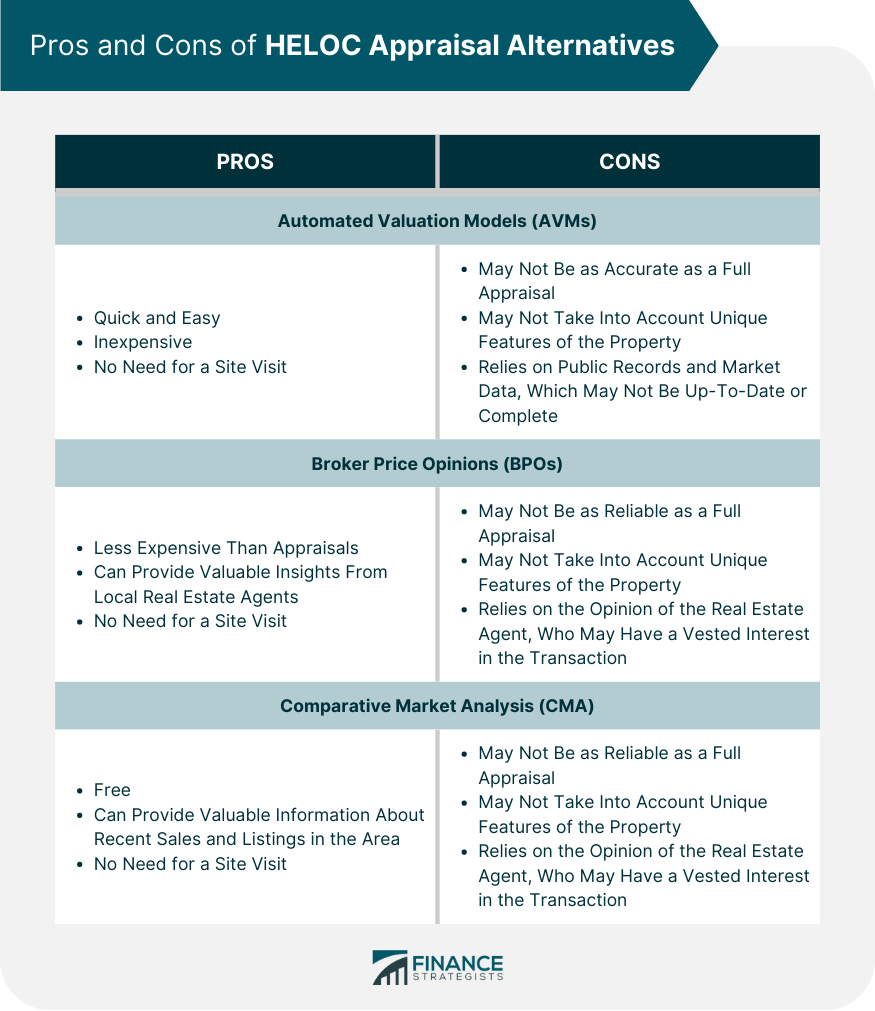

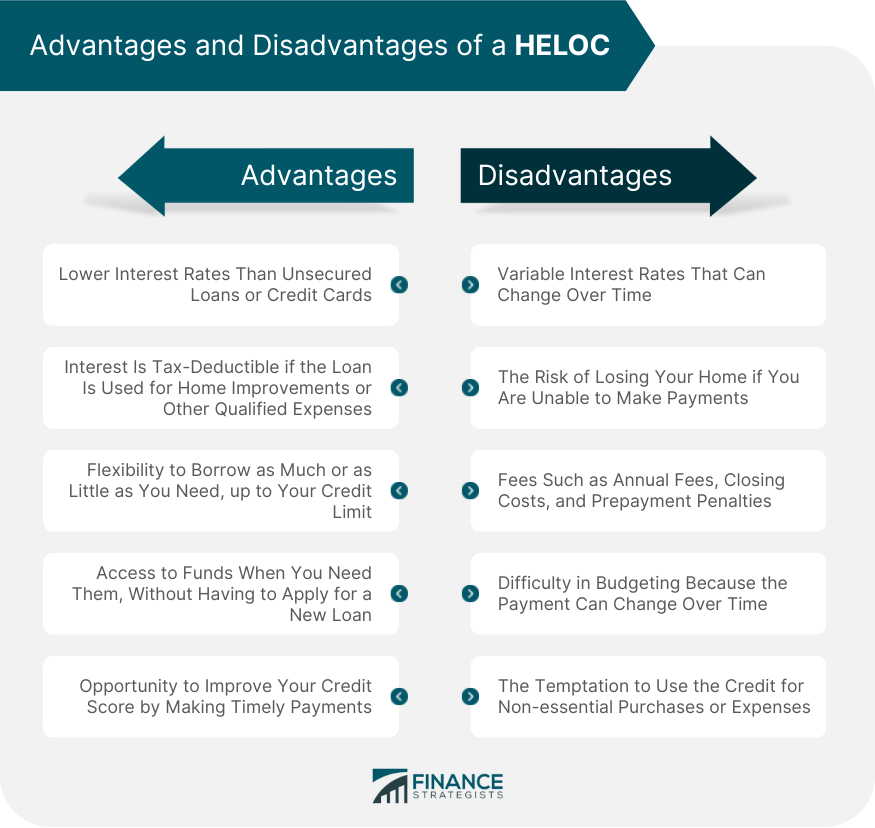

An appraisal may be needed for a HELOC if the lender wants to determine the current value of your home. The lender needs to know the value of your home to determine the amount of equity you have and how much they are willing to lend you. The lender wants to make sure that the loan is secured by a property that is worth enough to cover the loan amount in case the borrower defaults. Not all HELOCs require an appraisal. The need for an appraisal depends on several factors, including: If you are borrowing a small amount, an appraisal may not be necessary. The lender may use other methods to estimate the value of your home, such as a computerized valuation model or a broker price opinion. The loan-to-value (LTV) ratio is the ratio of the loan amount to the appraised value of the property. If the LTV ratio is low, the lender may not require an appraisal. For example, if you have a home worth $300,000 and you want to borrow $50,000, the LTV ratio is 16.7%. If the lender requires an LTV ratio of 80%, they may not need an appraisal for this loan. The lender may require an appraisal for certain types of properties, such as investment properties, condos, or properties in rural areas. The lender may require an appraisal for properties in certain areas, such as areas with high foreclosure rates or areas that are prone to natural disasters. Accurate property valuation is important because it affects the amount of equity you have and how much you can borrow. If the appraisal is too low, you may not be able to borrow as much as you need, or you may not be able to qualify for the loan at all. On the other hand, if the appraisal is too high, you may borrow more than you can afford and end up with a loan that you cannot repay. If an appraisal is required for your HELOC, you will need to find an appraiser. The appraiser will visit your home and evaluate its condition, location, and other factors that affect its value. The appraiser will then provide an appraisal report that includes an estimate of your home's current market value. Here are the steps to getting an appraisal for a HELOC: Contact Your Lender - Your lender can tell you if an appraisal is required for your HELOC and what type of appraisal they need. Find an Appraiser - Your lender may have a list of approved appraisers, or you can find an appraiser on your own. Make sure to choose an appraiser who is licensed and experienced. Schedule the Appraisal - The appraiser will need to visit your home to perform the appraisal. Make sure to schedule the appraisal at a time that is convenient for you. Prepare for the Appraisal - Clean and declutter your home before the appraiser arrives. Make sure that all areas of your home are accessible and that any necessary repairs have been made. Review the Appraisal Report - Once the appraisal is complete, the appraiser will provide a report that includes the estimated value of your home. Review the report to make sure that all of the information is accurate. The cost of an appraisal for a HELOC varies depending on the location and size of your home, as well as the appraiser's fees. The average cost of an appraisal is around $300 to $500, but it can be higher or lower depending on the factors mentioned above. The cost of the appraisal is usually paid by the borrower. If an appraisal is not required or if you want to avoid the cost and hassle of an appraisal, there are alternatives that you can consider. Here are some alternatives to an appraisal for a HELOC: AVMs are computerized algorithms that use public records and market data to estimate the value of a property. AVMs are quick and inexpensive, but they may not be as accurate as a full appraisal. BPOs are reports prepared by licensed real estate agents that estimate the value of a property based on recent sales in the area. BPOs are less expensive than appraisals, but they may not be as reliable as a full appraisal. CMAs are reports prepared by real estate agents that estimate the value of a property based on recent sales and listings in the area. CMAs are free and can provide valuable information, but they are not as reliable as a full appraisal. Each alternative to an appraisal has its own pros and cons. Here are some of the advantages and disadvantages of each option: A HELOC differs from a home equity loan in several ways. First, a HELOC is a line of credit, while a home equity loan is a lump sum loan. With a HELOC, you can borrow money as you need it, up to your credit limit. With a home equity loan, you receive a lump sum upfront and must repay it over time, usually with a fixed interest rate. Second, a HELOC’s interest rate is usually a variable rate, which means that the rate can change over time. A home equity loan usually has a fixed interest rate. Finally, with a HELOC, you only pay interest on the amount you borrow, while with a home equity loan, you pay interest on the entire amount of the loan. A HELOC has several advantages and disadvantages that you should consider before applying for one. Whether or not you need an appraisal for a HELOC depends on several factors, including the loan amount, loan-to-value ratio, type of property, and location. Accurate property valuation is important for a HELOC because it affects the amount of equity you have and how much you can borrow. If an appraisal is required, you will need to find an appraiser and prepare for the appraisal. If you want to avoid the cost and hassle of an appraisal, you can consider alternatives such as AVMs, BPOs, and CMAs. Each alternative has its own pros and cons, so it is important to choose the option that best meets your needs.When Is an Appraisal Needed for a HELOC?

Factors That Determine Whether an Appraisal Is Required

Loan Amount

Loan-To-Value (LTV) Ratio

Type of Property

Location

Importance of Accurate Property Valuation

How to Get an Appraisal for a HELOC

Cost of an Appraisal

Alternatives to an Appraisal for a HELOC

Automated Valuation Models (AVMs)

Broker Price Opinions (BPOs)

Comparative Market Analysis (CMA)

Pros and Cons of the Alternatives to an Appraisal for a HELOC

HELOC vs Home Equity Loan

Advantages and Disadvantages of a HELOC

Conclusion

Do You Need an Appraisal for a Home Equity Line of Credit? FAQs

The need for an appraisal depends on several factors, such as the loan amount, loan-to-value ratio, type of property, and location. Some lenders may require an appraisal, while others may use alternative methods to determine the value of your home.

The cost of an appraisal for a HELOC varies depending on the location and size of your home, as well as the appraiser's fees. The average cost of an appraisal is around $300 to $500, but it can be higher or lower depending on various factors.

Your lender may have a list of approved appraisers, or you can find an appraiser on your own. Make sure to choose an appraiser who is licensed and experienced.

Yes, there are alternatives to an appraisal for a HELOC, such as Automated Valuation Models (AVMs), Broker Price Opinions (BPOs), and Comparative Market Analysis (CMAs). Each alternative has its own pros and cons, so it is important to choose the option that best meets your needs.

Accurate property valuation is important for a HELOC because it affects the amount of equity you have and how much you can borrow. If the appraisal is too low, you may not be able to borrow as much as you need, or you may not be able to qualify for the loan at all. On the other hand, if the appraisal is too high, you may borrow more than you can afford and end up with a loan that you cannot repay.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.