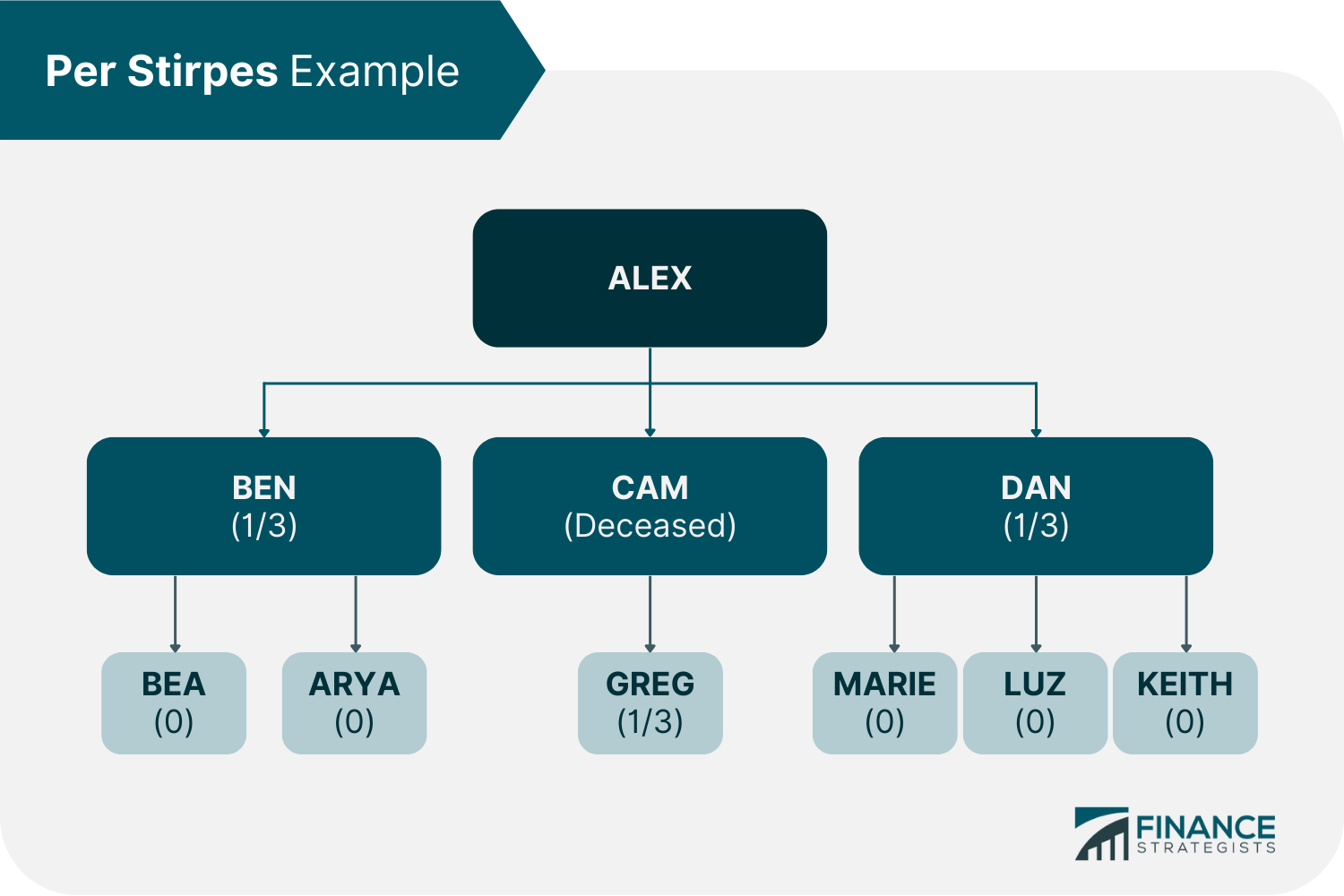

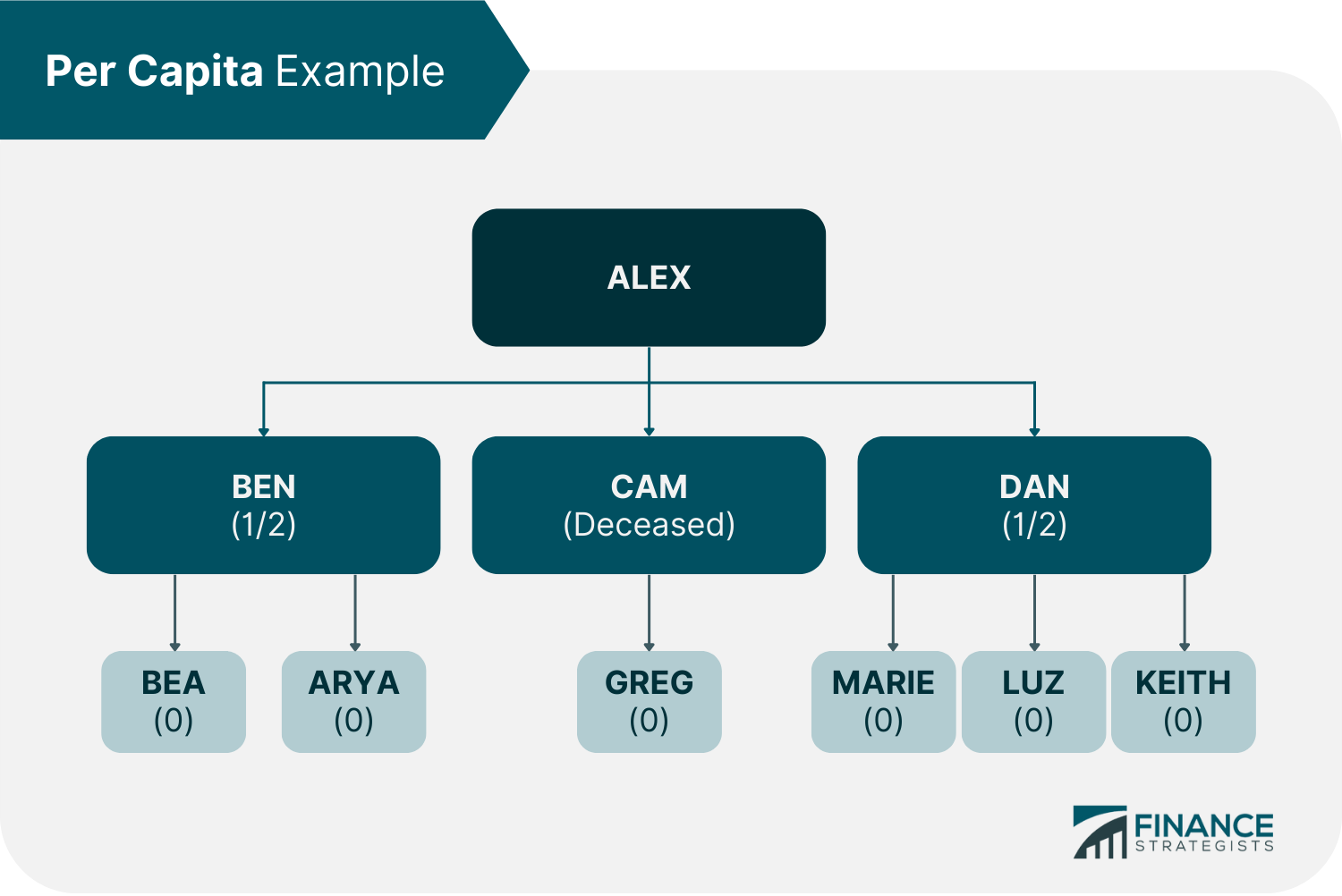

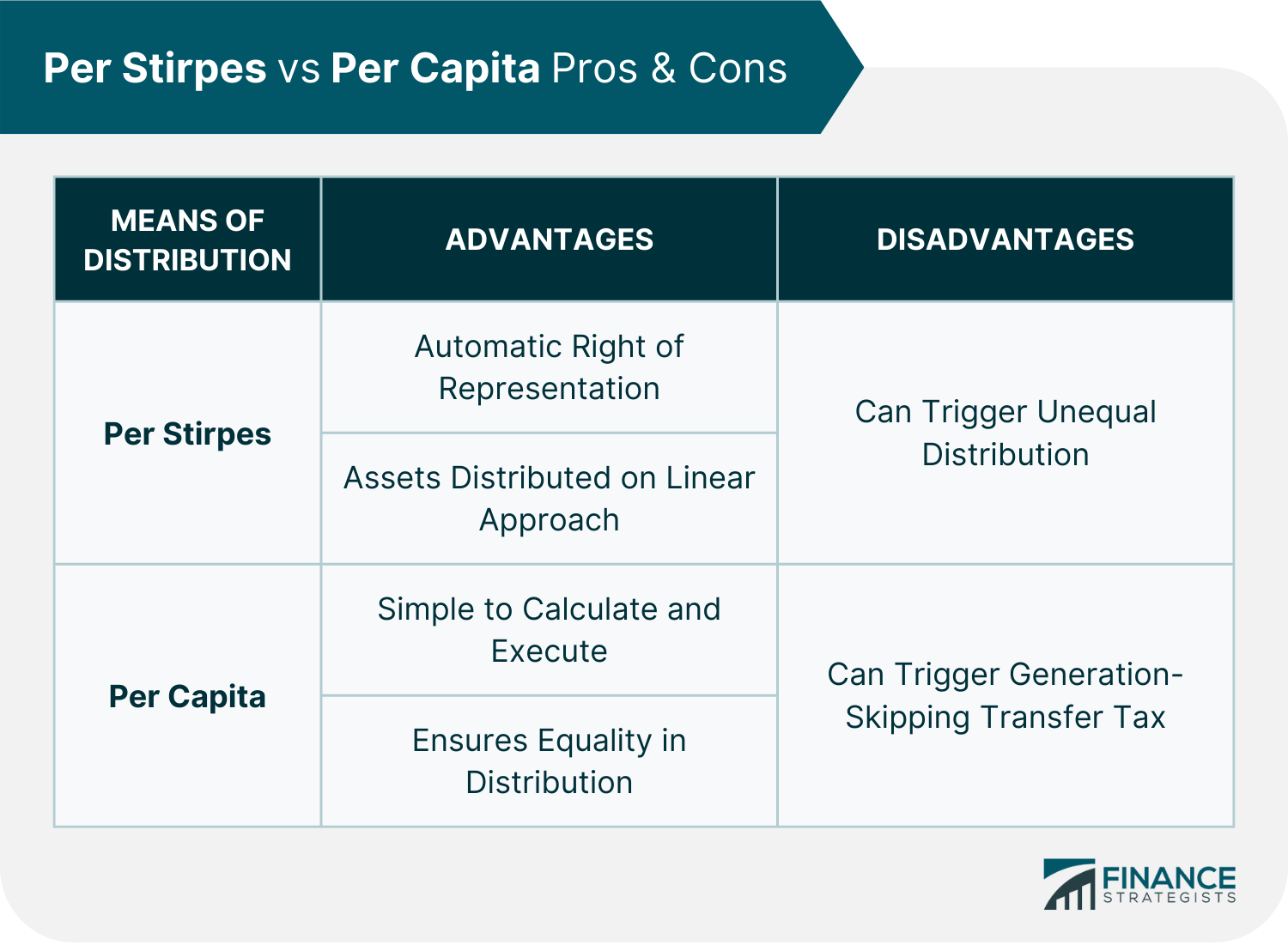

Per stirpes and per capita are both legal terms used in the law of inheritance and estate, specifically in drafting a last will and testament. Both are designation methods that dictate how the assets of the testator (the person making the last will and testament) will be distributed in the event that a specific beneficiary passes away ahead of him. It is important to understand how each one works before making a decision. This article will focus on the differences between the application of these terms in estate planning. The term per stirpes has a Latin origin which translates as “by roots” or “by branch.” Beneficiaries with the nearest linear relationship to the testator will inherit an equal share of the estate when the latter passes away. If one of the named beneficiaries dies ahead of the testator, the deceased beneficiary’s share will be equally divided among his heirs, usually children. Per stirpes states an equal asset distribution for each “branch” of a family tree. The children of the deceased beneficiary may represent their parents. Spouses, however, are not considered in a per stirpes distribution. Alex, the testator, has three children: Ben, Cam, and Dan. Cam has a son, Greg. Ben has two daughters, Bea and Arya. Dan has three children, Marie, Luz, and Keith. Alex’s will states that: “I leave my entire estate to my descendants, per stirpes.” If all three children of Alex survive him, each of them will inherit one-third of his estate. But let us say, Cam dies ahead of her father, Alex. Ben and Dan will each receive one-third of Alex’s estate. Cam’s son, Greg, will inherit the share by representation. He will get one-third of Alex’s estate. Bea, Arya, Marie, Luz, and Keith will not receive any. If Cam had no child, then her siblings, Ben and Dan, will inherit Cam’s one-third share of the estate, in addition to their own one-third shares. Not one of the grandchildren will inherit any portion of the estate. The idea of per stirpes is that the grandchildren would have to inherit their parent’s share one day so it is fair to apportion the deceased child’s share to them. With a per stirpes distribution, there is no need to amend the will if a child is born within the line of succession after the will has been executed. The child will automatically be included as a beneficiary through the right of representation. Per stirpes can also eliminate the possibility of instigating a family feud among siblings over who will get what since the assets are distributed on a linear approach. Typically, assets are passed on from generation to generation. The testator is assured that his assets are kept within the same branch of the family. However, with the use of per stirpes designation, it is possible to have a non-related person take over some assets. This may happen if an in-law is managing the assets on behalf of minor children. Per stirpes distribution may also trigger an unequal distribution of assets if some beneficiaries have more children than others. Per capita is another designation option that can be used in a will. Per capita means “by heads.” This method shares the assets equally among surviving descendants in the same generation nearest the testator. The shares of the predeceased beneficiary return to the estate unless the testator specifies that children and grandchildren are equal descendants in his will. Refer back to the previous example. This time, Alex’s will states that: “I leave my entire estate to my descendants, per capita.” If all three children survive Alex, each of them will inherit one-third of the estate. However, let us assume that Cam dies ahead of Alex. Per capita designation would mean that Ben and Dan each inherit one-half of Alex’s estate. Greg would not receive anything, as well as Bea, Arya, Marie, Luz, and Keith. With the per capita designation, the testator can specify if his assets will be distributed to his children, grandchildren, or both. In this case, if Alex specified that children and grandchildren are equal descendants, Ben, Dan, and Greg would each receive one-third of his assets. The other grandchildren will still not receive anything. In a case where all the children of Alex predecease him, then the grandchildren would each inherit an equal part of the estate. This means that Greg, Bea, Arya, Marie, Luz, and Keith will each receive one-sixth of the estate of their grandfather in a per capita distribution. With per stirpes, the grandchildren will inherit their parent’s share. This means that Bea and Arya will split Ben’s one-third share. Cam’s son, Greg, will get the full one-third to himself. Marie, Luz, and Keith will likewise split Dan’s one-third share. Per capita distributions are very simple to calculate and execute, as it provides for surviving beneficiaries at the time the will is executed. Deceased beneficiaries lose their rights unless explicitly specified in the will. It ensures that each beneficiary receives an equal share of the estate, no matter their relationship to the deceased. If the testator specifies that children and grandchildren are beneficiaries, then every child and grandchild have equal shares. Per capita distributions can help to avoid conflict among beneficiaries because the testator’s assets are distributed equally. However, this method of distribution does not come without disadvantages. Per capita distribution can trigger the generation-skipping transfer tax (GSTT) if the estate is large enough. This tax is imposed on transfers of property to someone who is two or more generations below the testator. Also, if the deceased wanted to leave a larger share of the estate to their children than their grandchildren, a per capita distribution would not allow for this type of distribution. Per capita provides for equal shares among them. Per capita distributions can result in unintended consequences if beneficiaries have died before the distribution is made. For example, if there are three children and one grandchild, but two of the children have passed away, the grandchild would receive an equal share of the surviving child. Ultimately, whether or not a per capita distribution is right for your will depend on your specific circumstances. If you have a large number of beneficiaries and you want to ensure that each person receives an equal share of the estate, then a per capita distribution may be right for you. The translations of the words per stirpes and per capita are substantial to their application. Per stirpes accounts for descendants by lineage while per capita accounts for descendants by heads. When a beneficiary dies before the distribution of assets, per stirpes allows for those assets to be passed on to that beneficiary’s descendants. Per capita would give those assets to the surviving beneficiaries who are alive at the time of distribution. Another key difference is that per stirpes can result in an unequal distribution of assets while per capita will result in an equal distribution. Finally, per stirpes takes into account the relationships between beneficiaries while per capita does not. With per stirpes, a testator can leave a greater share of assets to their children than grandchildren if they so choose. Per capita would give each person an equal share regardless of relationship. A will is created to document your final wishes so that they may be carried out when you die. There is no such thing as a “correct” distribution method. While the per stirpes and per capita distribution methods serve as guiding points, what you want ultimately matters most. A per stirpes distribution simplifies the distribution process and is favorable if you are comfortable with your children’s descendants inheriting. Per capita distribution gives you greater control but because it does not imply the right of representation, you may have to update your will’s stipulations when new children are born into the family or after a beneficiary predeceases you. If your estate is large enough to be taxable, per capita may trigger the generation-skipping transfer tax. It is important to note the long-term consequences of your decision. With this, consider utilizing the tool that will be most beneficial and the one that would leave a lasting impact to your loved ones. Consider talking to an estate planning lawyer or a finance expert to help you weigh your options.Per Stirpes vs Per Capita: An Overview

What Is Per Stirpes?

Example of Per Stirpes

Pros and Cons of Per Stirpes

What Is Per Capita?

Example of Per Capita

Pros and Cons of Per Capita

Key Differences Between Per Stirpes and Per Capita

The Bottom Line

Per Stirpes vs Per Capita FAQs

A beneficiary under a per capita designation is one of the surviving descendants of the same generation next to the testator. A per capita beneficiary is entitled to an equal share of the assets.

Per capita distribution implies that the beneficiary’s inheritance would be divided evenly amongst the surviving beneficiaries within the same generation unless explicitly specified that the next generation is also recognized as heirs.

With a per stirpes designation, when a beneficiary dies ahead of the testator, his share will be equally divided among his heirs, usually his children.

Here is a sample scenario to illustrate the application of per stirpes in a will. Alex, the testator, has three children: Ben, Cam, and Dan. He assigns his assets to each of them in equal shares, per stirpes. Cam has a son, Greg. Ben and Dan do not have children. Cam dies ahead of her father, Alex. Ben and Dan will each receive one-third of Alex’s estate. Cam’s son, Greg, will inherit her share by representation and will get one-third of Alex’s estate.

Per stirpes and per capita designation methods are both useful. To answer the question of which is better would be subjective to the situation and family dynamics. If the testator wants to take advantage of the inheritance by representation, it is advised to use per stirpes. If the testator wants to leave his assets only to one line of generation, per capita is advisable.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.