Discharged Bankruptcy on a Credit Report

Rebuilding Credit

Seeking a Bankruptcy Counseling Program

Waiting for the Bankruptcy to Fall off the Credit Report

Conclusion

How to Remove a Discharged Bankruptcy From a Credit Report FAQs

A discharged bankruptcy refers to the process of being relieved from paying certain debts following the completion of a bankruptcy case. A discharged bankruptcy can remain on an individual's credit report for up to ten years, making it more challenging to secure credit and loans in the future.

Yes, under certain circumstances. Inaccuracies on a credit report are grounds for removal. The most common options include disputing inaccurate information with credit bureaus and filing a dispute with the bankruptcy court.

Not all discharged bankruptcies can be removed from a credit report. If the bankruptcy was dismissed rather than discharged, it could not be removed from the credit report. Additionally, if the bankruptcy was legitimately filed and discharged, it cannot be removed from the credit report until the ten-year reporting period has expired.

A discharged bankruptcy can remain on an individual's credit report for up to ten years from the filing date.

Alternative options for managing the impact of a discharged bankruptcy on a credit report include rebuilding credit, seeking bankruptcy counseling programs, and waiting for the bankruptcy to fall off the credit report. Seeking the assistance of a financial advisor can also provide valuable support and guidance throughout the process.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.