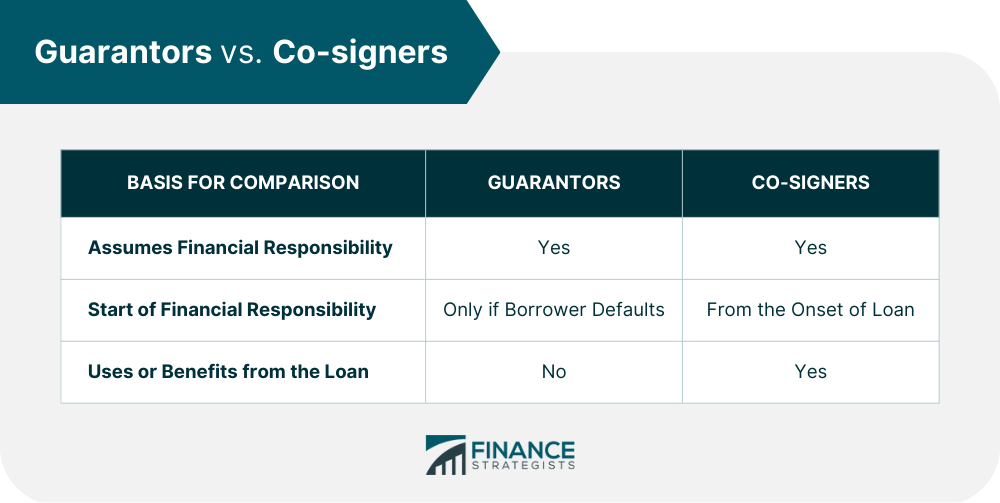

A guarantor is a person who agrees to take responsibility for a borrower’s debt or other financial obligation in the event of a default. Depending on the type of guarantee needed, a guarantor can be an individual, a business, or any other entity. Guarantors typically have a good credit score and financial history, supplementing the borrower’s own. Loan applications with a guarantor have higher chances of being approved since they provide additional security that the lender can recover the debt. A guarantor acts as a secondary funding source, covering any missed payments from the borrower if necessary. However, this is not required if the borrower can make all payments promptly. Both guarantor and borrower must sign an agreement outlining what will happen should the guaranteed party fail to meet their obligation. This document includes details such as the loan percentage the guarantor is responsible for and the circumstances when this might be required. The guarantor will also need to provide proof of their ability to pay the debt should it become due, such as a bank statement or other financial documents. Additionally, they must agree to accept responsibility for the loan and not attempt to transfer it to another party. A guarantor is only responsible for a debt if it goes unpaid, at which time the lender can pursue legal action against them and the borrower. They do not receive any benefit by taking on this responsibility – they simply agree to provide security for the lender in case of default. Guarantors can be individuals of good financial standing, such as an immediate family member, close friend, or business associate. Depending on the agreement, guarantors may also be third-party organizations like banks, lending institutions, or even government entities. For private agreements between two parties, it is advisable to choose a guarantor who knows what details must be indicated in the agreement. This helps ensure that all necessary information is included and that neither party is taking advantage of the other. Generally speaking, anyone over 18 with good credit, job stability, and sufficient assets to cover the loan can be a guarantor for another person. However, it is important to note that some lenders may require more than one guarantor when approving a loan application. There are different types of guarantors. Some of them are mentioned below: A limited guarantor provides a guarantee for only part of a loan. For example, they may agree to be responsible for only 50% of the total amount due if it goes into default. They may also commit to covering a loan only up to a specific time and not for the entire contract duration. This type of guarantor takes on more responsibility for the loan when compared to a limited guarantor. An unlimited guarantor agrees to be responsible for the entire debt or loan for the whole duration of an agreement if the borrower defaults. Guarantors are not only used when borrowing money. Sometimes, a lessor may require a guarantor to take responsibility for unpaid rent or damages caused by a tenant. For example, a parent can guarantee their child's lease agreement in their college dorm or apartment. Guarantors may also serve as certifiers who can vouch for a person's character or identity. For instance, a guarantor can help someone land a job by certifying that they know the applicant. Guarantors can even help a person obtain a passport by attesting to their identity. The ability to pay is the primary consideration of lenders before approving a loan. In some instances mentioned below, lenders might require a guarantor before agreeing to enter into a contract with you. Your income is a critical barometer of your ability to pay a loan. This may be from a job, a business, or even earnings from your investment portfolio. Whatever the source, a lender will review if the amount you earn in a year can reasonably cover your potential loan payments. Depending on the total loan amount, the lender may ask for a guarantor if you do not have enough documented income to pay the loan back easily. Sometimes, you have a considerable annual income, but you may still not be approved for a loan outright. Job stability is another factor lenders consider. Are you a freelancer or consultant who has variable incomes? Or are you employed part-time by multiple employers? This can be a red flag for some lenders, especially if you apply for a long-term loan. Having a guarantor can reassure the lender of your ability to repay the loan since they can step in and cover payments if necessary. Your credit score is also examined when deciding whether you qualify for a loan. This is affected by your past credit and loan payments. The higher your score, the more likely you will be approved and given competitive interest rates. If your credit history is less than stellar and marked by late or missed payments, lenders will find it hard to trust that you will be able to make payments on time. A guarantor can help you gain approval for a loan because they can take responsibility for the payments should you default. The landlord may ask for a guarantor if you are applying to rent your first home or apartment. They want assurance that you can make timely rental payments and keep up with other lease terms and conditions. A guarantor gives landlords extra confidence in your ability to cover costs associated with the contract instead of just taking your word for it. A guarantor can provide the borrower with the following benefits: A guarantor can increase the chances of approval for mortgages and other loans. This can be especially helpful if the borrower has a low credit score or no credit history. Having a guarantor demonstrates to the lender that they can trust the borrower to pay back the money. Not only will the loan application be approved, but having a guarantor can expedite the process and contribute to the quicker release of funds. A guarantor may also help improve loan terms for the borrower. Lenders can agree to a higher loan than initially offered since two parties are committing to pay the loan. This allows the borrowers to take on larger projects, such as starting a business or buying property. Lenders may also grant a lower interest rate since they are more assured of recouping their loaned amount. This lowers the borrower’s overall cost in obtaining the loan and lessens the amount they need to pay. Having a guarantor can also benefit a borrower’s credit history. Since the guarantor will be responsible for making payments if the borrower cannot, lenders can report that the loan got paid, even if a portion of the funds came from the guarantor rather than the borrower. Since any missed payments will not be recorded, the transaction will still improve the borrower’s score, making it easier to apply for other loans down the line. Becoming a guarantor carries with it several disadvantages. Some of them are mentioned below: The main disadvantage of being a guarantor is that they are held liable for any outstanding balance if the primary borrower defaults. The guarantor must pay off the remaining amount of the loan, lease, or contract that still needs to be fulfilled. In some cases, a court order may even be issued against them. Understanding this responsibility before signing on as a guarantor is essential, as it could have severe implications for an individual's financial situation. Becoming a guarantor for someone else’s loan can place a person's credit score at risk since it will appear on their credit report. The lender may run a credit check when accepting them as a guarantor, which could adversely affect their score. Additionally, if they are asked to take over payment of the loan and fail to do so, it could damage their credit rating further. Banks consider a guarantor a higher-risk borrower since they are vouching for someone else's debt. Even though they are not the primary borrower, it can still be considered their loan since they are committing to repay it in case of borrower default. This could limit their opportunity to take out other loans as the bank may be more reluctant to lend money, regardless of the guarantor's credit score or annual income. People sometimes use the terms guarantor and co-signer interchangeably. While they share financial responsibility with another person, several significant differences exist. A guarantor takes on the responsibility of a loan only if a borrower defaults on it. They do not own the asset in question or do not use the loaned funds themselves. It is only the borrower who directly benefits from the loan. On the other hand, a co-signer is a joint borrower who takes full responsibility for the debt. They are just as legally responsible for making payments on time and in full as the primary borrower. Co-signers take on financial risk from day one of taking out a loan. Co-signers can use or benefit from the loaned funds just as the borrower can. They also co-own any assets acquired through the loan, like a vehicle or an apartment. A guarantor is a person who agrees to be legally responsible for another person's debt or contractual obligations in case they default. The guarantor acts as an additional form of security, assuring the lender that the loan will be repaid. Anyone over 18 with good credit, job stability, and sufficient assets to cover the loan can be a guarantor for another person. This can be family, close friends, or even a third-party organization. Guarantors help people with a low income, an unstable job, a low credit score, or no rental history get access to loans or enter into a lease agreement. Having a guarantor can increase loan approval chances, improve loan terms, and positively affect a borrower's credit history. On the other hand, the loan agreement can also negatively affect guarantors since they are liable to pay off another person's debt. This places their credit score at risk and lessens the possibility of getting approved for their own loan. Guarantors and co-signers are different. Guarantors only pay a debt when the primary borrower defaults, while a co-signer bears full responsibility at the onset of a loan. Additionally, a guarantor does not usually use or benefit from the loan, while a co-signer does. If you are considering whether to include a guarantor or co-signer on your loan application or lease agreement, you may ask a financial advisor to help you through this process. What Is a Guarantor?

How Guarantors Work

Who Can Be a Guarantor?

Types of Guarantors

Limited Guarantors

Unlimited Guarantors

Lease or Rental Agreement Guarantors

Certifying Guarantors

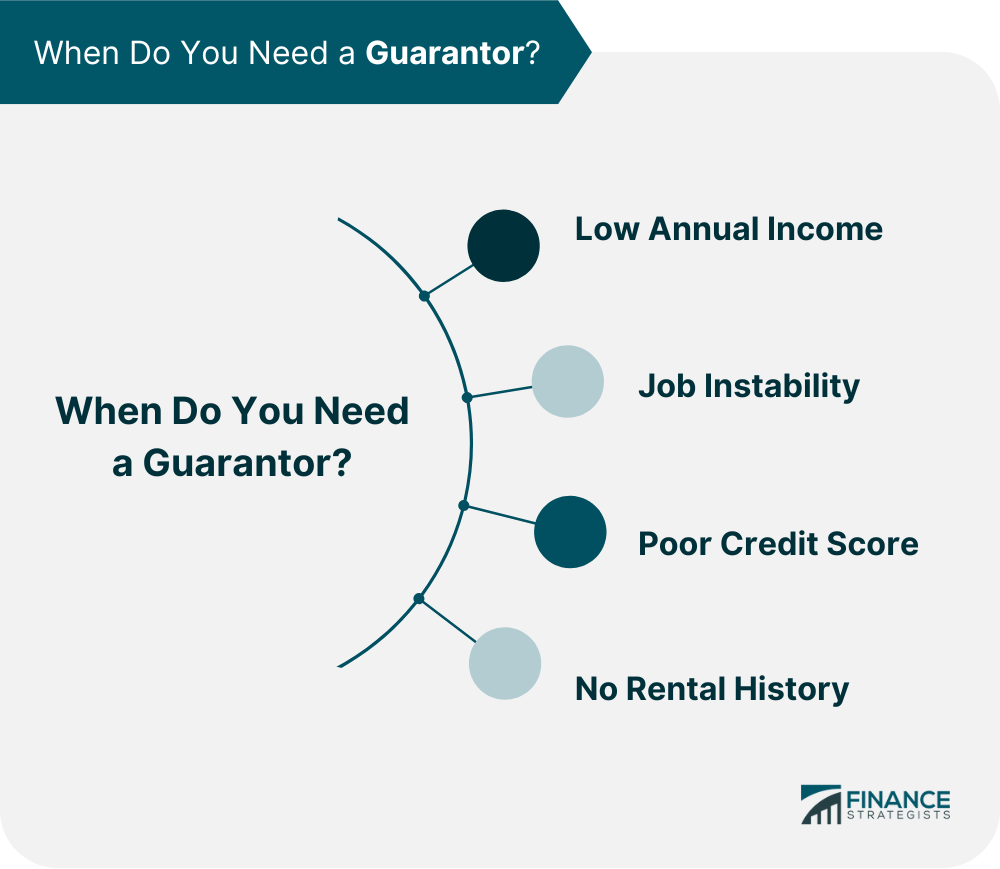

When Do You Need a Guarantor?

Low Annual Income

Job Instability

Poor Credit Score

No Rental History

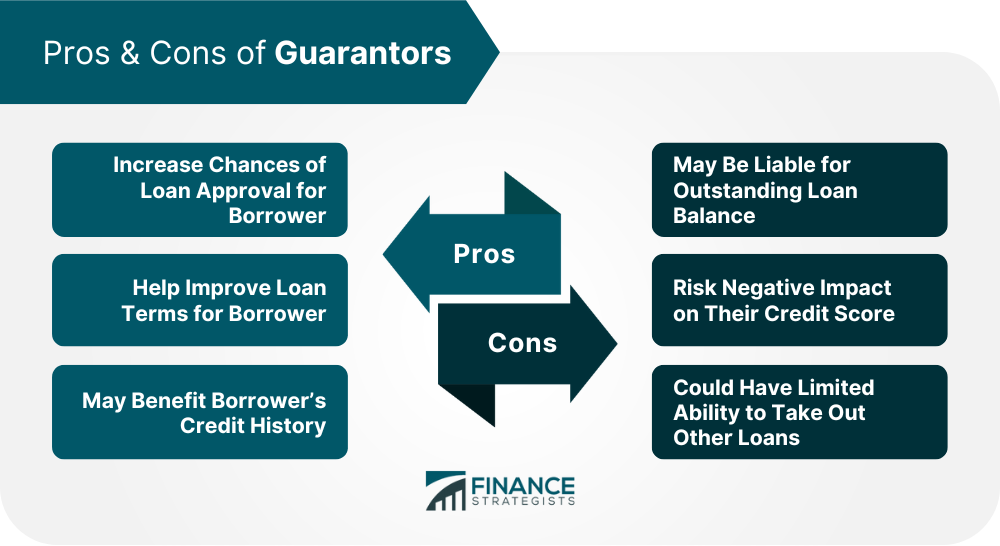

Advantages of Guarantors

Increase Chances of Loan Approval

Improve Loan Terms

Benefit Borrower’s Credit History

Disadvantages of Guarantors

May Be Liable for Outstanding Loan Balance

Risk Negative Impact on Their Credit Score

Could Have Limited Ability to Take Out Other Loans

Guarantor FAQs

Guarantors commit to paying a debt should a borrower default. They provide additional assurance for a lender that a loan will be repaid.

When you are the guarantor, you share legal responsibility for another individual's loan or lease agreement. You must ensure that the other party meets their financial obligations, or you will cover any associated costs if they fail to do so.

A guarantor must be of legal age and have enough financial resources to cover the obligations when the other party fails to do so. A guarantor should also have a good credit score and may need to provide proof of income. They can be family, friends, or even a third-party organization.

The advantages are mainly to the borrower: increased chance of loan approval, better loan terms, and possible improvement of credit score, while the disadvantages are primarily to the guarantor: liability to pay if the borrower defaults, risk of lowering credit score, and lesser chance of getting approved for their own loans.

No. Though both bear financial responsibility, a guarantor only pays if a primary borrower defaults, while a co-signer shoulders the loan at the onset and pays alongside the borrower. Guarantors also do not benefit from a loan, while a co-signer does.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.