A financial plan is a written statement of your current financial condition, intended financial state, a timeline for achieving those goals, and the steps you will take to get there. Your current financial condition is the foundation for all financial planning and the goals you hope to achieve. It will involve adding up your income, estimating expenses, creating a budget, managing debt load, savings and investment inventory, and the like. Setting short- and long-term financial goals is essential to financial security. You are more likely to overspend if you do not have a specific plan. Those who have a plan, have a financial objective in mind, follow it, and develop certain positive habits are more likely to succeed. A sound financial plan considers your circumstances and how they may impact your situation and goals. You can create your financial plan, use financial planning software, or work with a financial professional. A financial plan is created to help achieve financial goals. It is a roadmap that shows how to get from your current position to where you want to be. You can make the most of your salary, save money, and invest sensibly by making a financial plan. It can also help reduce stress and promote a more stable financial life. Reducing debt is possible because it gives a clear view of your current financial situation and where changes need to be made. It also prepares you for unexpected events such as job loss or a medical emergency. You can use your plan to set savings goals, invest for the future and improve your overall financial health, thereby building wealth. There is no definitive way to make a financial plan because it depends on your unique needs and situation. The following, however, are fundamental components that you should consider in financial plans to maximize potential outcomes: What you hope to achieve with your money should be indicated in your financial plan; it can be short-term, like saving for a down payment, or long-term, like retirement. You should also have a clear vision of when you want to achieve your goals. You can translate this into a timeline and set milestones to track your progress. Your net worth statement is a snapshot of your financial health. It includes all your assets (property, savings, investments, etc.) and liabilities (debts, bills, etc.). This information can help you determine investable assets and debts that must be settled before retirement. While net worth is just a single number and only one part of your overall financial picture, it tells the bottom line about your financial health. A detailed estimate of your income and expenses is necessary for a financial plan over a specific time frame. This information can help you assess if you have enough money to cover your spending. It can also help you find ways to save money and free up cash for other goals. Knowing how you will spend your money is important. Your budget should include all your income and expenses, both fixed and variable. You should create a short-term budget for your regular expenses and a long-term budget for your financial goals. Budgeting will help you monitor your progress and make adjustments as needed. If you have debt, you should include a debt management plan in your financial plan, as this will help you schedule payments and save money on interest. Most creditors will make concessions when you are on a good debt management plan. Eliminating interest can significantly reduce the monthly amount owed. They can also waive some fees and cut interest rates as part of the arrangement. Your investment plan is a strategy for how you will grow your money. It should include your investment goals, risk tolerance, and time horizon. It will help if you work with a financial professional to create an investment plan that is right for you. As a result, you can reach your financial goals while managing your risks. An insurance plan, which includes life, health, disability, and long-term care insurance, is a means to safeguard your assets and income. You should review your insurance needs regularly to ensure coverage and protect your family in an emergency. Your retirement plan is a way to ensure you have enough money to live on during retirement. Consider your retirement goals, savings goals, and investment strategy. You must constantly review your retirement plans to ensure you are on track to meet your goals. Having a comfortable retirement will be made possible by this. Making an estate plan can ensure that your assets are given out according to your wishes. It includes a power of attorney, will, trust, life insurance, health care directive, and tax exclusions, among others. Knowing that the individuals you designate will control your affairs and fulfill your wishes after your death can bring a sense of security. An implementation strategy should be incorporated into the financial plan to help you implement your plan and make it a success. Your implementation strategy should include a timeline, milestones, and tasks. You will most likely stay on target and achieve your financial objectives. Here are some of the steps to create a comprehensive financial plan: As a first step, decide what you want to accomplish and set a deadline for attaining them. Consider long- and short-term goals, as these, will be the driving force for your financial plan. SMART is an acronym for Specific, Measurable, Attainable, Realistic, and Time-related. Financial goals should be specific, measurable, achievable, realistic, and time-based. You can use this format to increase your chance of achieving your financial goals. I will pay $250/month (plus interest due) towards my $1,000 credit card debt in 4 months. I will reduce my dine-out and recreation expenses and refrain from using my credit card during this period. This goal statement will increase your chances of achieving your goal than saying, “I will pay off my credit card debt.” You can start by calculating your net worth and observing its trends. Calculate your debt-to-income ratio to determine if your financial situation is acceptable. You must develop a strong relationship with your money to advance financially. You can make a budget or update an existing one after you know exactly where your money is going. Ensure that your investment approach fits your circumstances. You can sense your ability to reach your financial goals by looking at your current financial condition. After you have determined your goals and assessed your current situation, you can begin creating a plan to achieve your goals. This plan should be realistic and achievable. Your plan should include a budget, savings goals, and investment strategy. Consider addressing debts and finding ways to reduce expenses. Making a reasonable budget and sticking to it is a worthy financial goal in and of itself. You will struggle to meet your objectives if you do not have a budget. Your budget allows you to analyze your strategy and make necessary changes to meet your goals. It may be simpler to begin on a small scale. Start saving in small regular amounts instead of keeping most of your income at once. Follow the steps stated in your strategy regardless of the lack of immediate results. Be careful of unexpected circumstances influencing your money, and adjust accordingly. Monitor your progress and make sure that you are on track. Your financial situation may change over time, so it is essential to rework your strategy appropriately. For example, you may get a raise or pay off some debt. These changes will impact your budget and savings goals. Additionally, you may adjust your timeline, increase your savings requirement, or modify your entire financial objective. Everyone can benefit from creating a financial plan as it can help you achieve your goals regardless of age or financial situation. If you are starting, a financial plan can help you get on track financially. It can guide how to save money and invest in the future. If you are nearing retirement, a financial plan can also help you ensure that you have sufficient money saved to cover your expenses. A financial advisor may be able to help you if you have a complicated financial state or need an expert in estate preparation, tax planning, or insurance. You may consider working with fiduciaries (financial advisors sworn to serve in the client's best interest) to prevent conflicts of interest. They can also help you reduce debt and manage your finances more efficiently using the financial tools that they have. Working with a financial advisor can objectively assess your situation based on your goals and financial situation. Working with one helps you stay on track by providing accountability and support. However, it is essential to consider credible financial advisors who align with your financial goals. Research potential advisors online and verify their backgrounds. In 2022, the average fee-only cost of a standalone financial plan is $2,400. A financial plan helps you manage your finances properly and prepare for the future. An effective financial plan contains important key components, such as your financial goals, net worth, cash flow projections, and budget. A financial plan's purpose is to provide a detailed strategy to guide you in meeting your financial goals, building your wealth, and preparing for unexpected events. There are basic steps to follow. These steps include knowing your goals, assessing your financial situation, creating a plan based on that information, implementing it, and periodically revising it. Regularly reviewing your plan will help ensure that it remains relevant and accurate. A financial plan is essential for everyone, regardless of age or financial situation. A financial advisor may help create a comprehensive and objective financial plan if you do not know where to start. Just make sure that you collaborate with a credible financial advisor.What Is a Financial Plan?

Purpose of a Financial Plan

Components of a Holistic Financial Plan

Financial Goals

Net Worth Statement

Cash Flow Projection

Short-Term and Long-Term Budget

Debt Management Plan

Investment Plan

Insurance Plan

Retirement Plan

Estate Plan

Implementation Strategy

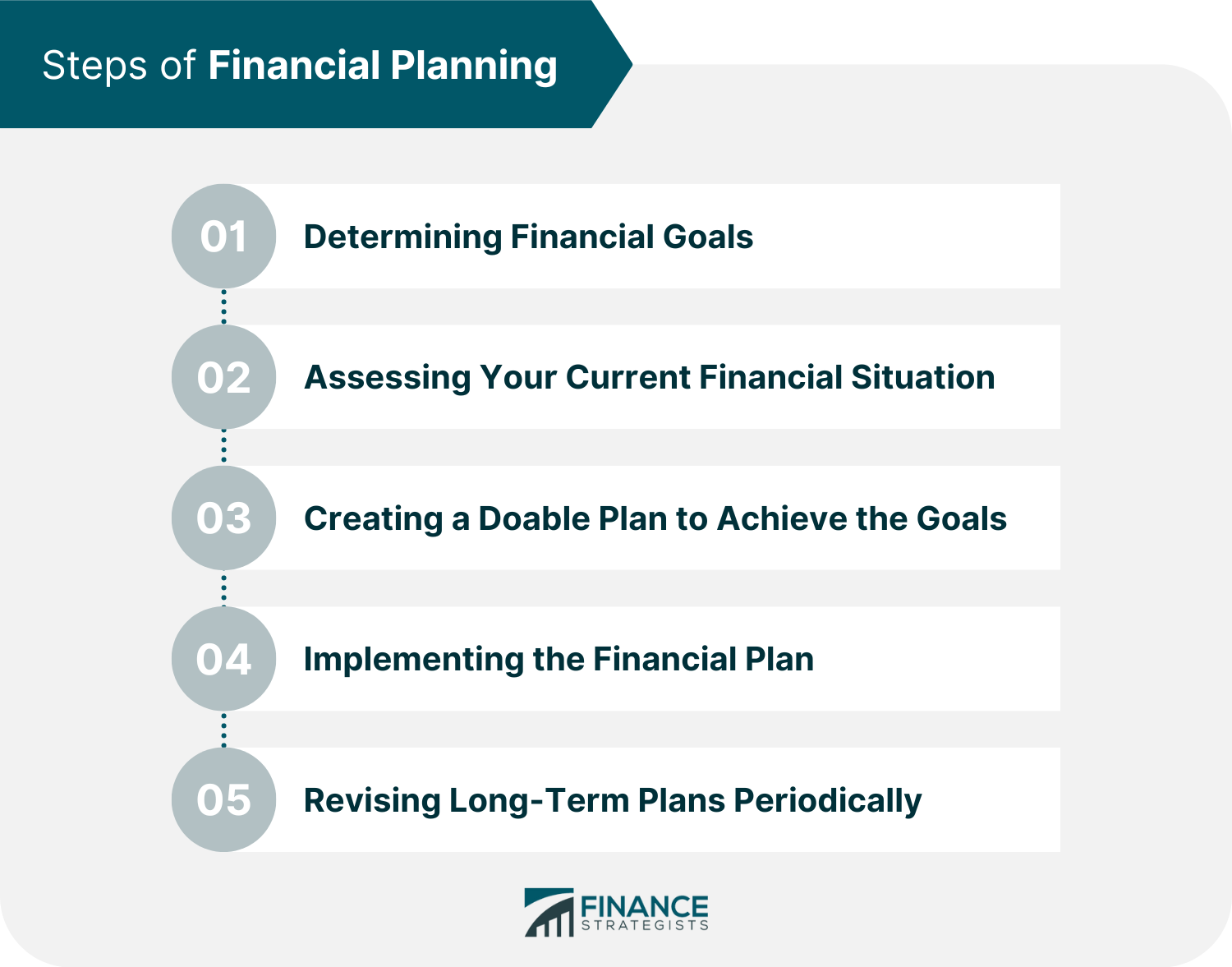

Steps in Creating a Financial Plan

Determining Financial Goals

Assessing Your Current Financial Situation

Creating a Doable Plan to Achieve the Goals

Implementing the Financial Plan

Revising Long-Term Plans Periodically

Who Needs a Financial Plan?

Financial Planning With a Financial Advisor

The Bottom Line

Financial Plan FAQs

Financial plans are documents that provide an overview of your current financial situation and present guidelines on how to achieve your financial goals.

A financial plan is intended to assist you in making the most of your money and achieving your long-term financial objectives. A financial plan offers a systematic and detailed plan to accomplish your goals.

A financial plan should include financial goals, a net worth statement, a cash flow projection, and a short-term and long-term budget. It should also contain debt management, investment, insurance, and retirement plans. Lastly, it should include an implementation strategy.

Possible financial plan goals are repaying credit card balances, creating a budget for your daily living, and saving six months' worth of income in an emergency fund.

Consulting with a financial advisor can help you create a complete financial plan that considers your unique situation. Getting help is necessary if you do not know where to begin or need assistance developing a practical and feasible strategy. They can assist with several complex financial subjects.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.