The business cycle is a natural occurrence in the economy. It is generally described as a sequence of periods of expansion, followed by a period of contraction, and finally a period of recovery. Knowing the business cycle is important for a few reasons. The business cycle has six phases: This is the first phase of the business cycle, and it’s generally marked by an increase in economic activity. GDP (Gross Domestic Product) rises, unemployment falls, and prices increase. During this period, businesses are steadily growing their production and investing in new opportunities. The peak is the point at which an expansion turns into contraction. It’s also known as the business cycle’s boom phase. Expansion has reached its maximum growth, and now businesses are maxed out. They no longer have room to grow or invest, so they stop doing both—which affects supply (production), demand (usage of goods and services), employment, investment, prices, etc. The recession is a period of economic decline that lasts from six months to a year; sometimes it can last up to 18 months or more (referred to as "Depression"). During this period most types of economic activity come to a halt. The unemployment rate rises as businesses lay off workers, and prices for goods and services drop. This is the lowest point of the business cycle, which may also be referred to as the recession’s trough. At this point, GDP (Gross Domestic Product), employment, production, consumption, investment, personal income, and business profits are all low. The trough is the bottom of the recession. This is where the economy hits its lowest point. In terms of GDP, employment, investment, prices, etc., it’s generally a very bleak time. The recovery phase starts when economic activity begins to rise again. It’s marked by an increase in economic activity, as businesses start hiring again and production begins to pick up. Unemployment declines and prices begin to increase modestly. This period can last for months or years depending on how long it takes an economy to recover from a depression—which happens in a small number of depressions that have been studied by economists. A number of things can trigger the business cycle, such as: Changes in labor market conditions (changes in unemployment and wages) can affect businesses’ decisions about hiring and investing. Demand-side shocks also play a role here: if consumers suddenly start spending more or less money that will affect businesses. These include changes in resource prices (the cost of oil, for example), which could decrease production costs—or they could increase them. Supply-side shocks also include changes to technology. If technological advances allow companies to produce goods and services more cheaply, this will affect the economy by boosting supply and decreasing prices. Understanding what happens during each phase of the business cycle is important because it can help you make better decisions about your finances. For example, if you know a recession is on the horizon, you may want to start saving money or investing in short-term assets rather than long-term ones. What Is a Business Cycle?

Importance of Knowing the Business Cycle

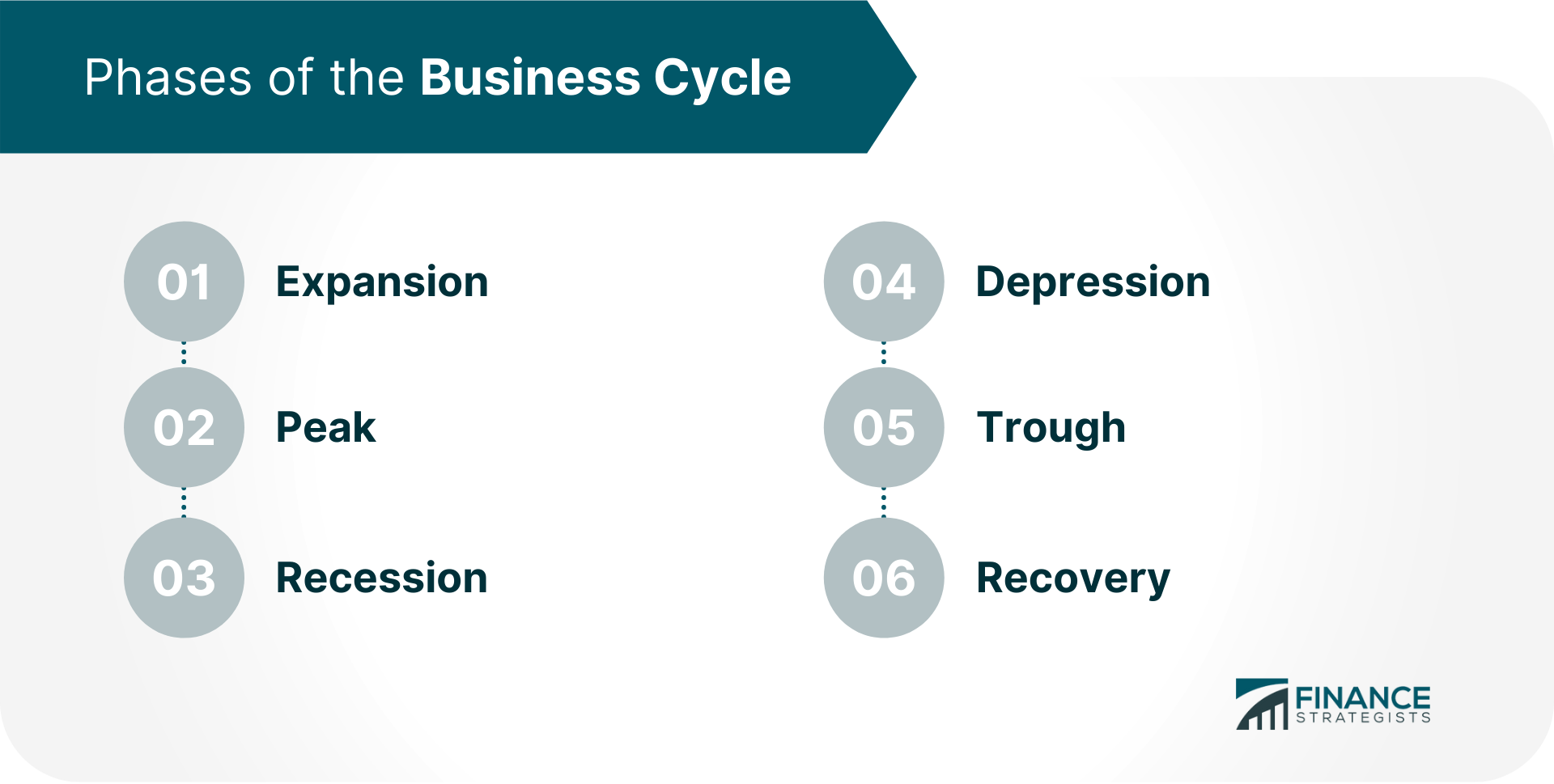

Phases of the Business Cycle

1. Expansion

2. Peak

3. Recession

4. Depression

5. Trough

6. Recovery

Factors That Shape the Business Cycle

Labor Market Shocks

Supply-Side Shocks

The Bottom Line

Business Cycle FAQs

A recession is a period of economic decline that lasts from six months to a year. Depression is a longer period of economic decline that may last for up to 18 months or more.

Labor market shocks can affect businesses’ decisions about hiring and investing. For example, if unemployment rises, businesses may lay off workers. If wages change, that could also affect businesses’ decisions.

A supply-side shock is an event that changes the cost of producing goods or services. A demand-side shock is an event that affects how much consumers want to buy.

It depends on how severe the depression is. In some cases, the economy may not fully recover for many years.

During an expansionary period, it can be beneficial to invest in long-term assets. During the recession phase, you may want to start saving money or investing in short-term assets like CDs (Certificates of Deposit). When the economy is booming and prices are high, it could be a good time to buy goods; when the economy is weak this isn’t necessarily the best time to make purchases.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.