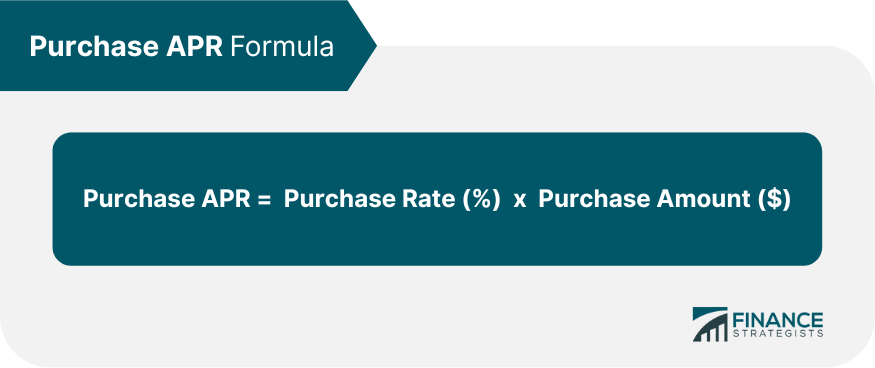

Purchase APR, also called Purchase Annual Percentage Rate, is the interest rate expressed as an annual percentage that a credit card company will charge you when you start making purchases on your credit card. It can be different from your normal Annual Percentage Rate (APR), which relates only to the balance of your account and not purchases made on it. Purchase APR is one of the credit card terms that you should be aware of because it can cost you more than your normal APR. Purchase APR is an important part of any type of credit card transaction because it determines how much you pay for using the card. Along with your monthly or annual fee, Purchase APR is one of the two factors in your card's interest rate and is one of the main components when it comes to calculating how much you pay in interest charges. Purchase APR can be key when it comes to making sure you don't overspend on purchases or make a large purchase that could lead to debt problems. Purchase APR is an interest rate and as such is expressed as a percentage. This number shows how much you will be charged in terms of annual interest every time you purchase your credit card. To calculate the Purchase APR, this formula is used: For example, if your Purchase APR is 25% and you have made purchases totaling $500 during the month, then your total Purchase APR would equal $125. The Purchase APR calculation is usually displayed along with the Annual Percentage Rate (APR) when looking at different types of credit cards. Purchases are calculated monthly and they usually include purchases made on regular shopping trips or even larger transactions like car rentals or hotel stays. In general, Purchase APR is either fixed or variable. A fixed Purchase APR will stay the same as long as you have a balance on your new card. However, if you make a late payment, the Purchase APR could rise and if you miss more than three consecutive payments it may increase even more until you pay everything off. With a variable Purchase APR, the amount of interest charged can change depending on an index rate set periodically by your credit card company. Lately, credit card companies have been giving their customers this type of Purchase APR because it allows them to charge their client's fair interest rates for purchases at times when market interest rates go up. It also gives them the flexibility to offer lower Purchase APR to attract new customers during periods of low economic activity, but the Purchase APR remains the same even if market interest rates go up. Many factors influence Purchase APR rates, some of which are as follows: While you do not have much choice in determining whether or not you will get a Purchase APR discount, there are things you can do to make sure your future Purchase APRs are as low as possible. You can avoid high-interest rates by either paying off what you purchase right away or by doing the following: Whenever you use your credit card to make a purchase, Purchase APR will either be fixed or variable. Fixed Purchase APR charges remain the same as long as you have a balance and change only if you miss more than three consecutive payments. Variable Purchase APR changes depending on an index rate set by your credit card company and is usually lower than fixed Purchase APRs. Some Purchase APRs can double or even triple due to late payments and missed payments. If possible, try to make more frequent payments and pay off what you purchase right away. Do not take out cash advances unless necessary because your Purchase APR will be higher than if you used the card for a regular purchase. Why Is Purchase APR Important?

How Do Purchase APR Rates Work?

How to Calculate Purchase APR?

Fixed vs Variable Purchase APR

Fixed Purchase APR

Variable Purchase APR

Factors That Influence Purchase APR

Ways to Avoid High Purchase APR

Key Takeaways

Purchase Annual Percentage Rate (APR) FAQs

Purchase APR is the amount of interest you will be charged for every purchase you make with your credit card. It is determined by many factors such as fluctuating market interest rates and inflation/decrease in the price level.

It is important to understand Purchase APR because it will help you understand the amount of interest that is associated with your Purchase transactions.

You will have to put in an annual percentage rate that is determined by your credit card company.

Make regular, monthly payments with your credit card to avoid late fees and interest charges on unpaid balances. Keep track of all transactions made throughout the month to avoid overspending and making purchases you cannot afford.

Purchase APRs are primarily used to determine the interest rate of credit cards and other types of loans. For example, if you have late payments or missed payments in the past, your Purchase APR will be higher than if you always pay on time.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.