A Promissory Note is a legal record that outlines the conditions and terms of a loan between two parties. It is a written promise to repay a loan or debt, and it serves as evidence of the loan agreement. Promissory notes can be used for a wide range of loans, from personal loans to business loans, and can be either secured or unsecured. The purpose of a Promissory Note is to provide a written record of the loan agreement and to establish the legal obligations of both parties. It is also used to provide a measure of security to the lender, as it can be used as evidence of the borrower's obligation to repay the loan in the event of a dispute or default. There are several types of Promissory Notes, each with its own unique characteristics and requirements. Some of the most common types of Promissory Notes include: A secured Promissory Note is a loan that is secured by collateral, such as real estate or a car. If the borrower defaults on the loan, the lender has the right to seize the collateral to recover the outstanding balance. An unsecured Promissory Note is a loan that is not secured by collateral. The lender relies solely on the borrower's promise to repay the loan, and if the borrower defaults, the lender must use legal means to recover the outstanding balance. A convertible Promissory Note is a loan that can be converted into equity in the borrower's company at a later date. This type of loan is commonly used in startup financing, as it allows investors to lend money to a company and then convert that loan into ownership shares at a later time. A demand Promissory Note is a loan that can be called due at any time by the lender. This type of loan is often used in short-term lending situations, such as bridge loans, where the borrower needs quick access to cash. An installment Promissory Note is a loan that is repaid in regular installments, such as monthly or quarterly payments. This type of loan is commonly used for long-term financings, such as mortgages or car loans. Promissory Notes typically include several key components, which are essential for establishing the terms and conditions of the loan. These components include: Parties Involved in a Promissory Note: The Promissory Note should identify the borrower and the lender, as well as any co-signers or guarantors who are responsible for repaying the loan. Loan Amount and Interest Rate: The Promissory Note should state the amount of the loan and the interest rate that will be charged. The interest rate may be fixed or variable, depending on the terms of the loan. Repayment Terms: The Promissory Note should specify the repayment terms, including the length of the loan, the frequency of payments, and the due date for each payment. The Promissory Note may also include provisions for early repayment, prepayment penalties, and late payment fees. Default and Late Payment Provisions: The Promissory Note should include provisions for what will happen if the borrower defaults on the loan or is late with payments. This may include penalties, such as increased interest rates or additional fees, or legal remedies, such as repossession or foreclosure. Prepayment Options: The Promissory Note may include provisions for prepayment, allowing the borrower to pay off the loan early without penalty. This can be an attractive option for borrowers who are able to repay the loan ahead of schedule. Promissory Notes are important for a number of reasons. For borrowers, a Promissory Note provides a clear record of the loan agreement and the terms and conditions of the loan. This can help borrowers avoid misunderstandings or disputes with lenders and can also provide a measure of protection in the event of a dispute. For lenders, a Promissory Note provides legal protection in the event of default or non-payment. The Promissory Note can be used as evidence of the borrower's obligation to repay the loan and can be used to pursue legal remedies such as repossession or foreclosure. Promissory Notes also help establish trust between borrowers and lenders. By setting out clear and transparent terms and conditions for the loan, both parties can enter into the agreement with confidence and trust in each other. The Small Business Administration (SBA) is a trusted government agency in the United States that provides resources and assistance to small business owners, making their website a reliable source of information. As Promissory Notes are frequently used in small business loans, the SBA's page covering the basics of Promissory Notes can be especially helpful for business owners in the US looking to better understand their loan agreements and protect their financial interests. Making a Promissory Note is a straightforward process. Here are the steps involved. 1. Choose a Promissory Note Template - There are many Promissory Note templates available online, which can be used as a starting point for drafting your own document. It is important to choose a template that meets the legal requirements for your jurisdiction and to customize the document to reflect the specific terms of your loan. In the event that a borrower defaults on a Promissory Note, the lender may need to take legal action to recover the outstanding balance. There are several remedies available to lenders, including: Filing a Lawsuit for Collection: If the borrower refuses to repay the loan, the lender may need to file a lawsuit to collect the outstanding balance. This can be a lengthy and expensive process but may be necessary in some cases. Negotiating a Settlement: In some cases, it may be possible to negotiate a settlement with the borrower to repay the outstanding balance. This can be a more cost-effective and expedient option than pursuing legal remedies. Using Collection Agencies: If the borrower continues to refuse to pay the outstanding balance, the lender may turn to a collection agency to recover the debt. Collection agencies are trained to pursue debtors and may use tactics such as phone calls, letters, or legal action to collect the debt. Promissory Notes are an important tool for borrowers and lenders alike. They provide a clear and transparent record of the loan agreement and establish the legal obligations of both parties. They may be issued by banks but can also be issued by other types of lenders. By understanding the types of Promissory Notes, the components of a Promissory Note, the importance of Promissory Notes, and the process of drafting, signing, and enforcing a Promissory Note, both borrowers and lenders can enter into loan agreements with confidence. While enforcing a Promissory Note can be a difficult and expensive process, it is important for lenders to know their legal rights and to pursue legal remedies when necessary to recover outstanding debts.What Is a Promissory Note?

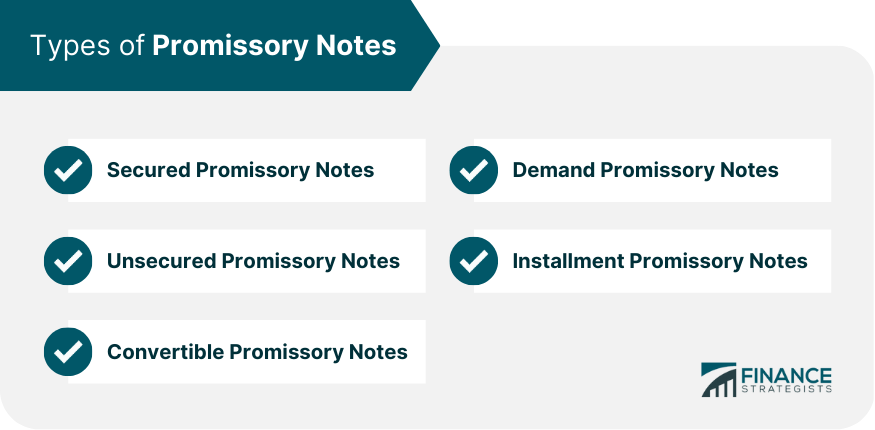

Types of Promissory Notes

Secured Promissory Notes

Unsecured Promissory Notes

Convertible Promissory Notes

Demand Promissory Notes

Installment Promissory Notes

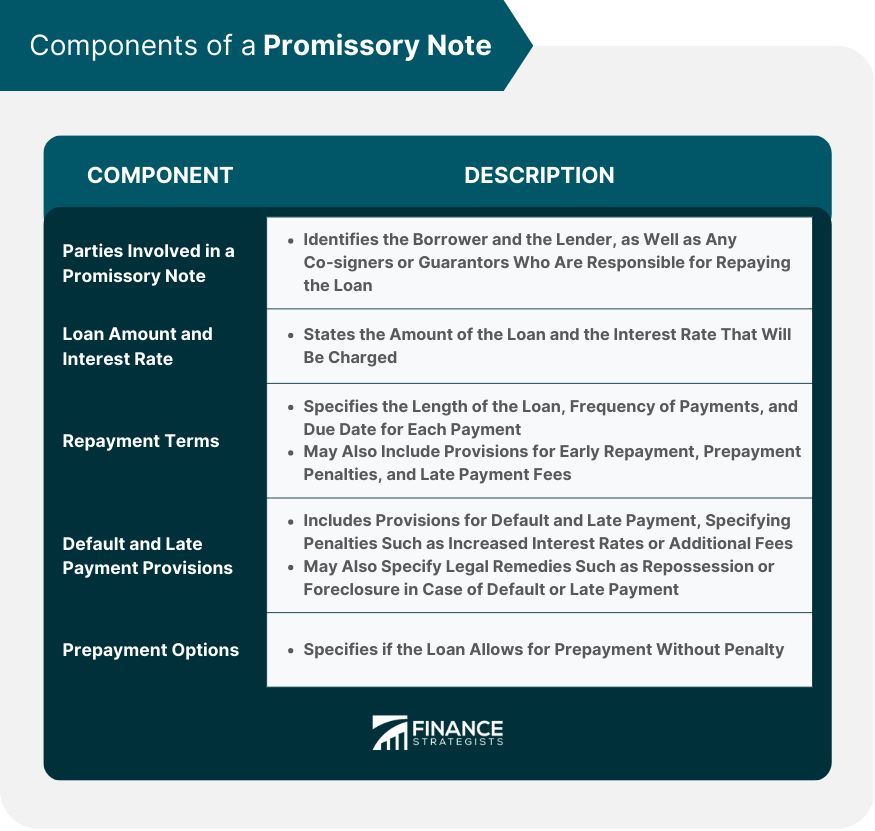

Components of a Promissory Note

Importance of Promissory Notes

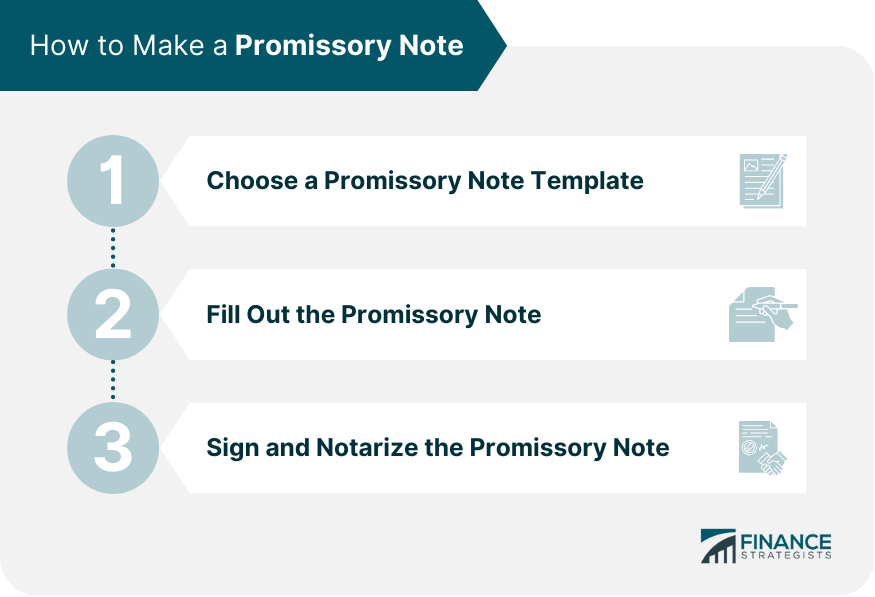

How to Make a Promissory Note

2. Fill Out the Promissory Note - Once you have chosen a template, you will need to fill in the details of the loan, including the loan amount, interest rate, repayment terms, and any other relevant information.

Be sure to review the document carefully for accuracy and completeness.

3. Sign and Notarize the Promissory Note - Both the borrower and lender must sign the Promissory Note to make it legally binding. In some jurisdictions, the Promissory Note may also need to be notarized to be valid.

Enforcing a Promissory Note

Conclusion

Promissory Note FAQs

A Promissory Note is a document that outlines the conditions and terms of a loan between two parties. It is a written promise to repay a loan or debt, and it serves as evidence of the loan agreement.

There are several types of Promissory Notes, including secured Promissory Notes, unsecured Promissory Notes, convertible Promissory Notes, demand Promissory Notes, and installment Promissory Notes.

The components of a Promissory Note include the parties involved in the loan, the loan amount and interest rate, repayment terms, default and late payment provisions, and prepayment options.

Promissory Notes are important for establishing the terms and conditions of a loan, providing legal protection for both parties, and establishing trust between borrowers and lenders.

Enforcing a Promissory Note can involve legal remedies such as repossession or foreclosure, filing a lawsuit for collection, negotiating a settlement, or using a collection agency to recover the outstanding debt.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.