Unlimited liability is a legal concept that refers to the full legal and financial responsibility that business owners or partners have for all the debts and obligations of their business. In other words, if the business is unable to pay its debts or is sued, the owner's personal assets, such as their savings or property, can be used to satisfy the debts. It is important for business owners and entrepreneurs to understand the concept of unlimited liability as it can have significant implications on their personal finances and assets. Failing to understand the risks associated with unlimited liability can lead to serious financial consequences if the business fails or faces legal challenges. Unlimited liability poses significant risks and consequences for business owners and partners, including: With unlimited liability, business owners are personally liable for all the debts and obligations of their business. This means that if the business is unable to pay, creditors can seize the owner's personal assets, such as their savings, retirement accounts, or property, to pay the debts. This can result in financial consequences for the business owner or partner, including bankruptcy, foreclosure, or wage garnishment. Unpaid business debts can also have a negative impact on the owner's personal credit score. Late or missed payments can lower the owner's credit score, making it difficult to obtain loans, credit cards, or other financial products in the future. Unlimited liability can also make it more challenging for business owners to obtain financing for future business ventures. Banks and lenders may be hesitant to provide funding to a business owner who has previously experienced financial difficulties or has a history of unpaid debts. Unlimited liability can also put business owners at risk of business failure and bankruptcy. If the business cannot pay its obligations, the owner's personal assets may be used to satisfy the debts. This can result in the closure of the business and significant financial loss for the owner or partner. Choosing the right business structure is a vital decision that can have legal, financial, and operational implications for a business. There are two main types of businesses with unlimited liability: sole proprietorships and general partnerships. It is a type of business owned and operated by a single individual. In a sole proprietorship, the business owner has unlimited liability for all the debts and obligations of the business. This means that the owner's personal assets are at risk if the business is unable to pay its debts. A general partnership is a business structure owned and operated by two or more individuals. In a general partnership, each partner has unlimited liability for all the debts and obligations of the business. This means that each partner's personal assets are at risk if the business is unable to pay its debts. Unlimited liability can also have legal implications for business owners and partners. Business owners with unlimited liability may be required to purchase more extensive liability insurance coverage to protect their personal assets in the event of a lawsuit. This can be costly and may result in higher insurance premiums. In addition, business owners with unlimited liability have certain legal protections and responsibilities. For example, they must ensure that their business complies with all relevant laws and regulations, including tax laws, employment laws, and health and safety regulations. They may also be held personally responsible for any legal or regulatory violations committed by the business. There are alternatives to businesses with unlimited liability that provide limited liability protection to business owners and partners. A Limited Liability Company (LLC) is a flexible and relatively easy-to-establish business structure that combines elements of a partnership and a corporation. LLCs provide limited liability protection to their owners, also known as members, while allowing for flexibility in terms of taxation and management. Members of an LLC are typically not personally liable for the debts and obligations of the business, and their personal assets are protected from business creditors. A corporation is a more complex business structure that is typically used by larger businesses. Corporations are separate legal entities from their owners, and their shareholders are not personally liable for the debts and obligations of the business. Corporations can also raise capital by issuing stocks and have the ability to protect their intellectual property through patents and trademarks. Business owners and entrepreneurs should carefully consider the risks and benefits of unlimited liability and alternative business structures. Business owners should weigh the risks and benefits of unlimited liability and alternative business structures, such as LLCs and corporations. They should consider their personal assets, the size and complexity of their business, and their future growth plans when deciding on a business structure. Business owners should also be aware of their legal obligations and responsibilities, regardless of their business structure. They should ensure that their business complies with all relevant laws and regulations and seek legal advice when necessary. When choosing a business structure, business owners should consider factors such as taxation, management, liability protection, and future growth plans. They should also consult with a business lawyer or accountant to determine the best structure for their business. In conclusion, unlimited liability can have serious risks and consequences for business owners and partners. It is important to understand the concept of unlimited liability and consider alternative business structures that provide limited liability protection. Business owners should carefully weigh the risks and benefits, understand their legal obligations and responsibilities, and consider factors such as taxation, management, and liability protection when choosing a business structure. Seeking professional advice and guidance, such as tax services, can help business owners make informed decisions and protect their personal assets and financial future. It is recommended that business owners carefully weigh the risks and benefits, seek professional advice and guidance, and ensure that they comply with all legal obligations and responsibilities. What Is Unlimited Liability?

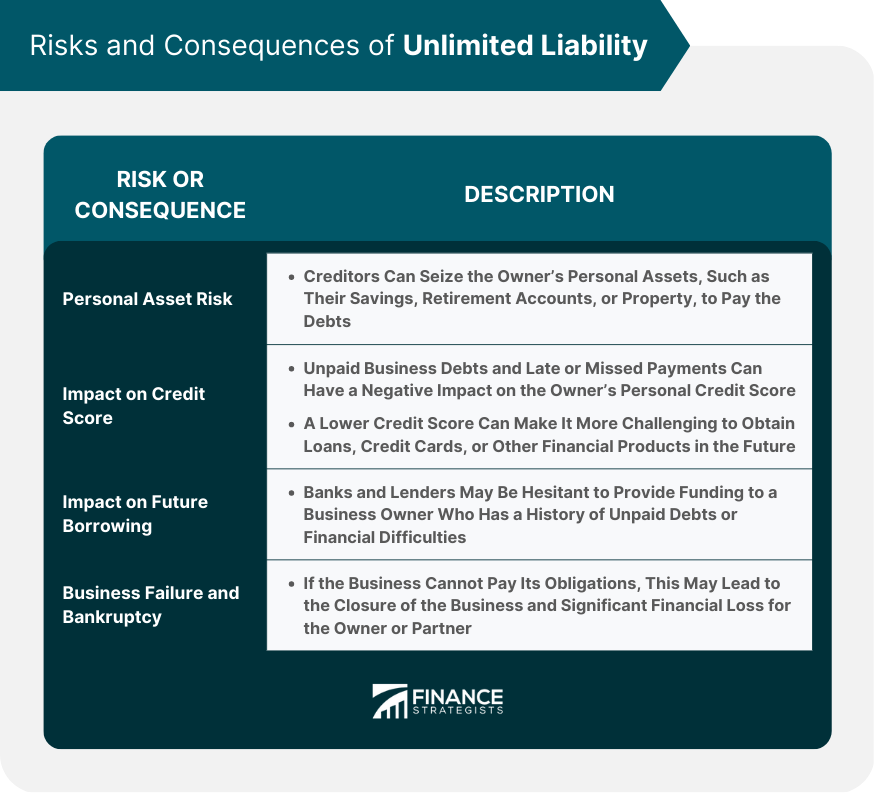

Risks and Consequences of Unlimited Liability

Personal Asset Risk

Impact on Credit Score

Impact on Future Borrowing

Business Failure and Bankruptcy

Types of Businesses With Unlimited Liability

Sole Proprietorship

General Partnership

Legal Implications of Unlimited Liability

Impact on Liability Insurance Coverage

Legal Responsibilities of Business Owners With Unlimited Liability

Unlimited Liability Alternatives

Limited Liability Companies (LLCs)

Corporations

Considerations for Business Owners

Weighing the Risks and Benefits

Legal Obligations and Responsibilities

Factors to Consider When Choosing a Business Structure

Final Thoughts

Unlimited Liability FAQs

Unlimited liability is a legal concept that makes business owners personally responsible for all the debts and obligations of their business. This means that if the business is unable to pay its debts, creditors can seize the owner's personal assets to satisfy the debts, potentially resulting in significant financial loss.

Business owners can protect themselves from unlimited liability by choosing alternative business structures that offer limited liability protection, such as Limited Liability Companies (LLCs) or corporations. These structures can help shield personal assets from business debts and obligations.

Unlimited liability can pose significant risks to business owners, including personal asset risk, impact on credit score and future borrowing, business failure, and bankruptcy. These risks can have devastating financial consequences for the owner or partner.

Yes, if a business with unlimited liability fails to pay its debts or obligations, it can negatively impact the personal credit score of the business owner or partner.

Business owners with unlimited liability have certain legal protections and responsibilities. For example, they must ensure that their business complies with all relevant laws and regulations, including tax laws, employment laws, and health and safety regulations. They may also be held personally responsible for any legal or regulatory violations committed by the business.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.