Collateral refers to property or assets that borrowers pledge to lenders as security for a loan. Lenders can take possession of the collateral if the borrower does not repay the loan according to the terms of the agreement. Collateral is used in various contexts, including loan agreements, legal proceedings, and financial markets. It is an important concept in finance and law, and understanding its various uses and implications is valuable for a wide range of professions and individuals. The various types of collateral are used in lending and financial transactions, including real estate, vehicles, stocks and bonds, and other financial assets. The most commonly used forms of collateral are in real estate. In fact, a mortgage or a home equity loan may require the borrower to pledge their property as security for the loan. Real estate is preferred by lenders because it is typically a stable and valuable asset that can be easily liquidated if the borrower defaults on the loan. Real estate appraisals are typically required to determine the value of the collateral, and the amount of the loan is usually based on a percentage of the property's appraised value. Automobiles, in particular, are commonly used as collateral in lending. Auto loans and title loans are two common examples of loans that require the borrower to pledge their vehicle as collateral. Like real estate, vehicles are often easily liquidated in the event of default, making them a preferred form of collateral for lenders. The value of the collateral is typically determined by the make, model, and condition of the vehicle, as well as other factors such as the borrower's credit history and income. Another type of collateral that is commonly used in financial transactions are stocks and bonds, particularly in margin accounts and other types of securities trading. Traders opening a margin account are required to provide collateral in the form of cash, stocks, or other financial assets, which serves as a form of security for the margin loan. The specific types of stocks and bonds that are accepted as collateral may vary depending on the financial institution and the specific transaction. Savings accounts, certificates of deposit, and other types of investments can also be used as collateral in some lending and financial transactions. These assets are typically highly liquid and easily convertible to cash, making them an attractive form of collateral for lenders. The specific types of financial assets that are accepted as collateral may vary depending on the lender or financial institution. Collateral is used to reduce the lender's risk when making a loan. By pledging an asset as collateral, borrowers give lenders a way to recoup their losses if the borrower fails to repay the loan. This makes it easier for lenders to offer loans to borrowers who may not have strong credit histories or other forms of security. The U.S. Small Business Administration (SBA) provides guidance to business owners on using collateral to secure business loans. Collateral can also be used in personal finance, particularly in secured credit cards or home equity loans. For instance, secured credit cards necessitate a security deposit, which serves as collateral for the credit limit. This helps to reduce the risk for the lender and can make it easier for individuals with poor credit to obtain a credit card. Home equity loans also require collateral, which is typically the borrower's home. This allows borrowers to access the equity they have built up in their homes to obtain a loan. Collateral is used in derivatives trading and other financial transactions to mitigate counterparty credit risk. In these transactions, one party may be required to make a payment to the other party at a later date. Collateral is used as a guarantee that the payment will be made if the party that owes the payment defaults. The use of collateral helps to reduce the risk of default and ensure that both parties are protected. Collateral plays a key role in reducing credit risk and increasing market efficiency. By requiring parties to provide collateral, financial institutions can reduce the risk of default and ensure that trades are settled in a timely manner. This helps to increase market efficiency and stability, as it reduces the potential for disruptions due to defaults. Collateral is often used in debt collection, bankruptcy, and other legal cases as a way to secure payment. For example, if a borrower defaults on a loan, the lender may be able to seize the collateral to recover their losses. Similarly, in bankruptcy cases, creditors may be able to seize the collateral to satisfy outstanding debts. Collateral can also play a role in securing judgments or settlements in legal cases. For example, in a personal injury lawsuit, the plaintiff may be awarded damages, but the defendant may not have the funds to pay. In this case, the plaintiff may be able to secure the judgment by placing a lien on the defendant's property, which serves as collateral. Collateral is an important concept in finance and law, with a wide range of applications in loan agreements, financial markets, legal proceedings, and personal finance. By understanding the various types of collateral and their implications, borrowers, lenders, investors, legal professionals, and individuals interested in personal finance can make informed decisions about how to use collateral effectively and responsibly. While using collateral can offer benefits such as increased access to credit and reduced credit risk, it is important to be aware of the potential risks and downsides, including the possibility of losing the collateral in the event of default. If you are considering using collateral in a loan agreement or other financial transaction, it is important to carefully weigh the benefits and risks and seek professional advice if necessary. Additionally, if you are involved in legal proceedings that involve collateral, it is important to work with a qualified legal professional who can guide you through the process. In summary, the importance of collateral cannot be overstated, and taking the time to understand its various uses and implications can help you make sound financial and legal decisions. So, take the initiative to learn more about collateral and its applications today, and start making smarter financial decisions.What Is Collateral?

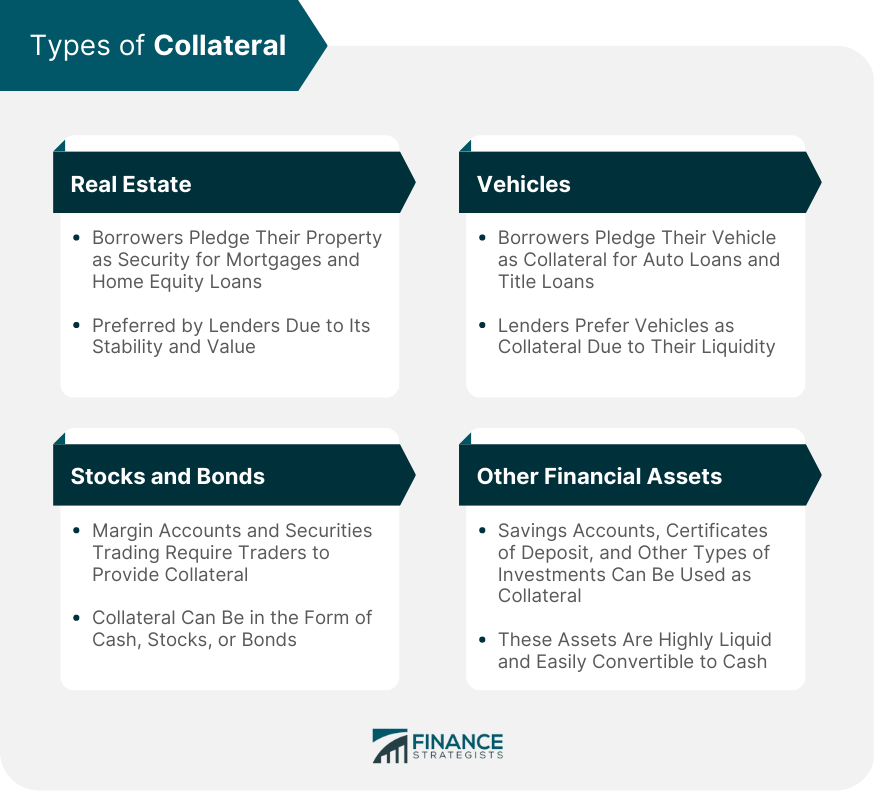

Types of Collateral

Real Estate

Vehicles

Stocks and Bonds

Other Financial Assets

Collateral in Loan Agreements

Collateral in Personal FinanceCollateral in Financial Markets

Collateral in Legal Proceedings

Final Thoughts

Collateral FAQs

Collateral refers to property or assets that a borrower pledges to a lender as security for a loan. If the borrower fails to repay the loan according to the terms of the agreement, the lender can take possession of the collateral.

Collateral can take many forms, including real estate, vehicles, stocks and bonds, and other financial assets. The specific type of collateral required by lenders may vary depending on the type of loan or transaction.

Collateral is commonly used to secure loans, particularly when the borrower has a low credit score or a high risk of default. By providing collateral, the borrower reduces the lender's risk and increases their chances of being approved for the loan.

While using collateral can be beneficial for obtaining credit, there are also risks involved. If the borrower defaults on the loan, they may lose the collateral that they provided, which could have significant financial and emotional consequences.

Collateral is commonly used in financial markets, particularly in derivatives trading and other complex financial transactions. By requiring traders to provide collateral, financial institutions reduce their credit risk and increase the efficiency and stability of the market. Common types of collateral used in financial markets include cash, government bonds, and high-quality corporate bonds.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.