A Chartered Alternative Investments Analyst or CAIA is an individual who is designated by the CAIA Institute as having the necessary abilities to research, analyze, and manage alternative investments. Alternative investments or AI are those which do not fall into the traditional categories of equity, income, or cash categories. Examples include private equity, commodities, real property, and hedge funds. The distinction of CAIA is important to the industry because AI is minimally regulated by the SEC. Have a financial question? Click here. The CAIA designation is relatively new and came about in the early 2000's when alternative investments, especially private equity, grew as a mainstream investing practice. CAIA's are mainly tasked with setting the standard for AI best practices and furthering the knowledge of the profession. They are able to analyze the risk-reward tradeoff of AI and determine how they fit into portfolio goals. This designation signals a high level of proficiency in alternative investments. As the financial world diversifies and complexity grows, such specialized knowledge becomes not only valuable but vital. Similar to a Chartered Financial Analyst, career paths of CAIA's include investment analyst, portfolio manager, investment manager, credit structurer and Senior Vice President at private equity or other investment firms. Alternative investments, by nature, aren't mainstream. Delving into them requires precision, patience, and prowess. A CAIA expert conducts rigorous research to uncover hidden gems, untangle convoluted data, and discern patterns that might elude the average eye. From studying market trends to deciphering the intricacies of specific sectors, their research forms the bedrock of informed investment decisions. By analyzing the minutiae of these investments, they provide a comprehensive understanding, enabling stakeholders to make informed decisions. It's not just about spotting opportunities; it's about understanding them inside out. With investments, returns are but one side of the coin; risks make the other. A CAIA is trained to meticulously assess both. They weigh potential returns against inherent risks, sculpting a comprehensive risk-reward profile for every alternative asset. It's about maximizing profits while safeguarding against potential downturns. Their expertise goes beyond mere numbers, diving into market conditions, geopolitical factors, and industry-specific nuances. This holistic risk assessment ensures that stakeholders are not diving into alternatives blindfolded but are making choices grounded in robust analysis. Once research is conducted and risks assessed, it's time for action. CAIA professionals excel in crafting tailored investment strategies for alternative assets. This might involve selecting appropriate investment vehicles, timing the market, or diversifying portfolios for optimal returns. Implementing these strategies is equally crucial. A well-laid plan demands meticulous execution. The CAIA professional ensures that strategies are not just theoretically sound but are also practically feasible, leading to tangible financial gains. Investments, especially in the alternative realm, aren't a one-time affair. Continuous monitoring is crucial. A CAIA is adept at tracking the performance of these assets, evaluating them against benchmarks, and recalibrating strategies as markets evolve. This iterative evaluation ensures that investments remain aligned with financial goals. If discrepancies arise or market dynamics shift, they're on top of it, ready to pivot and ensure sustained growth. To become a CAIA, candidates must pass two standardized tests including the fundamentals of risk and return for AI and a practicum on alternative investment portfolio management. Due to the unregulated environment of AI, ethics and the professional environment also comprises 15-25% of the exam. Aspiring candidates usually need a bachelor's degree and one year of professional experience in the alternative investment industry. Alternatively, four years of professional experience, even without a degree, can also grant eligibility. It's worth noting that this isn't just about ticking boxes. The CAIA Association ensures that those who wear the CAIA mantle possess both theoretical knowledge and practical expertise, making them true maestros in the field. Once deemed eligible, candidates embark on a rigorous journey spanning two levels of exams. Registration involves fees, with discounts often available for early birds. But, let's not forget, this isn't just about monetary investment. It's a commitment of time, energy, and intellect. The exams, typically computer-based, are held globally, ensuring accessibility for candidates regardless of their geographical location. It's an open door, but one that demands grit to pass through. The content is expansive, covering the intricacies of alternative investments, professional standards, and ethics. It's a blend of theory and practice, ensuring holistic grooming of candidates. To aid in this journey, the CAIA Association provides a plethora of study materials. Think textbooks, study guides, and sample questions. This exam encompasses the foundations of alternative investments, delving into topics like real assets, hedge funds, private equity, and structured products. Ethics and professional standards also feature prominently, ensuring candidates are groomed both in skill and integrity. Beyond specific assets, the curriculum explores tools and techniques vital for analysis. This foundational knowledge sets the stage for the more advanced topics tackled in Level II. Structured meticulously, the Level I exam involves multiple-choice questions that test both basic understanding and the ability to apply concepts in practical scenarios. Typically spanning four hours, this examination demands not just knowledge but also time-management skills. Each section of the curriculum carries its weight, and candidates must tread with balance. It's not just about knowing; it's about showcasing that knowledge under pressure. Successful candidates often intersperse study sessions with mock tests, gauging their understanding and refining their approach. The CAIA Association provides a rich repository of resources, from study guides to sample questions. External providers also offer prep courses, bringing in diverse perspectives. Whether it's group study, seeking mentorship, or leveraging online resources, the key lies in consistent, focused preparation. Building on the foundation set by Level I, the Level II examination plunges deeper. It delves into advanced topics in alternative investments, including nuanced strategies, recent innovations, and current industry trends. Ethical considerations, always pivotal, gain even more prominence. The curriculum explores the application of knowledge in real-world scenarios. It's a transition from knowing the notes to playing the symphony. The Level II format combines multiple-choice questions with constructed responses, demanding candidates to craft well-thought-out answers. Spanning approximately four hours, this exam tests depth of understanding, analytical skills, and the ability to articulate complex ideas succinctly. Candidates often find this level more challenging, not just due to content depth but also the complexity of the examination format. It's a true test of expertise. For Level II, preparation becomes even more critical. Candidates often go beyond the core materials, exploring industry reports, journals, and current market trends. Mock tests, especially for the constructed response section, become invaluable. Networking with current CAIA charterholders, joining study groups, and participating in webinars can provide insights beyond textbooks. The mantra remains: diversify, delve deep, and stay dedicated. Achieving the CAIA designation isn't the end; it's the beginning. To maintain this coveted title, professionals need to engage in continuous learning. Every two years, CAIA charterholders are required to complete 20 hours of professional development. This ensures they remain at the cutting edge, always updated, always evolving. This ongoing commitment to education reflects the dynamic nature of the alternative investment industry. It's not about resting on laurels; it's about consistently soaring higher. The avenues for continuing education are diverse. Charterholders can attend seminars, workshops, webinars, or courses. Reading industry journals, authoring articles, or even teaching can also count towards these requirements. The CAIA Association often provides resources, events, and updates to aid in this continuous learning journey. It's a collaborative endeavor, with the community and the association propelling each other forward. From asset management firms to private equity, hedge funds to consulting, the opportunities are vast and varied. Many organizations prioritize CAIA charterholders for roles demanding expertise in alternative investments. But it's not just about the doors that open; it's about the trajectory thereafter. The CAIA often accelerates career advancement, propelling professionals to leadership roles faster. Earning a CAIA is akin to wearing a badge of honor. It's a testament to one's expertise, dedication, and commitment. In the world of finance, especially within the realm of alternative investments, CAIA charterholders command respect. This credibility isn't just about individual recognition. It translates to trust from clients, peers, and organizations. A CAIA professional's word carries weight, and their insights are often sought and revered. Beyond knowledge, the CAIA journey is about connections. CAIA charterholders join an elite global network of professionals. This community, rich in expertise and experience, becomes a treasure trove of insights, collaborations, and opportunities. Regular events, webinars, and forums foster this sense of community. It's a space to learn, share, and grow, propelled by collective wisdom. The world of alternative investments is vast and varied. Grasping its intricacies is challenging, not just because of the content depth but also due to the lack of standardization. Unlike traditional assets, alternative investments often lack uniform benchmarks, making analysis and comparisons challenging. For CAIA aspirants, this complexity translates to rigorous study hours, constant updates, and a need to remain agile in the face of evolving market dynamics. Alternative investments often navigate a web of regulations. These regulations vary across geographies and asset types. For CAIA professionals, staying updated on these regulatory landscapes is pivotal. It's a tightrope walk, balancing investment strategies with compliance. Moreover, as ethical considerations gain prominence, ensuring adherence to best practices becomes non-negotiable. It's not just about financial acumen; it's about integrity and diligence. Unlike mainstream assets, many alternative investments suffer from limited liquidity. This can pose challenges in terms of valuation, exit strategies, and portfolio diversification. For CAIA professionals, crafting strategies in such a landscape demands innovation and foresight. Market access, especially for niche alternative assets, can also be restricted. Navigating these waters requires a blend of patience, persistence, and prowess. A Chartered Alternative Investment Analyst designation identifies individuals skilled in researching, analyzing, and managing alternative investments. They conduct thorough research, assess risk-return profiles, develop tailored strategies, and monitor performance. Earning the CAIA designation offers career opportunities, credibility, and a global network. However, challenges exist. Complex and non-standardized alternative investments demand constant updates and agility. Adhering to diverse regulatory landscapes requires diligence and ethical practices. Limited liquidity and market access necessitate innovative approaches. Despite these challenges, CAIA professionals thrive in the dynamic alternative investment field, contributing to the finance industry's growth and success. Their expertise ensures informed decision-making, benefiting investors and organizations alike.What Is a Chartered Alternative Investment Analyst?

CAIA Designation

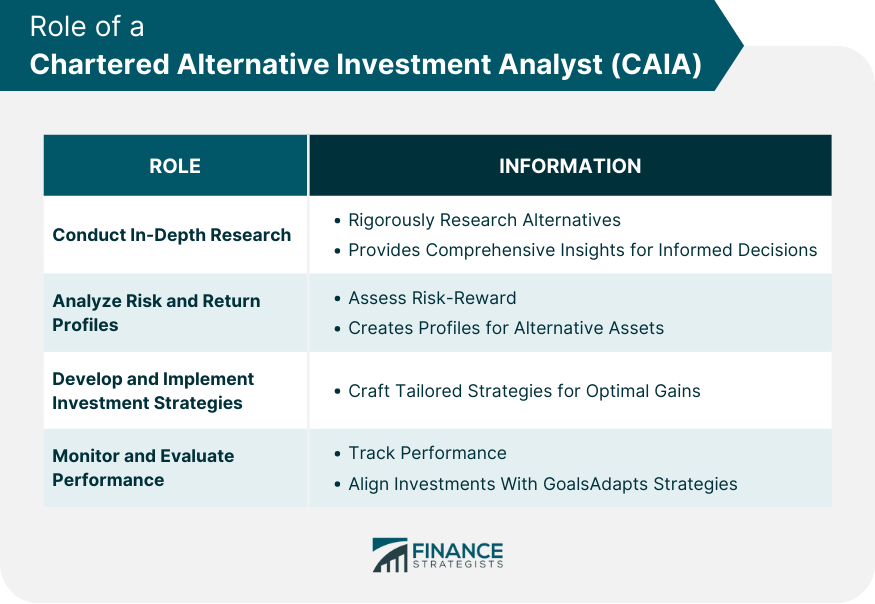

CAIA Career and Role

Conduct In-Depth Research

Analyze Risk and Return Profiles

Develop and Implement Alternative Investment Strategies

Monitor and Evaluate Performance

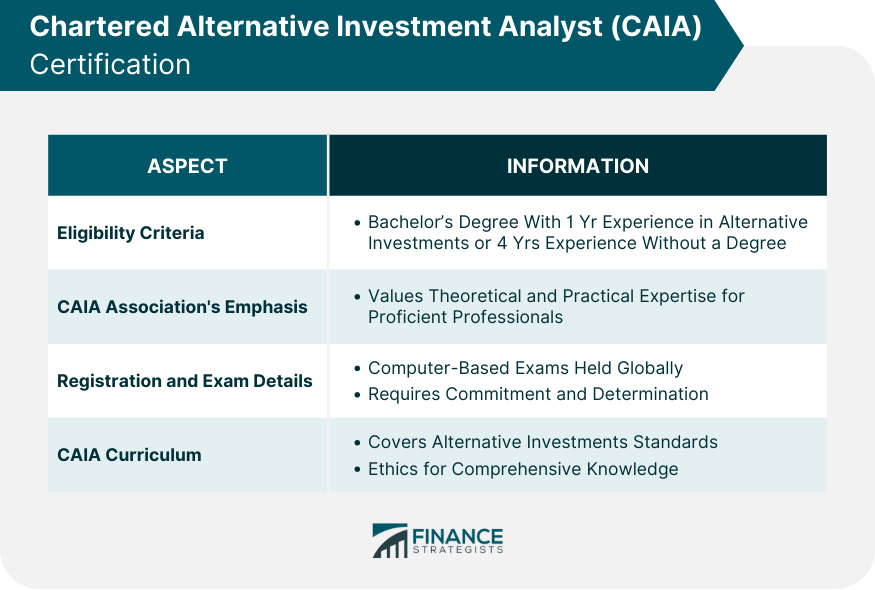

CAIA Certification

Eligibility Criteria

Registration and Exam Details

CAIA Curriculum

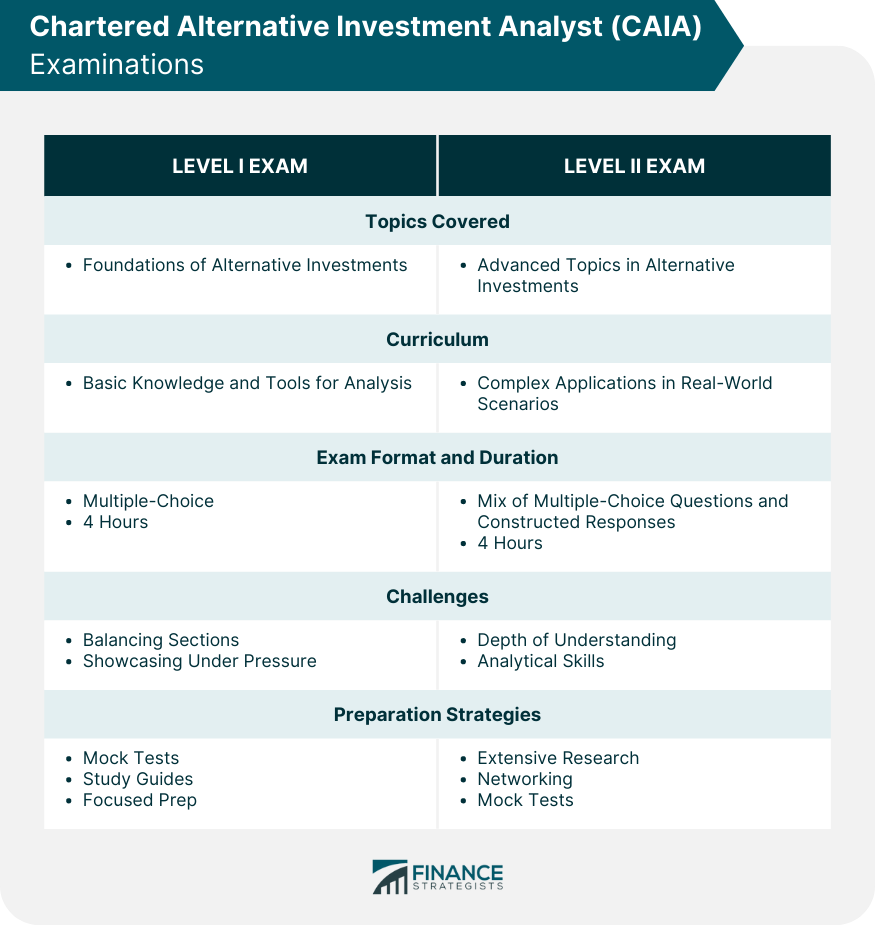

CAIA Level I Examination

Exam Format and Duration

Preparation Strategies and Resources

CAIA Level II Examination

Topics Covered in Level II Exam

Exam Format and Duration

Preparation Strategies and Resources

CAIA Continuing Education Requirements

Maintaining CAIA Designation

Options for Continuing Education

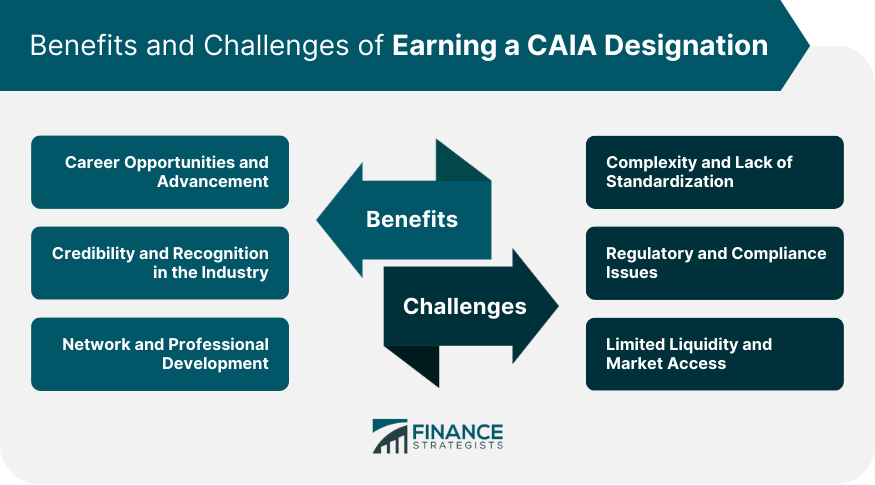

Benefits of Earning a CAIA Designation

Career Opportunities and Advancement

Credibility and Recognition in the Industry

Network and Professional Development

Challenges of Earning a CAIA Designation

Complexity and Lack of Standardization

Regulatory and Compliance Issues

Limited Liquidity and Market Access

Conclusion

Chartered Alternative Investment Analyst (CAIA) FAQs

CAIA stands for Chartered Alternative Investment Analyst.

A Chartered Alternative Investment Analyst or CAIA is an individual who is designated by the CAIA Institute as having the necessary abilities to research, analyze, and manage alternative investments.

Alternative investments or AI are those which do not fall into the traditional categories of equity, income, or cash categories. Examples include private equity, commodities, property, and hedge funds.

CAIA’s are mainly tasked with setting the standard for AI best-practices and furthering the knowledge of the profession. They are able to analyze the risk-reward tradeoff of AI and determine how they fit into portfolio goals.

Candidates must pass two standardized tests including the fundamentals of risk and return for AI and a practicum on alternative investment portfolio management. Due to the unregulated environment of AI, ethics and the professional environment also comprises 15-25% of the exam.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.