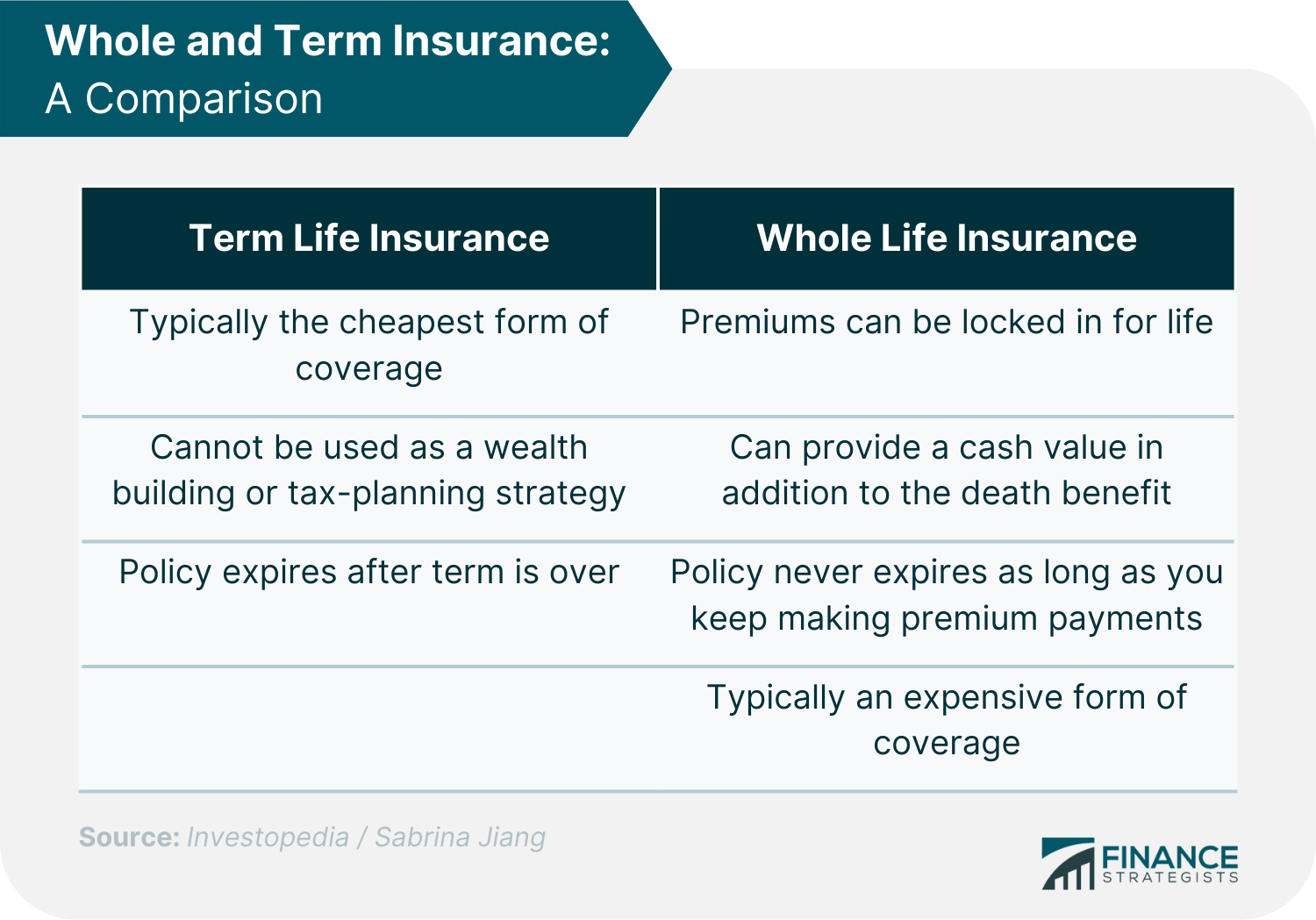

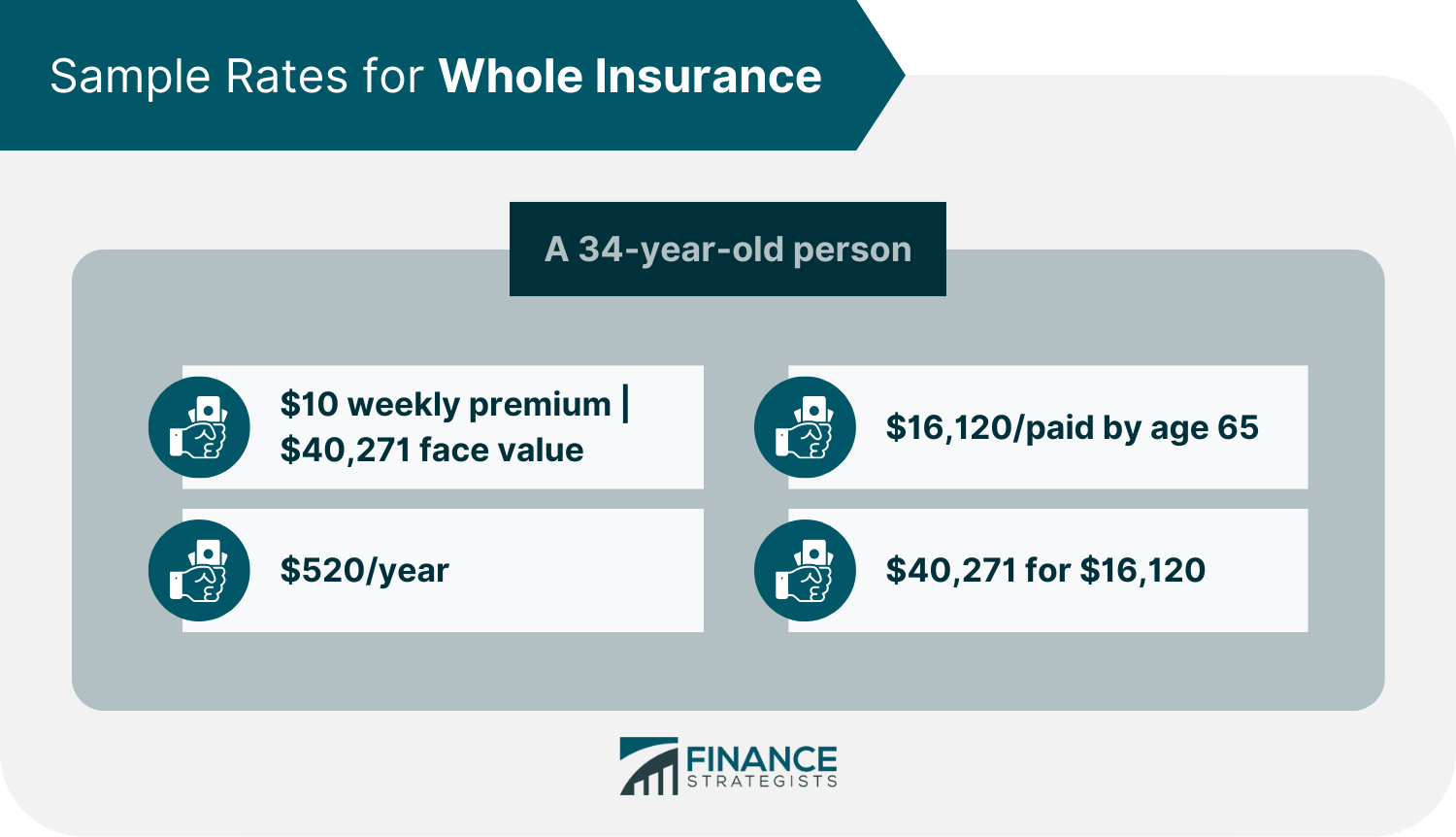

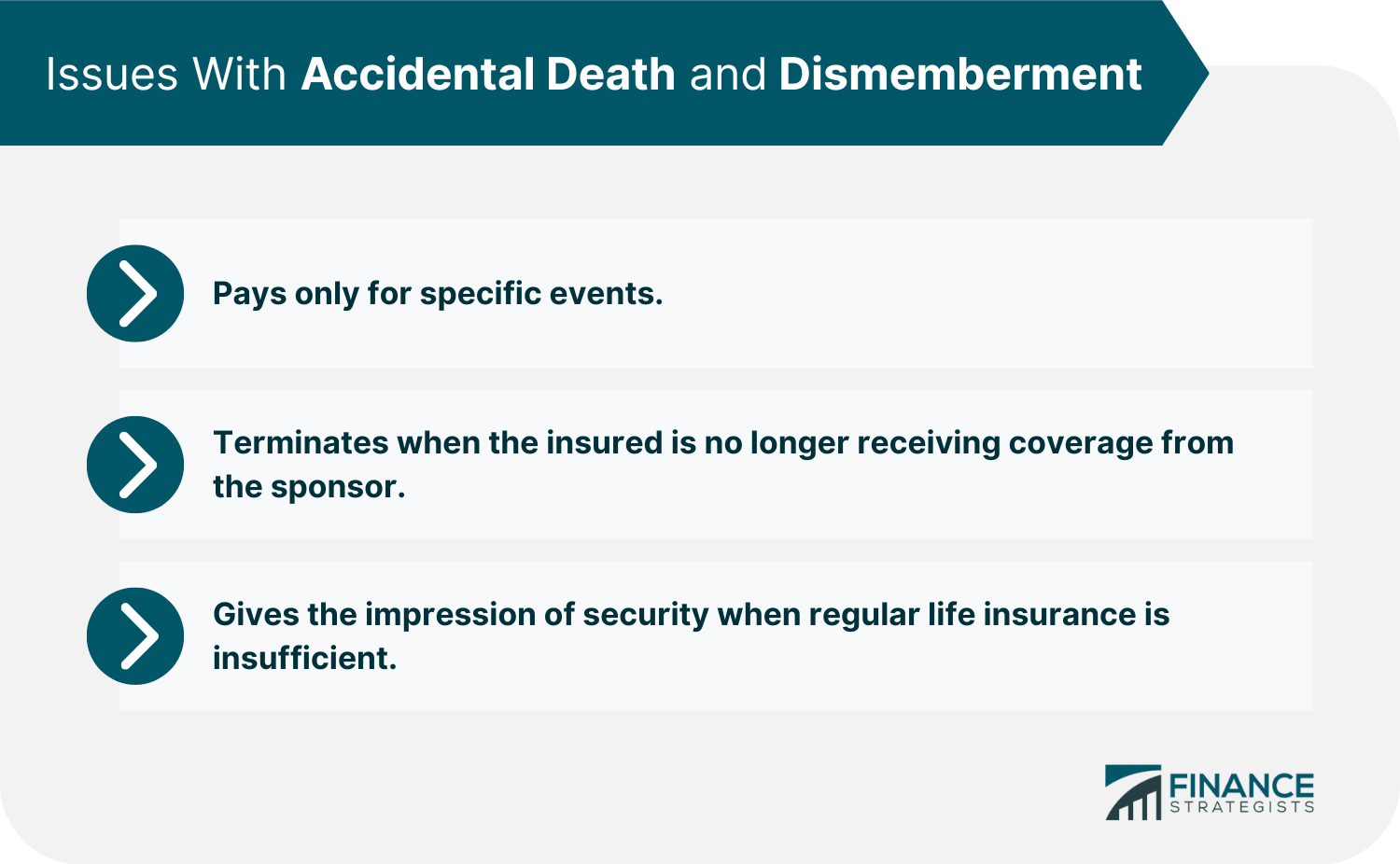

Life insurance is a contract between an insurance policyholder and an insurer, where the insurer agrees to pay a designated beneficiary a sum of money (the "death benefit") upon the death of the insured person. Life insurance is one of the most important types of insurance to have. It helps financially protect your family in the event of your death. Life insurance can be used to help pay for final expenses, like funeral costs and outstanding debts. It can also provide your family with money to live on if you are the primary breadwinner. There are different types of life insurance policies, but they all have one common goal: to give your loved ones financial security after you are gone. The most basic type of life insurance is called term life insurance. This type of policy provides coverage for a set period of time, typically 10, 20, or 30 years. If you die during the term of the policy, your beneficiary will receive the death benefit. If you live to the end of the term, the policy will expire and you will not receive a death benefit. Another type of life insurance is whole life insurance. This type of policy does not expire after a set period of time like term life insurance. As long as you continue to pay the premium, the policy will remain in force. Whole life insurance also has a cash value component, which means that the policy builds up cash value over time. You can borrow against the cash value of your policy or even surrender the policy for its cash value. It is essential that you choose the right type of life insurance for your needs. You should also make sure that you are getting the best possible rate on your life insurance policy. Below is a short explanation of the words and phrases you'll encounter in your insurance policy. Premium Beneficiary Insured Policyholder Cash Value Face Value There are several alternative types of life insurance. The two most popular kinds are Whole Life and Term Life Insurance. These are generally the most straightforward and useful for most individuals. Many people find themselves wondering if Whole Life or Term Life insurance is the better option. The answer, in short, is that it depends on your needs. However, too often, those who sell these products do not take the time to explain which would benefit them. Let me break down both types of insurance so you can make an informed decision. This kind of coverage has a set duration. 10, 20, 30 years, and then it ends. In New York, the term is until you are 80 years old, and then it expires. What does this imply? To expire means that your insurance will no longer be available after the term ends. The issue is that once your term is up and you meet the requirements for additional coverage, it will be whole life or permanent insurance, at which point your rate will be higher because you are many decades older. When you first bought your insurance, you were healthy and fit. However, during the 20, 30, or 40 years of your life, you have acquired a condition that the insurance carrier considers uninsurable. This might be diabetes, cancer, or a stroke. You can not get any more insurance now because you are still alive. Guess what? The insurance company does not refund your premiums; instead, it keeps all of your money since it has insured you for so long. You are out of luck now. That is how it works. This insurance is guaranteed for the rest of your life. It is never terminated. The policy price does not change, so it will not rise as you age. The Face Value of the policy will not alter. It also accrues value in the form of cash. As a result, part of your premium payments goes toward a savings account for you to use when you want it. Also, whenever you need money, you may borrow it from yourself. More on this later. So why would anybody choose term over the whole?” Many people choose term insurance over whole life insurance because it is cheaper; a $250,000 policy costs only $25 per month, while the entire life would be $25 per week. Both whole life insurance and term insurance have their advantages, which make them more useful in different ways. For example, if you have a $300,000 mortgage that will last for 30 years, you could get a $300,000 term policy covering you for those same 30 years. That way, if something happens to you during that period, your family can use the money from the policy to pay off the mortgage and keep the house. Term Insurance is suitable for covering specific periods in your life when there is a greater financial risk. What I find wrong and misleading is when financial "experts" act as if whole life policies are useless. If you take the time to think about this is an ignorant perspective. They continually advocate for term life insurance as being cheaper and better. They say you can get more coverage with a term policy, but what happens when you live past the age limit? They never answer that question. For example, in New York State, insurers will not cover anyone over 80 years old for term life insurance. After 80, your policy expires, and there is no renewing it--you are out of luck. Have you ever thought about how much your life insurance policy might cost if you live to be older than 80 years old? A whole life policy could cost as much as $40/month for only $6,000 if you can find someone to insure you. So, why would you not get a much more cost-effective whole-life policy when you are younger and will most likely need it for a more extended period? Let us assume you are 20 years old and $100,000 in whole-life costs $40 a month, for example, and that you continue to pay the same premium (monthly payment) until you reach 80 years old (never having to re-qualify), after which your beneficiary gets paid. Does not this make more sense? The fact is that most term policies expire without having been paid out because the insured survives beyond the term. According to some reports, as little as 1% of term policies pay a death benefit. That means insurance companies keep 99 percent of premiums but pay nothing. If you die during a specific period, term life insurance is the option. Whole life insurance is designed to cover you when you pass away. It is disgusting that these business authorities mislead people into buying products for the wrong reasons. Because of television financial advisor experts like this, many individuals are fiercely opposed to whole-life coverage. A rude awakening happens when their term policy ends after 40 years. They have no coverage, financially insecure children or grandchildren, and a mountain of debt without assistance. With whole life insurance, you are guaranteed coverage no matter when you pass away. Your beneficiaries will receive a financial legacy from you upon your passing. If you tried to use term insurance this way, however, you would have to sit around all day at 79 years old, hoping to die within the next year so that your family can get something back from the policy after all those years of payment. It Does not make sense. Unfortunately, some salespeople sell term life insurance to the general public when what people genuinely want is whole life insurance. They succeed in doing so because term life is less expensive. I have seen many individuals arrive at an agent furious because their term coverage was going to expire at 50 years old, and they wanted to get a whole life policy. They are angry now since they wish they had purchased a whole life policy decades ago when rates were much lower. It always happens, but you do not need it to happen to you. There is still a lot of confusion and outrage over the price gap between life and term, yet when you consider what you are gaining for your money, your whole life remains an excellent investment in your future. Consider the following scenario: That is a 249 percent return on investment. With a guaranteed return on investment of 249%, you would be foolish not to invest. Most people will never see that kind of growth elsewhere. In the perfect scenario, you would have a bit of both whole life and term life insurance. Most families who bring in a middle-class income do not need more than $50,000 in whole life coverage to cover basic expenses and leave some money for their kids. Then you can get a $250K - $1M term life insurance policy as a safety net in case something unexpected happens. If you can afford more whole-life coverage, go for it! But this is how you should think about insurance when approaching it from now on. Accidental Death and Dismemberment insurance is relatively cheap and pays out $1,000-$40,000 in the event of an accident. Sometimes these policies are even given away for free as an incentive to buy other products. The main issue with Accidental Death and Dismemberment plans is that you can only collect if you die in specific ways. For example, a heart attack would not be covered. Neither would natural causes, God-related incidents such as getting struck by lightning or drowning. Here is an example of something that would be covered. If you were driving your motorcycle on the street and a dump truck stopped in front of you abruptly, causing your bike to slide underneath it and resulting in your decapitation, then you would be eligible for benefits. However, if you slid under the truck and only had your head crushed (as opposed to being severely dismembered) and subsequently died from the injuries sustained, then you would not be able to collect because guidelines state that dismemberment is required. I know this example seems morbid, but it's important to remember that insurance companies are very specific when deciding whether someone can make a claim. For instance: having an arm cut off or hanging by a thin piece of skin is not considered dismemberment according to differentiating standards set by these organizations. It is not advised to rely on these types of coverage for protection. The payout is so improbable that it is not worth the risk. Double-check your job's life insurance policy terms before assuming it will be there for you. Find out if the policy is portable, meaning it stays with you even if you leave the company. If not, relying on that coverage, you could be left high and dry without insurance, which happens more often than many realize. And even if you can get coverage later on, by then, it may be too late – old age can make it difficult (and expensive) to get insurance rates as favorable as they were when you were younger. A whole life insurance policy's cash value is the payout you receive. This amount begins to accrue several years after the start date of the policy; for example, if you pay $40 per month for a $30,000 whole-life policy and sign up on July 9th, 2012, your cash value will begin accruing at 10% starting in 2014--so on August 9th, 2014 you would have accrued $4 worth of cash value. The cash value you receive varies from company to company, but it is often interest-bearing and can also provide dividends. Additionally, suppose you miss a policy payment (premium). In that case, the insurance company can use your cash value to make the premium payment and prevent policy lapse or termination due to non-payment. You can also borrow your policy's Cash Value and spend it on other things or lend it to someone else. What do we mean by loaned? It means you should return it after you have used it. I utilize the term should since you are not required to, but doing so is a good habit because your insurance might be canceled out due to doing so. If you loan money from your policy without ever paying it back, the insurance company will deduct the amount owing from the face value of the coverage when your beneficiary receives the cash payout. For example, if you have a $100,000 policy and loan out $10,000 from the cash value when your policy pays out to the beneficiary upon your death, they will receive $90,000. The other issue is that when you lend money, it usually gets interest added. This implies you must repay the funds as well as interest at a later date. Typically 5-10% interest is charged. You want to pay back the borrowed money because your policy's face value may be greater than the amount you owe. So, if your insurance is worth $30,000 and the sum of money you owe from cash value loans is $31,000, your policy will terminate. This should be kept in mind when taking out these cash-value loans. In the case of an emergency, cash value loans are convenient. You do not want to borrow money just to buy a new pair of shoes. Perhaps a new set of lungs, but not necessarily shoes. People misuse these funds all the time, putting themselves in needless debt. The money should be kept in the policy and available when there is no premium payment. This is how you can make the most of your money. Child riders protect one or more children up to a certain age, usually 18, for a set sum of money. It's frequently relatively inexpensive to acquire it. A single dollar weekly premium might cover ten children on occasion. The good news is that if you are on a budget and have a big family, you can protect all of your kids for relatively little money. The good news is that it is a short policy, which means you will be covered for the duration. However, it has an end date, and when each kid reaches the age stated on your policy, their coverage expires. It is not stand-alone insurance. If your main policy is canceled, your kids will have no coverage. A whole life policy is a better investment for your children than other options. For as little as $2 per week, you could receive up to $20,000 for each child when they reach adulthood. It is undoubtedly a good idea to obtain insurance for your children as soon as possible. Because insurance rates are based on age, if you get a whole life policy rate locked in on the kid when they are one year old, they will have it when they are 90 at the same low price. Furthermore, with whole life insurance, you don't have to worry about proving insurability at any time, so you will be covered in most cases regardless of what condition or event occurs to the child. I believe that most situations apply because you must inquire whether insurability must be demonstrated later. The amount of coverage you should get will vary depending on your circumstances. For example, if you plan to leave behind student loans or a mortgage or would like to provide a certain level of financial support for your beneficiaries, you may need more coverage than someone without these obligations. As a general rule of thumb, if you have $300,000 worth of debt (e.g., from a mortgage and car loan), you should make sure your policy covers at least this amount. Do not spend more than you can afford. Buying insurance should not bankrupt you. You must balance the advantages against your debt once again. If you have children and make 30K a year but owe 750K in student loans, automobile loans, and house payments, a larger sacrifice for greater coverage might be required. If you are a police, a fireman, or a cast member on World's Deadliest Catches, where you might easily fall off the boat and perish in freezing water, a term policy is something you should consider more than others since it provides more coverage for your family. In the event of an emergency, make sure your family is protected. Because the chance of something occurring is far greater than the average person, you will want to have more protection. A $1 million - $2 million policy combined with some whole life coverage should be considered. Most people do not have these concerns, but if you are one of the few who do, this is for you. Some Whole Life insurance policies include a paid-up policy or a paid-up reduced or paid-up option into the coverage. The policy owner may take whatever cash value is in the plan at a certain age and use it to purchase a whole life policy that has been paid in full with no payments due. The positive aspect is that you now have coverage for the rest of your life without paying anything. The negative side is that even if you buy this way, your policy will always be of lesser value than the one you previously paid premiums on. For example, I have a $100,000 whole-life policy. When I turn 65, the policy's cash value will be $12,000. I can purchase a paid-up reduced policy with a $40,000 face value with that money. The original $100,000 policy will be terminated at that point, but I will have coverage for the rest of my life without paying any more premiums. Too much insurance can be just as bad as not having any, so finding that sweet spot is important. If you are a single-income household making $20,000 annually and your premiums cost you $50 a week, you might want to reassess your coverage levels. Those payments aren't feasible for most people in that financial situation. But if you bring in $250K per year? That is a different story altogether. Only purchase an insurance policy that you can comfortably afford- do not overspend. If you get a too expensive policy for your current income level, cancellation fees may apply if you need to terminate the contract early. This would be considered a waste of money, so be mindful when selecting your coverage limit and premiums. The greatest strategy to deal with it is to get a tiny start now, then add to the plan each year until you reach the coverage you require. For example, if your goal is to have $300K in whole life coverage but you only make $25K a year, start with a $50K whole life plan. Then, every year after that, purchase more coverage until you reach your goal. So next year, let us say you get a raise and can afford to add an additional $50K to give you a total of $100K in coverage. After about six years or so following this method, you would have successfully maintained the policies long-term without taking an initial big financial hit. Some salespeople will pressure you into buying a large insurance policy so that they can make a more significant commission. Figure out how much coverage you need. Rating agencies evaluate the company's top insurance firms. The most popular rating agencies as of the writing of this guide are Standard & Poor's, A.M Best, Moody's, and Fitch. All insurance companies have different rating grades, but it is advisable to go with a company with a "AAA” or "AA+” rating. A simple "A” reflects a company with an average track record and stability. When purchasing life insurance, knowing what to ask is a good idea. This book was created to give you basic insurance knowledge so that you may communicate intelligently with an agent about it. The questions below are some things you should inquire about to get a better sense of your insurance policy. Whole life and term life are similar from company to company, although there are differences in interest rates, dividend payouts, penalties, and riders accessible. By asking these questions, you should be able to choose the best product for yourself. This guide will equip you with the information needed to make the best decisions for you and your loved ones. We wrote this guide to make life insurance less daunting.Defining Life Insurance

Have a questions about Life Insurance? Click here.

If I obtain a $20,000 policy on my spouse, I become the policyholder while she becomes the insured.

The policyholder has the option to cancel and change the beneficiaries on the insurance. The insured does not have this legal right unless they are the policyholder. This is crucial information.

“So, can someone buy a life insurance policy on you, and you have no legal authority to change it?” Yes.

When someone purchases a life insurance policy on you in New York, they must usually have your consent by signing a form. Exceptions to this rule are small policies taken out on spouses--usually $15,000 or less--and children under the age of 15.

If you did not give your consent and found out about the policy after it was purchased, you would then need to take extra-legal measures.Which Is Better: Whole or Term?

Term Insurance

Whole Life Insurance

Example of Whole Life Insurance

What Is Accidental Death and Dismemberment, and How Does It Work?

Does Your Job Insurance Cover You When You Are Gone?

What Is Cash Value?

Misuse of Cash Value

What Is a Child Rider?

Is It Necessary for My Kids to Have Insurance?

Deciding on How Much Coverage You Need

What if I Have a High-Risk Job?

What Is a Paid Up Policy?

Is It Possible to Be Over Insured?

Rating's Agencies

The Top 10 Questions to Ask an Agent

In Conclusion

Life Insurance FAQs

A life insurance is a contract between an insurer and a policyholder in which the insurer agrees to pay a designated beneficiary a sum of money upon the death of the insured person.

There are two main types of life insurance: whole life and term life. Whole life insurance provides coverage for the duration of the policyholder’s life, while term life insurance only covers the policyholder for a set period of time.

When shopping for life insurance, you should consider your age, health, lifestyle, and coverage needs. You should also compare different policies to find the one that best meets your needs.

Whole life insurance covers the policyholder for the duration of their life, while term life insurance only covers the policyholder for a set period of time. Whole life insurance also accrues cash value, which can be used to cover expenses in the event of the policyholder’s death.

When looking for a life insurance policy, you should consider the insurer’s financial stability, the policy’s premiums, and the policy’s coverage. You should also read the fine print to make sure you understand the terms and conditions of the policy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.