Non-discretionary expenses are those fundamental costs an individual or household simply can't avoid. As it relates to personal budgets, non-discretionary spending refers to spending on expenses necessary for daily existence. Examples of these expenses include: Rent Food Mortgage payments They encapsulate the essentials, the unavoidable bills and payments without which everyday living becomes near impossible. Sometimes these expenses referred to as "fixed" or "mandatory" costs. However, while their nature is obligatory, their magnitude can vary. For instance, rent payments might be fixed, but choosing between an upscale apartment and a more affordable one can adjust the amount. In contrast, discretionary spending refers to non-essential expenses, such as hobbies and travel. For example, going to a movie or buying an expensive gift for a friend is considered discretionary spending. It is important to account for non-discretionary spending first while setting a budget. Extra cash left over after non-discretionary expenses should be used for discretionary spending. Non-discretionary spending is essential and non-negotiable spending defined within a budget. In this context, budgets can be personal or pertaining to legal contracts or government expenses. Whether it's a monthly mortgage payment, rent, or property taxes, housing often consumes a significant chunk of our incomes. While these expenses are unavoidable, choices do arise. Opting for a smaller house in a less upscale neighborhood or refinancing a mortgage to secure a better interest rate can lead to potential savings. Nevertheless, regardless of the strategies employed, housing costs will always remain on the ledger. Water, gas, electricity, and even the internet (arguably a necessity in today's digitized world) fall under this category. The monthly ebb and flow of utility bills can slightly vary, influenced by usage and external factors. Energy-saving appliances, thoughtful usage, and seasonal adjustments can lead to minor fluctuations, but the foundational costs are ever-present and inescapable. Life's unpredictability necessitates safeguards. Insurance, in its various forms—be it health, life, car, or home—offers a cushion against unforeseen circumstances, making insurance premiums a non-negotiable expense. Each type of insurance serves its purpose, and while premiums can sometimes feel burdensome, the protection they offer often outweighs the cost. Shopping around, availing discounts, or bundling can influence the premium's weight, but its essence remains untouched. Be it the fuel that propels cars, the tickets that allow bus rides, or the occasional repair and maintenance, these costs move us—literally and figuratively. Opting for public transport, carpooling, or even biking can offer alternatives. Yet, whether we choose the luxury of a personal vehicle or the economy of a subway ride, the inevitability of transportation expenses remains. Good health is priceless, but maintaining it comes with a price. Doctor visits, medications, therapies, and even preventive measures like vaccinations form the spectrum of healthcare expenses. With or without insurance, some healthcare expenses are unavoidable. Preventive care might save costs in the long run, but the immediacy of a health concern often leaves little room for negotiation. Loans offer financial assistance, but they come tethered to the obligation of repayment. Monthly installments on mortgages, student loans, credit card debts, or personal loans are obligatory until the debt is cleared. Timely payments not only prevent additional interest accumulation but also safeguard one's credit score. The weight of debt can be burdensome, but with disciplined repayment, the load gradually lightens. Knowledge might be free, but formal education often isn't. Tuition, textbooks, and other academic essentials form the mosaic of education expenses. From early schooling to higher education, each phase brings its costs. Scholarships and financial aid can alleviate the burden, but the essence of the expense persists. Surprisingly, even within the realm of non-discretionary expenses, there might be hidden excesses. Perhaps a seldom-used subscription sneaked its way into utility bills, or maybe an insurance plan offers coverage that's no longer relevant. By scrutinizing every expense, one can often identify and eliminate these unnecessary costs. It's not about compromising essentials but about ensuring every dollar spent genuinely serves a purpose. While some costs are set in stone, many are open to negotiation. Rent, insurance premiums, and even some utility bills can sometimes be renegotiated, either for a discount or for better terms. The art of negotiation can lead to substantial savings. It's about understanding one's value as a customer and leveraging it to secure better deals. Regularly revisiting contracts and bills ensures that one always enjoys the best possible terms. Adaptability is a financial virtue. Sometimes, switching to a different service provider or opting for a generic brand can lead to significant savings without compromising on quality. This strategy extends beyond mere product choices. Maybe a local community college offers a course equivalent to an expensive university program, or perhaps public transport becomes a viable alternative to a personal vehicle. Exploring these alternatives widens the horizon of possibilities and potential savings. Even if it's a small amount set aside each month, over time, this fund grows, offering a cushion against unforeseen non-discretionary expenses. It's not just about savings; it's about peace of mind. If non-discretionary expenses become overwhelming, seeking financial assistance or support might become necessary. This help can come in the form of government programs, community initiatives, or even charitable organizations. Moreover, financial counseling can provide guidance on managing expenses, offering insights and strategies tailored to individual circumstances. Ensuring that the most vital non-discretionary expenses—like housing and healthcare—are covered becomes paramount. Some expenses, though essential, might temporarily take a backseat. Prioritizing doesn't mean neglecting. It's about understanding the hierarchy of needs and ensuring that the most pressing ones are addressed first, buying time to manage the rest. Within the U.S. budget, non-discretionary spending is referred to as mandatory spending and includes spending on social service programs, such as social security, Medicaid and Medicare. Funding for research and defense is considered discretionary spending. As the U.S. population grows older, the share of mandatory spending is expected to rise relative to discretionary spending. In finance, a non-discretionary account is a brokerage account that requires client permission for each trade made by a broker. Thus, the broker would have to contact the client for each trade. A discretionary account, on the other hand, allows brokers to initiate and close trades without client permission. As it relates to legal contracts, non-discretionary spending is spending required by a contract, budget, and other lawful commitments. For example, the budget for a government department may set aside a certain amount for environment-related initiatives as non-discretionary spending. Non-discretionary expenses are essential and inescapable costs that individuals, households, and governments must incur. These mandatory expenditures are crucial for daily existence and are defined by fixed and non-negotiable obligations. Non-discretionary spending includes items such as housing costs, utilities, insurance premiums, transportation, healthcare expenses, debt payments, and education expenses. While some strategies, such as cutting unnecessary costs and negotiating bills, can help manage these expenses, the core nature of non-discretionary spending remains unchanged. Proper management of non-discretionary expenses involves creating emergency funds, seeking financial assistance if necessary, and prioritizing essential expenses to maintain financial stability. In the context of the U.S. budget, non-discretionary spending is often referred to as mandatory spending, with the share expected to rise as the population ages. Overall, understanding and effectively managing non-discretionary expenses are essential for maintaining financial health and stability.What Are Non-discretionary Expenses?

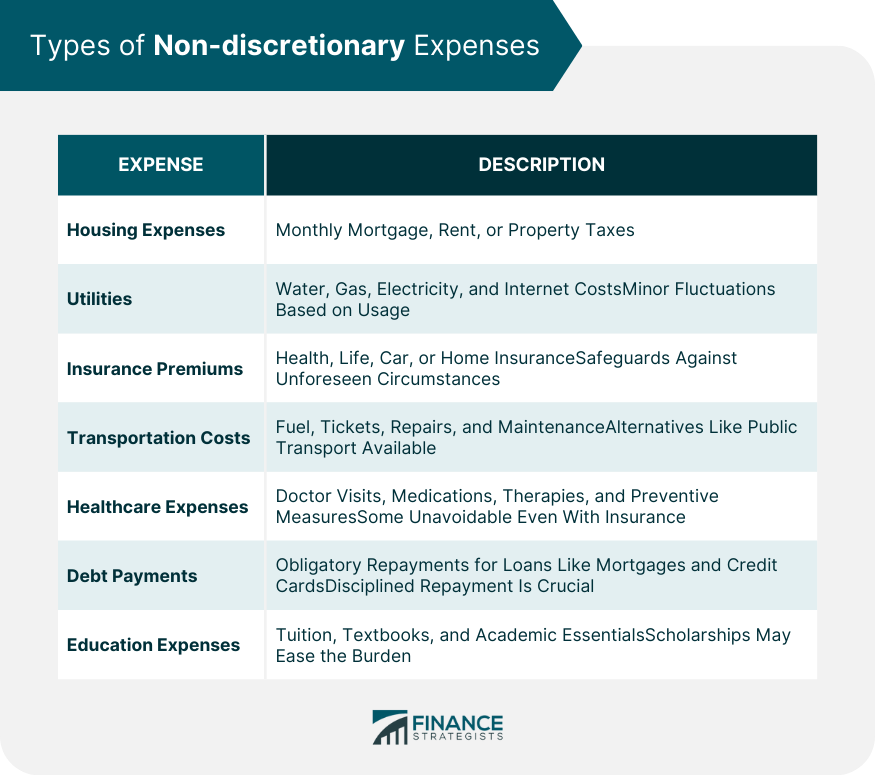

Types of Non-discretionary Expenses

Housing Expenses

Utilities

Insurance Premiums

Transportation Costs

Healthcare Expenses

Debt Payments

Education Expenses

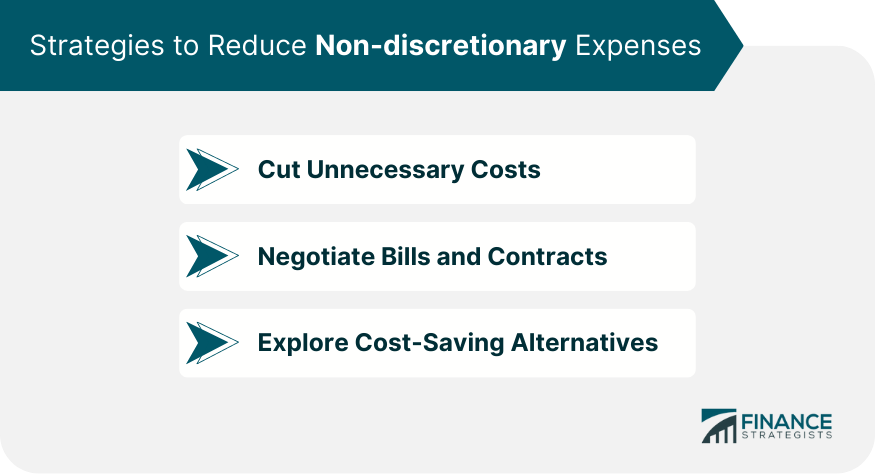

Strategies to Reduce Non-discretionary Expenses

Cut Unnecessary Costs

Negotiate Bills and Contracts

Explore Cost-Saving Alternatives

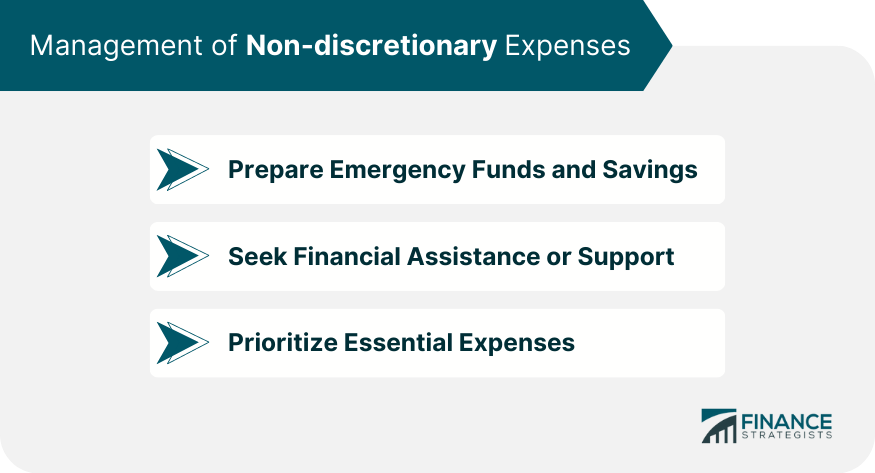

Management of Non-discretionary Expenses

Prepare Emergency Funds and Savings

Seek Financial Assistance or Support

Prioritize Essential Expenses

Non-discretionary Expenses Explained

Non-discretionary in Legal Contracts

Conclusion

Non-Discretionary FAQs

Non-discretionary spending is essential and non-negotiable spending defined within a budget.

Examples of these expenses include: rent, food, or mortgage payments. In contrast, discretionary spending refers to non-essential expenses, such as hobbies and travel.

As it relates to legal contracts, non-discretionary spending is spending required by a contract, budget, and other lawful commitments.

A non-discretionary account is a brokerage account that requires client permission for each trade made by a broker.

As the U.S. population grows older, spending on social service programs, such as Social Security, Medicaid and Medicare increases. Thus the share of mandatory spending is expected to rise relative to discretionary spending.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.