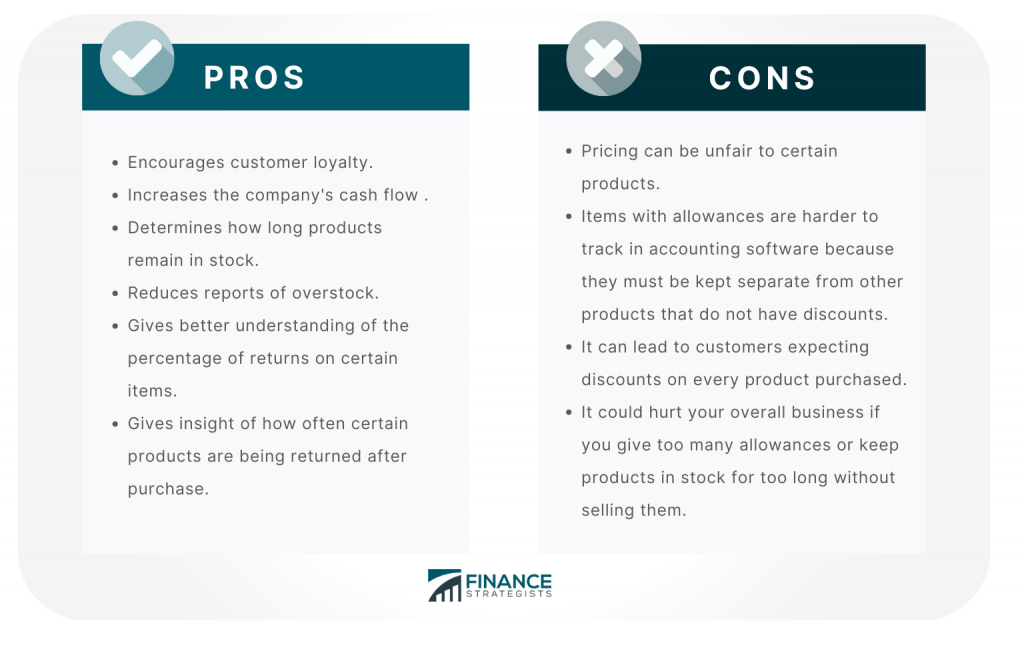

Sales Allowances are the reduction in the actual sales price that occurs when a particular item does not perform to expectations or when there are other defects in the product. Sales allowances are typically used in commercial transactions, such as when a product is returned or not delivered to the buyer. When you sell an item through your business, there should be some allowance for returns and other contingencies. Every company has its policy on how much can be deducted from the sales price due to returns and other factors. It is important to establish the policy for your company, but you need to be sure that it will not discourage customers from buying your product or service. You can use this strategy if your company has an overstock of inventory, for example, on seasonal items. You can also use a sales allowance when you have an aging inventory and it has been in your store for more than six months. The problem with this type of strategy is that customers may not trust the quality of your product if there are major discounts on items that were just manufactured or stocked. It's important to price your products fairly, but it is also important to use a sales allowance to make items more attractive. Let's say, for example, Company XYZ utilizes sales allowances. In 2023, they offered discounts on certain products to encourage customers to buy them at reduced prices before the end of the year. This was done as part of their annual inventory reduction plan, which occurred from October through December each year. This example of a sales allowance is used every year by Company XYZ to help get rid of older inventory while also encouraging customers to purchase items still in demand. It was very successful for them, as they could sell more than the expected amount that had been forecasted before 2023 even began. The pros to having a Sales Allowance policy include: The cons to having a Sales Allowance policy include: This will cause problems when you go to restock items because it might be difficult and costly to do so, which means there could also be additional costs associated with this strategy, such as storage expenses. Sales Allowances allow retailers like yourself an opportunity to maximize profit margins by selling older or damaged goods and help increase customer satisfaction. Customers appreciate discounts, and it can lead to increased revenue for everyone involved. It also helps retailers maximize profit margins by selling older or damaged goods. Customers appreciate discounts, and it can lead to increased revenue for everyone involved.When Should You Use It?

Why Does Sales Allowance Matter to Your Business?

Example of How To Use Sales Allowance In Your Company:

This also allowed individuals who bought items during this time period additional savings over those who purchased these things after 2023 began.Pros and Cons of Sales Allowance

Final Thoughts

Sales Allowance FAQs

The person who is managing your inventory counts typically does this. You must have someone calculate allowances, so it doesn't slow down processes within overall daily operations.

There are different ways to determine this, such as having your employees inspect products before putting them into inventory. You want to keep damaged goods from being included in your sales allowance calculations, so you have a more accurate number when doing this.

Yes, this is exactly what you should be doing. You want to make sure you're taking all of these costs into consideration. It's not a good idea to leave this out as it could affect your overall allowance price and cause you to lose money. Sales Allowances are crucial for your business. It gives you additional opportunities when shopping with customers while helping increase their overall satisfaction with doing business with your company.

You can get this information from your accountant or bookkeeper. It's important to do the calculations and determine how much you're giving away for it to be successful. If you don't consider these costs, then there is a great chance that you will lose money each time this technique is used.

A sales allowance is a reduction in the price of goods or services that is offered by a seller to a customer as compensation for an issue with their purchase. It can be used as an incentive to encourage customers to remain loyal or to resolve disputes quickly and amicably.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.