A Withholding tax is an amount of money that an employer withholds from an employee's salary and pays directly to the government. This amount is then considered a credit against the employee's income taxes for that year. The majority of workers in the US who earn an income from a trade or business will have withholding tax levied upon them. Essentially, it involves the payer of the income deducting the tax and remitting it directly to the government, rather than the recipient of the income paying it. This preemptive collection method reduces the risk of tax evasion and ensures a steady flow of revenue for governments. The withheld amount acts as a credit against the recipient's total annual tax liability. The purpose of a withholding tax is to allow the US government to tax residents at the source, i.e. their employer, rather than trying to collect taxes after they have been earned. The primary type of withholding tax is US resident withholding tax, which is collected from every employer in the United States. The only income exempt from withholding tax is income earned by independent contractors and investors, although those groups are not exempt from income tax. A significant portion of our income, for many of us, stems from our labor – our wages and salaries. From the eyes of the tax authority, these are prime targets for withholding tax. By automating tax collection from these consistent income streams, governments ensure a steady, reliable flow of revenue. For employees, this means less hassle. While your paycheck might seem smaller, come tax time, you're either all set or may even be due for a refund. Those lucky enough to enjoy streams of interest and dividends are not exempt from the long arm of the taxman. Indeed, even these passive forms of income are subject to withholding taxes. It’s a testament to the thoroughness with which governments have integrated this tax collection tool. Every time an artist's song is played, a writer's book sold, or a patent used, there might be a payment involved. These earnings, too, come under the umbrella of withholding tax. By capturing these streams, tax authorities ensure diverse sources of revenue are effectively tapped. Life isn’t just about taking – it's also about giving back. Recognizing this, tax systems often provide advantages to charitable organizations or specific non-profits. Entities engaged in public good might find themselves exempt from certain taxes. It means that money meant for charity or societal improvement doesn't get unduly taxed, ensuring maximum impact where it's needed most. If an entity or individual has had excessive tax withheld over the fiscal year, they could be eligible for a return of the excess amount. It ensures the balance between efficient tax collection and fairness to taxpayers. Borders might divide countries, but economies are interconnected. Acknowledging this reality, many countries enter into tax treaties. These agreements are designed to prevent the double taxation of the same income. If an individual or firm operates across borders, the treaties can significantly reduce withholding tax burdens. Diversified economies often seek investments from abroad. To lure foreign investors, certain exemptions in withholding taxes are offered. This magnet of tax benefits can attract foreign capital which, in turn, could boost local industries, job markets, and overall economic health. Some bonds or securities come with a sweet deal – tax-exempt interests or dividends. While the face value might be lower, the post-tax earnings could be significantly higher, making them an enticing option for savvy investors. Such securities often bypass the usual withholding tax channels, further cementing their allure. Pragmatism sometimes dictates tax policy. For incomes below a certain threshold, it might not be feasible to apply withholding taxes due to administrative costs. By setting exemption thresholds, tax authorities can focus on more substantial, meaningful revenue streams. By routing income through countries with the most favorable treaties, businesses and individuals can optimize their tax situations. Such strategies, though complex, can yield significant savings. Whether it's equity or debt, lease or purchase, the structure can change the withholding tax game. By considering these nuances, entities can navigate toward the most tax-efficient outcomes. For the discerning investor, the choice of vehicle matters. Trusts, mutual funds, or special-purpose entities might offer routes to minimize withholding tax exposure. Deployed astutely, these vehicles can drive an investor's journey toward maximized post-tax returns. Withholding tax may also be levied upon interest and dividend income from securities owned by a nonresident alien, as well as income earned by nonresidents of a country. This is to ensure that proper taxes are levied on sources of income earned within the US. Withholding tax serves as a preemptive collection method, deducting tax at the source and reducing the risk of tax evasion. Understanding the types of income subject to withholding tax, such as wages and salaries, interest and dividends, and royalties and licensing fees, helps individuals and businesses comply with their tax obligations. Withholding tax offers several benefits, including exemptions for certain organizations and entities engaged in public good, the possibility of tax credits and refunds, and the advantages provided by tax treaties. Foreign investors may also enjoy exemptions, attracting foreign capital and boosting local economies. To navigate the complexities of withholding tax, strategic planning is essential. Utilizing tax treaties, structuring transactions optimally, and investing through tax-efficient vehicles can lead to significant tax savings for individuals and businesses alike. Understanding withholding tax exemptions and implementing effective planning strategies empowers taxpayers to manage their tax liabilities more efficiently and make informed financial decisions.Define Withholding Tax in Simple Terms

The Purpose of Withholding Tax in Finance

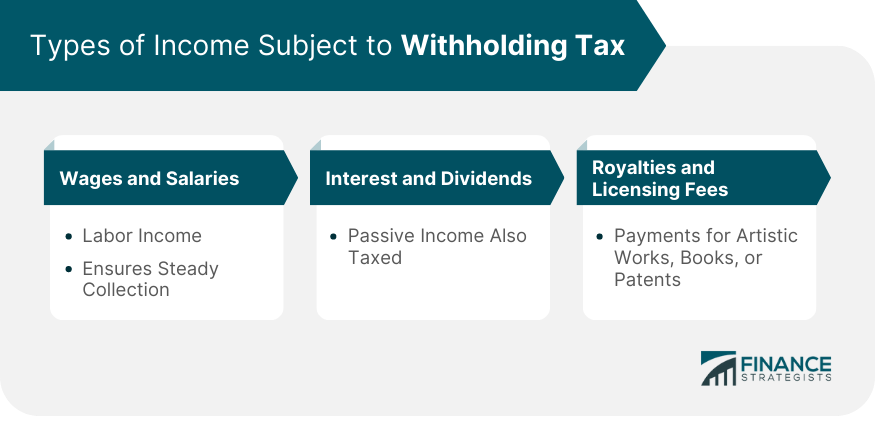

Types of Income Subject to Withholding Tax

Wages and Salaries

Interest and Dividends

Royalties and Licensing Fees

Withholding Tax Benefits

Exempt Organizations and Entities

Credits and Refunds

Tax Treaty Advantages

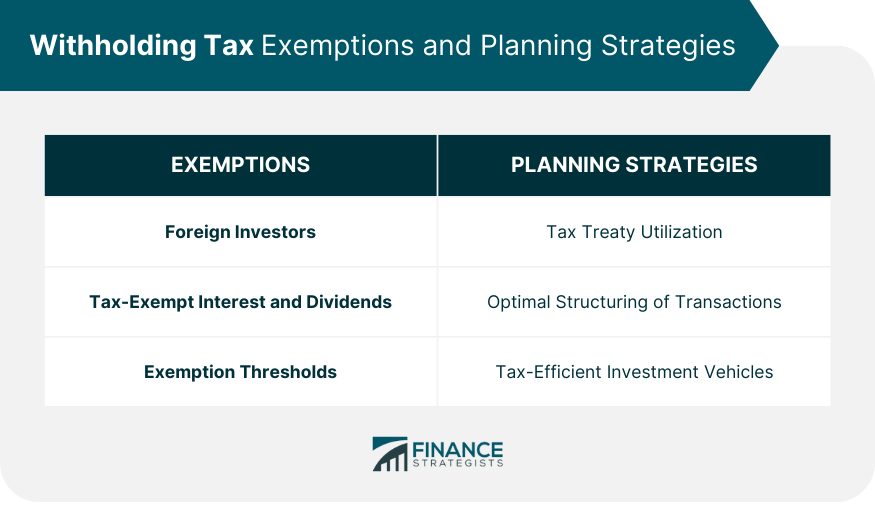

Withholding Tax Exemptions

Foreign Investors

Tax-Exempt Interest and Dividends

Exemption Thresholds

Withholding Tax Planning and Strategies

Tax Treaty Utilization

Optimal Structuring of Transactions

Tax-Efficient Investment Vehicles

Withholding Tax Example

Conclusion

Withholding Tax FAQs

A withholding tax is an amount of money that an employer withholds from an employee’s salary and pays directly to the government.

The amount put aside from a withholding tax is considered a credit against the employee’s income taxes for that year.

The purpose of a withholding tax is to allow the US government to tax residents at the source, i.e. their employer, rather than trying to collect taxes after they have been earned.

The United States government use a withholding tax to ensure that proper taxes are levied on sources of income earned within the US.

The only income exempt from withholding tax is income earned by independent contractors and investors, although those groups are not exempt from income tax.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.