A T-account is used in bookkeeping, which involves keeping track of the financial transactions that occur within a business. The name is based on the way that a T-account appears, with two columns and one line. It can be used to balance books by adding all transactions in a set of accounts so the total debits equal the total credits for each account. A T-account can have many different types of transactions within it but they must always follow this same basic format.How Does a T-Account Work?

In order to understand better how a T-account works, it is important to understand some basic accounting terms.

Because all financial transactions affect at least two accounts, one side of this transaction will entail a debit and the other side credit.

An account title should likewise be noted on top of the horizontal line of the T structure to give it a proper label.How a T-Account Appears in Balance Sheet Accounts

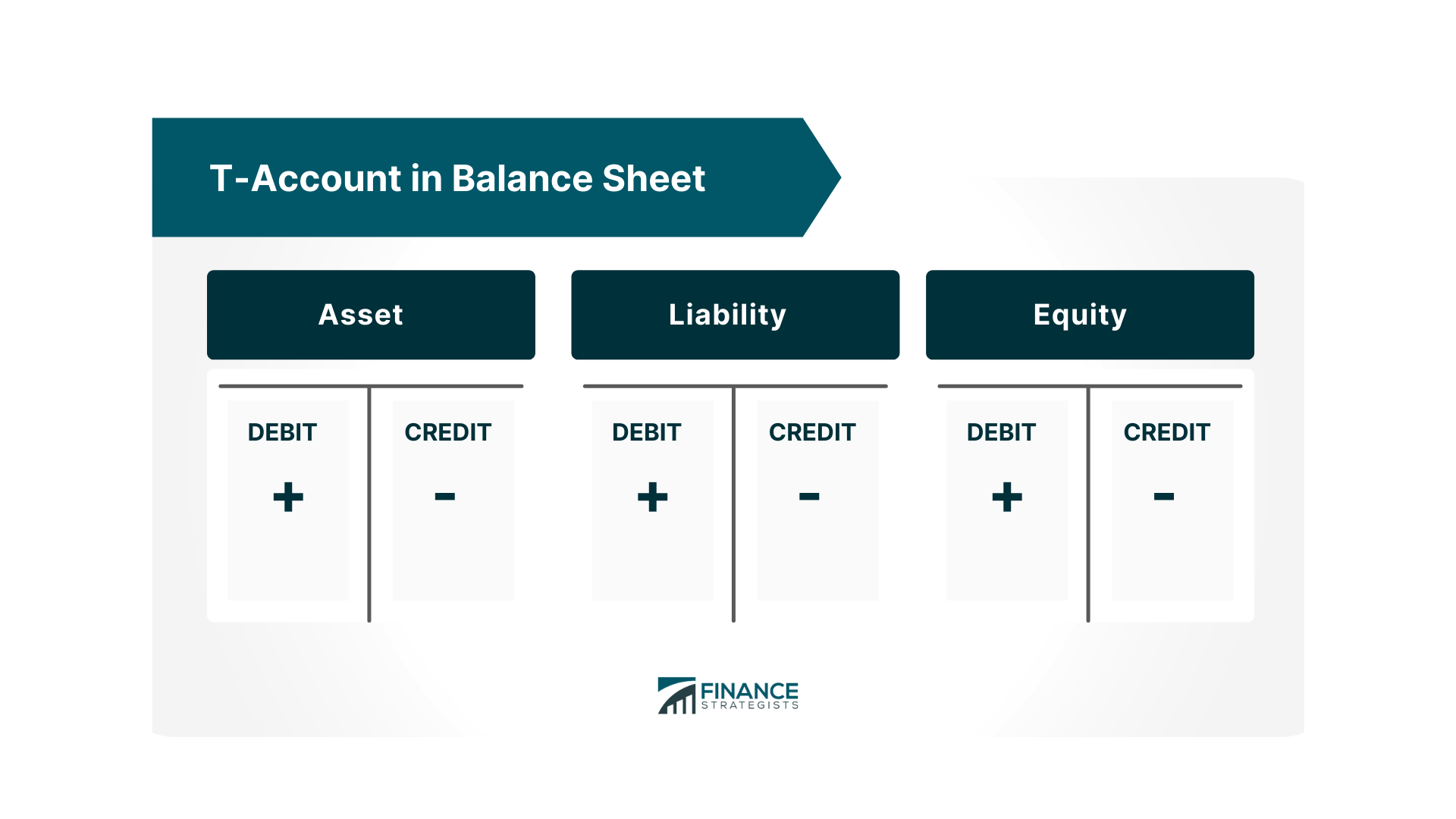

Here’s a visual illustration of how transactions would appear in the accounts that compose the balance sheet such as assets, liabilities, and equity.

For liability accounts such as payables and equity accounts like capital, all increases are posted as credits which are on the right column of the T-account. Conversely, all decreases are posted as debits which are on the left column.How a T-Account Appears in Income Statement Accounts

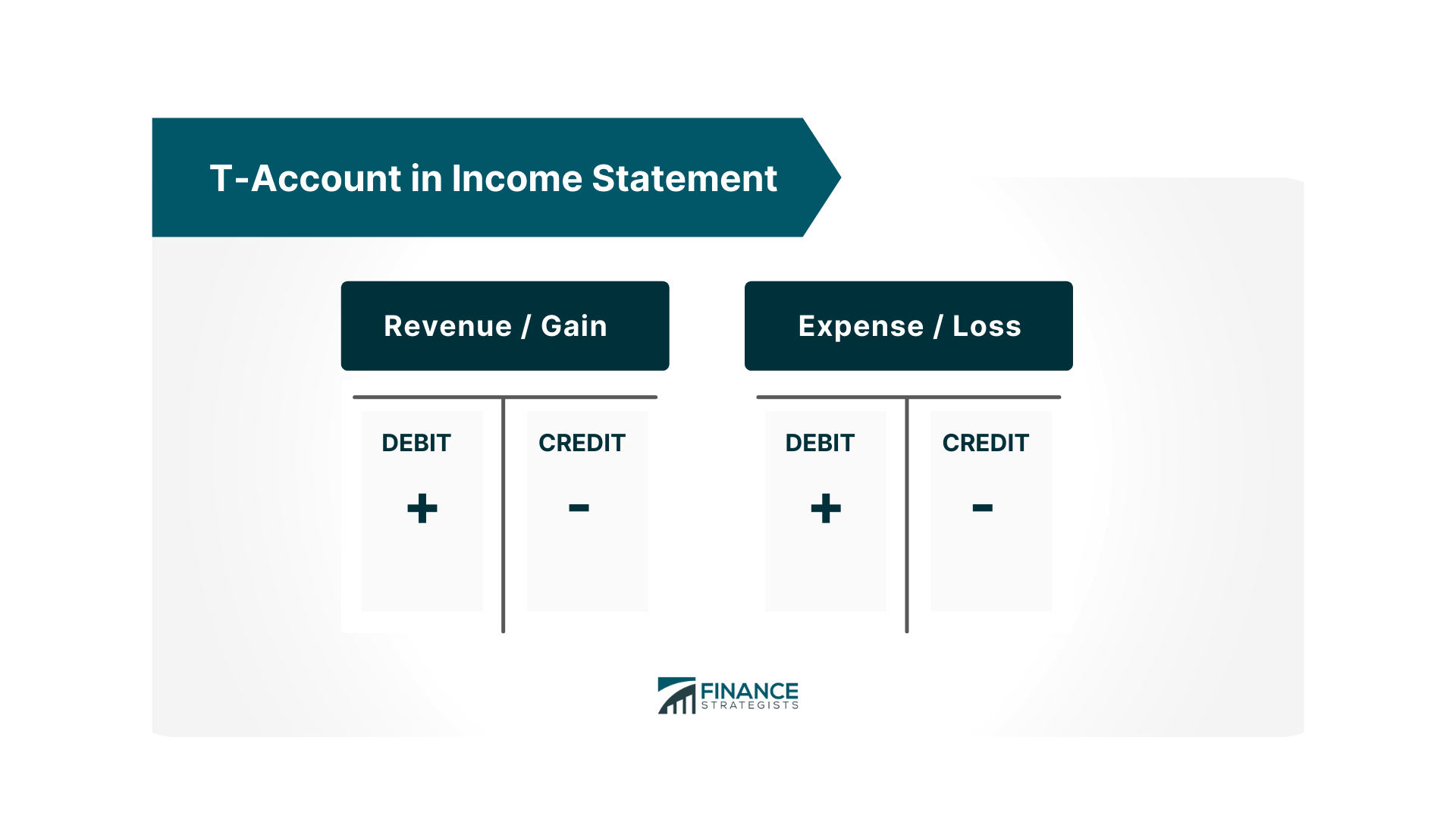

For expense and loss accounts, all increases will be taken as debits and should appear on the left column of the T-Account. Conversely, all decreases are to be posted as credits and thus, should appear on the right column of the T-Account.Illustration

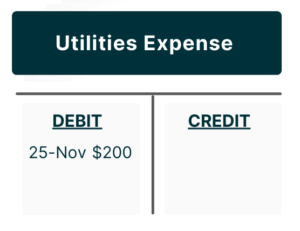

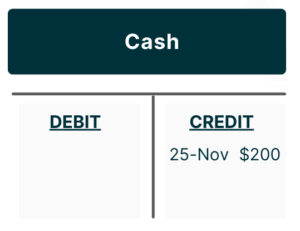

A company pays in cash for its electricity consumption for the month amounting to $200.

The two accounts affected in this transaction are the Utilities Expense account and the Cash account.

The company will record a debit of $200 on the Utilities Expense account and a credit for the same amount on the Cash account.

The T-accounts will appear in this manner:

Advantages of Using a T-Account:

The T-account is a useful tool for businesses of all sizes and can be used in conjunction with other financial tools to track different types of transactions as well.

It works particularly well when recording debits and credits because it clearly shows the two sides of a transaction on either side of the horizontal line within the structure.

Additionally, it allows proper balancing of accounts because discrepancies will be avoided in the recording of each transaction. This gives companies an accurate picture of where they stand financially at any given time.The Bottom Line

The T-account is a versatile tool that many companies have been using for decades to manage their daily bookkeeping activities.

It is a great tool to use in any type of business where financial transactions take place.

It provides a clear way to record every transaction and shows the various debits and credits associated with each one, which can come in handy when balancing books.

T-Account FAQs

A T-Account is an accounting tool used to track debits and credits for a single account. It is typically represented as two columns with the accounts that have been affected listed on either side, usually labeled Debit (left) and Credit (right).

A T-Account can be created by manually drawing out the two columns, labeling each one as Debit and Credit. Alternatively, many accounting software packages allow users to enter accounts they wish to track and automatically generate a T-Account.

A T-Account records the debits and credits that affect an account, as well as the running balance of the account.

The main purpose of using a T-Account is to help track and manage an individual’s financial transactions. By keeping track of debits and credits, it becomes easier to monitor the flow of money going in and out of a particular account.

The balance on a T-Account is calculated by first totaling up all debits and adding them together. Then all credits are totaled up and added together. Finally, the difference between the two numbers is the balance on the T-Account.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.