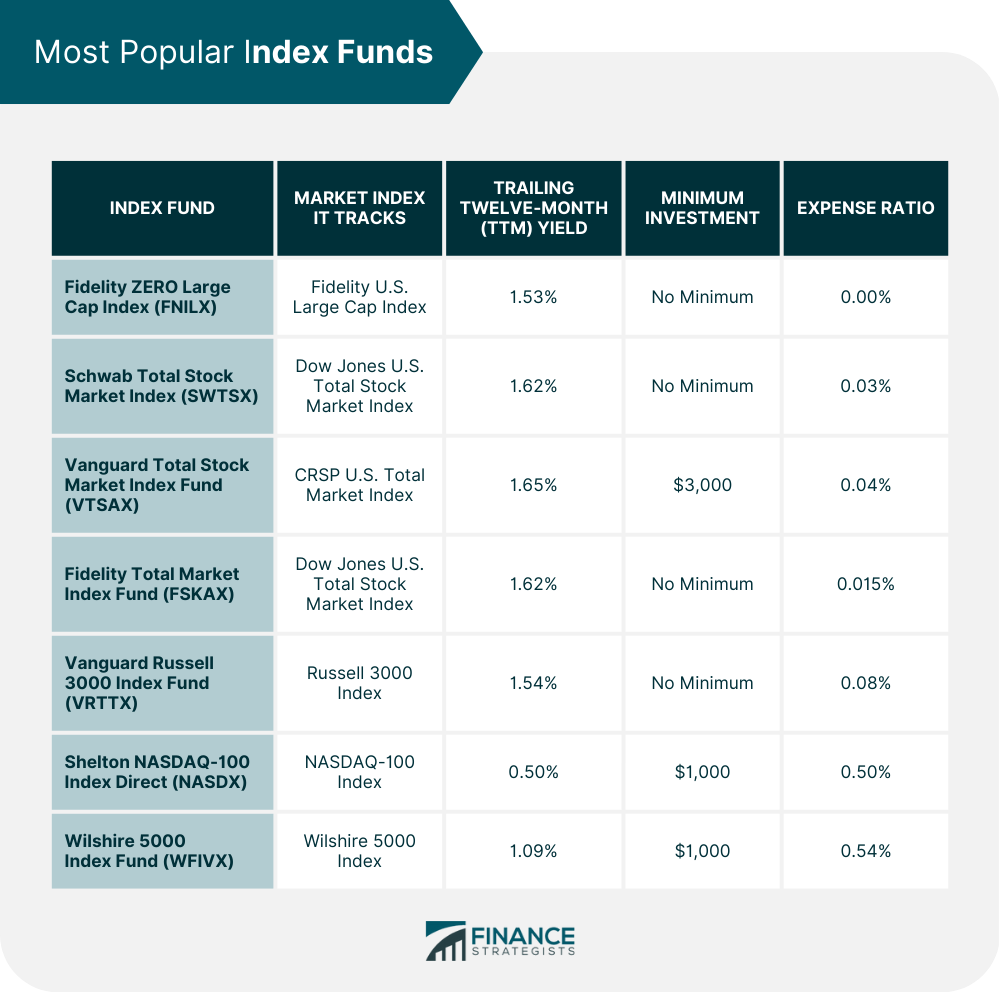

An index fund is a type of investment fund with a portfolio built to track or match financial market index components, such as the Standard & Poor's 500 Index (S&P 500). Basically, an index is a standard method to track the performance of groups of assets. It typically measures the performance of a basket of securities aimed to duplicate a specific area of the market. These index funds are passively managed, which means they are not actively managed by a portfolio manager making the investment decisions. Rather, they only aim to track the performance of their target index as closely as possible. Index funds also intend to be the market with an autopilot approach that holds the same securities in a similar proportion as the index. Index funds are an excellent way to simplify your investing while also reducing your costs. You can buy index funds through your individual retirement account (IRA) or 401(k), or also through an online brokerage account. According to Warren Buffet, Berkshire Hathaway’s Chairman and CEO, one of the wealthiest men in the world, it makes more sense for an average investor to buy all of the S&P 500 investments at the low cost that an index fund offers rather than choosing individual stocks for investment. Index funds are a type of mutual funds where when you buy shares in these funds, you are combining your money with other investors. With index funds, the pool of money is then used to purchase portfolios whose holdings replicate the performance of a target index. These indexes are standardized measurements and methodology for tracking the price performance of a group of securities. Investments are often grouped on the basis of industry, like tech stocks or climate stocks or the stock market overall. Fund managers adjust and share these portfolios to match the index. With this, the return of the fund should then match the performance of the target index prior to accounting for fund expenses. Interest, dividends, and capital gains are paid out to the investors on a regular basis. The main idea of an index fund is that by mimicking the index profile—a broad segment of the stock market or as a whole—the fund will match its performance as well. For instance, the Schwab Total Stock Market Index Fund aims to track the total U.S. stock market as measured by the Dow Jones U.S. Total Stock Market Index. This index fund is designed to be a comprehensive blend of large, mid-sized, and small corporations. It has over $15 billion in total net assets as of January 11, 2024. There is no minimum investment required, and its net expense ratio is just 0.03%. Its trailing twelve-month (TTM) yield was 1.62%. Index funds offer a number of advantages that make them an attractive investment for many people. Here are some of them: Investors could capture the returns of a large part of the market in one index fund. These index funds could often invest in hundreds or thousands of holdings. Index funds that have higher amounts of holdings have lower relative market risk compared to those with fewer holdings. They often offer exposure to larger securities than their actively managed counterparts. For instance, the Russell 3000 measures the performance of the 3,000 largest U.S. companies that constitute approximately 97% of the investable U.S. equity market. A large part of the underlying index is represented by securities in the financial, health care, consumer discretionary, and technology sectors. As a function of their passive management, index funds are low-cost since managers do not spend their money and time researching stocks or bonds to buy and sell for the portfolio. Index funds are much lower on its management costs compared to those of its competing products. There are many index funds that offer fees of less than 0.2%, whereas active funds typically charge fees of more than 1%. These low-cost index funds are then passed along to the investor of the index fund. Thus, you should look for an index with the lowest expense ratios so that more money is working for you. Expense ratios include all of the operating expenses such as transaction fees, payments to advisors and managers, taxes, and accounting fees. For example, Schwab S&P 500 Index Fund (SWPPX) and Fidelity ZERO Large Cap Index (FNILX) have an expense ratio of 0.020% and 0.00%, respectively. The overall stock market grows in value over time. As a result, index funds generally yield high returns at a lower cost compared to other investment vehicles. For instance, the S&P 500 has had a 14.7% average annual return over the past decade, beating its long-term historic average of 10.7% since it was introduced 65 years ago. Index funds have a number of advantages, but like all investments, they also come with some disadvantages that you should be aware of. Here are some of them: The biggest downside of investing in index funds is that there is no human element to it. Index funds are passively managed, which implies that they are not actively managed by a fund manager who is making decisions on which stocks or bonds to buy and sell for the portfolio. This could be considered a downside because there is no one making decisions on behalf of the fund. Although there are some broad market index funds that outperform the majority of actively-managed funds, investors cannot "beat the market" with a major market index fund. This is due to the fact that these funds track a particular market index, and therefore, the gains are limited to the growth of that specific index. Whereas for an actively-managed fund, the fund manager may be able to generate higher returns by making strategic decisions on which stocks or bonds to buy and sell. Because most index funds are passively managed, fund managers cannot buy and sell securities based on their choice to fight adverse market conditions. They are only limited to the securities that make up the index. If you are interested in index funds and want to start investing, here are a few things you need to do. You can pick an index from hundreds of different indexes you can track through your index funds. For example, the most popular index is the S&P 500 index, which includes the top 500 companies in the U.S. stock market. Additionally, you can also find sector indexes that are associated with specific industries, style indexes that emphasize fast-growing companies or value-priced stocks, country indexes that target the stocks in single nations, and other indexes that are limited in their investments based on their specified filtering systems. Once you have chosen an index fund, you can then proceed to find at least one index fund that tracks it. S&P 500, for instance, has a dozen or more choices, all tracking the same index. If you have more than one index fund choice for your chosen index, you may want to ask these basic questions to yourself: Your answers to the above questions should make it easier to choose the right index funds for you. If you already have your investment account set up, you can now fund the account and purchase your first index funds. Ensure to check any fund minimums and make sure that you are ready to invest at least that much. Your broker will have you accomplish a trade ticket where you can choose how your money is invested. For instance, you will dictate whether you want to make the purchase at the market price or a limited price. When you place a limit order, your buy order will not be executed until the value of the fund drops to or below your limit price. Once your trade is completed, your money starts to work in the funds you have chosen. There are a number of index funds to choose from, and it can be difficult to decide which one is right for you. Here are some of the most popular index funds in 2024 with their corresponding expense ratio, minimum investment, and trailing twelve-month (TTM) yield. Index funds are a great way to diversify your portfolio and invest in a wide range of companies with little effort. Index funds are one of the most effective and simplest ways to invest your money. Investing in it can be a great way to build your wealth over time, but it is not suitable for everyone. It is critical to remember that index funds are not immune to market fluctuations, and you could lose money if the market Index falls. Before investing in an index fund, make sure you understand how it works and the risks involved. By understanding how they work and knowing which ones to choose, you can make the most of your investment and reach your financial goals. If you are not sure whether index investing is right for you, seek the help of a financial advisor.What Is an Index Fund?

How Do Index Funds Work?

Benefits of Investing in Index Funds

Broad Diversification

Less Expensive

Strong Long-Term Returns

Downsides of Investing in Index Funds

No Human Element

Limited Gains

Vulnerable to Market Swings

How To Start Investing in Index Funds

Step 1: Pick an Index

Step 2: Choose an Index Fund

Step 3: Buy Index Fund Shares

Most Popular Index Funds in 2024

Final Thoughts

Index Fund FAQs

Index funds are a great way for newbie investors to get started in the market because they are simple to understand and manage. Additionally, index funds offer a high level of diversification, which can help reduce risk.

Index funds are most likely to benefit investors who have a long-term investment horizon and are looking for low-cost options to diversify their portfolios. Additionally, index funds can be a good choice for investors who do not want to actively manage their investments.

Index funds pay dividends or interest earned by the individual investments in the portfolio of funds because regulations need them to do so in most cases.

The main difference between an index fund and a mutual fund is that an index fund invests in a specific list of securities, while a mutual fund invests in a changing list of securities picked by an investment manager.

Index funds are a good investment because they offer diversification, low costs, and potential for long-term growth. Additionally, index funds can be a good choice for investors who do not want to actively manage their investments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.